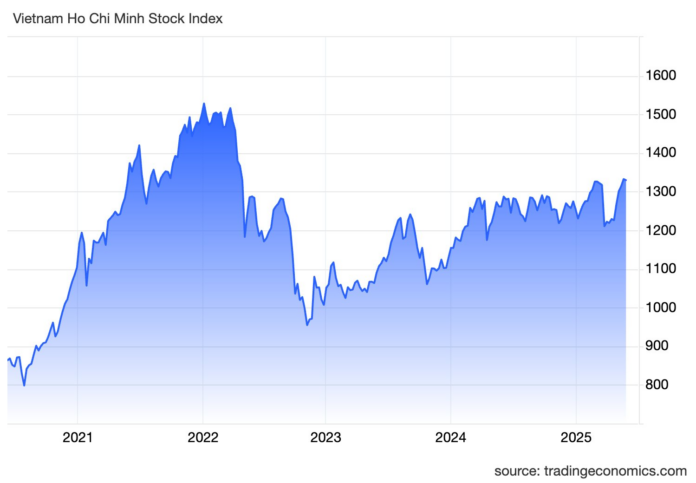

After four weeks of solid gains, the stock market opened the first week of June 2025 with a tug-of-war between buyers and sellers. The final session witnessed intensified selling pressure, dragging the VN-Index down to 1,329.8 points, a slight decline of 0.2% from the previous week’s close.

Foreign investors’ trading activities were also lackluster, with net selling dominating the last session of the week. Overall, after five sessions, foreign investors net sold VND 1,781 billion on the entire market.

VN-Index could fall below 1,300 points if selling pressure intensifies for large-cap stocks

According to Mr. Nguyen Thai Hoc, a securities analyst at Pinetree, the Vietnamese stock market experienced its first week of correction after four consecutive weeks of gains, with the VN-Index fluctuating around the old peak from early March, ranging between 1,324 and 1,350 points. Although the correction was mild, the current money flow and technical signals indicate a cautious market sentiment with increasing short-term downside risks. The money flow has not been sustainably dispersed but rather rotated among large sectors, focusing on pulling stocks with unique stories. After the banking group, money flowed into real estate, then securities, and subsequently the electricity sector. However, this rotation has not generated sufficient momentum to push the index higher.

Notably, the large-cap stocks, especially those within the Vingroup ecosystem (VIC, VHM, VRE), remained resilient despite the market correction. However, Mr. Hoc cautioned that if this group of stocks undergoes a correction, the VN-Index may face significant selling pressure.

Technically, last week’s VN-Index reflected a strong tug-of-war between buyers and sellers, indicating indecision and an unclear short-term direction. The signals also warned of weakening upward momentum and increasing correction risks. According to the Pinetree analyst, the market remains highly cautious, awaiting clear supportive information, particularly regarding the Vietnam-US trade negotiations, which investors closely monitor. Consequently, a breakthrough for the VN-Index in the coming week seems unlikely.

The index continues to struggle to break through the old peak zone of 1,320-1,343 points, a crucial price level before the sharp fall due to tariff concerns. The inability to decisively surpass this resistance zone indicates weak buying pressure, while selling pressure is mounting. Technical signals, such as breaking below the MA10 and the MACD cutting down the signal line, further emphasize the short-term correction risks.

In a negative scenario, Mr. Hoc forecasts that the VN-Index may face strong volatility and retreat to test the support zone around 1,280-1,300 points. This technical level warrants close monitoring to assess the market’s potential stabilization or further correction. The likelihood of the index falling to this zone will become more apparent if selling pressure intensifies for large-cap stocks, and investors should consider this factor when formulating their investment strategies.

Vietnam-US trade negotiations enter a “critical” phase; investors should exercise heightened caution

Mr. Dinh Quang Hinh, Head of Macroeconomics and Market Strategy at VNDIRECT, noted that the Vietnamese stock market witnessed a positive trend in the first two sessions of the week, with the VN-Index climbing to 1,347.3 points. However, profit-taking pressure intensified at the 1,350-point resistance level, causing domestic stock indices to decline for three consecutive sessions toward the week’s end.

The lack of supportive information after the first-quarter earnings reports and shareholder meetings, coupled with the ongoing Vietnam-US trade negotiations yet to reach a breakthrough, has made investors more cautious, especially with just over a month left before the 90-day tariff suspension expires.

Entering the new trading week, Mr. Hinh anticipated that the VN-Index would retest the support zone around 1,320 points. The index’s performance at this level will determine the sustainability of the short-term uptrend. If this support is lost, the VN-Index may retreat to the deeper support zone at 1,300 points. In this context, investors should consider reducing leverage and adjusting their stock exposure to safer levels. Realizing profits and prioritizing risk management in portfolios are advisable as the market approaches the crucial 30-day period, packed with significant events such as the FED’s policy meeting in mid-June and the tariff negotiation deadline in early July.

A New Dawn: Vietnam Reaches 10 Million Stock Market Accounts

In the first five months of the year, domestic investor securities accounts surged by almost 800,000, an impressive testament to the burgeoning interest in securities and a promising sign for the domestic market.

“Market Meltdown: VN-Index Plunges Below 1330 Points as Investors Bail Out”

Selling pressure soared in the afternoon session, plunging numerous mid and small-cap stocks into the red. While 107 tickers on the HoSE fell by over 1% in the morning, this number skyrocketed to 160 by the closing bell. The drop in the VN-Index fails to convey the full extent of the damage inflicted on individual stocks.