The corresponding issuance ratio is 4:1 (shareholders owning 4 shares will receive 1 new share), with no restrictions on transferability. The issuance capital comes from the Company’s undistributed post-tax profits as of December 31, 2024, as recognized in the audited separate financial statements for 2024.

According to the plan, FRT will issue no later than the third quarter of 2025, thereby increasing its capital scale from over VND 1,362 billion to over VND 1,703 billion.

According to VietstockFinance data, the last time FRT paid dividends was for the year 2022, including a 5% cash dividend (VND 500/share) and a 20:3 stock dividend ratio (shareholders owning 20 shares will receive 3 new shares).

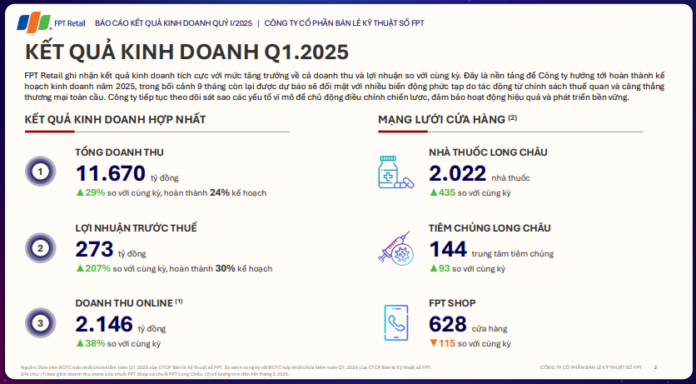

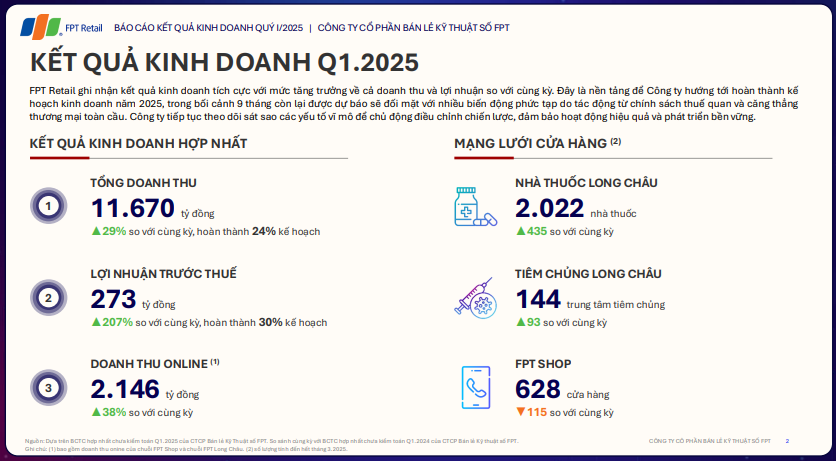

The decision to implement the dividend plan comes as FRT has just experienced a positive first quarter of 2025 in terms of business performance. Specifically, the Company recorded a total revenue of VND 11,670 billion, up 29% over the same period last year and achieving 24% of the yearly plan; pre-tax profit of VND 273 billion, up 207% and fulfilling 30% of the plan. In the revenue structure, the online segment (including online revenue from the 2 chains FPT Shop and FPT Long Chau) contributed VND 2,146 billion, up 38%.

In terms of store network, the Company recorded 2,022 Long Chau drugstores, an increase of 435 stores over the same period, with an average revenue of VND 1.3 billion/store/month; 144 Long Chau vaccination centers, an increase of 93 centers; meanwhile, the FPT Shop chain decreased by 115 stores, leaving 628 stores.

In the investor newsletter updating the first-quarter business results, FRT stated that this lays a foundation for the Company to strive to complete its 2025 business plan, amidst a backdrop of complex fluctuations expected in the remaining nine months due to the impact of tariff policies and global trade tensions.

Source: FRT Investor Newsletter

|

As the dividend payment date draws near, FRT stock transactions have drawn attention recently due to continuous selling by the Dragon Capital group, reducing their ownership from nearly 15.1 million shares (a rate of over 11.06%) to nearly 12.1 million shares (a rate of over 8.86%) in the period from April 28 to May 22.

In the past period, FRT shares have gone through many fluctuations, especially the phase of sharp declines and rapid recoveries associated with tariff shock events. At the latest close (June 6), FRT was priced at VND 165,000/share, down 11% from the beginning of the year, with an average liquidity of nearly 502,000 shares/day.

| FRT Stock Price Movement since the Beginning of 2025 |

– 09:58 09/06/2025

“Petrolimex CEO, Mr. Dao Nam Hai, Steps Down”

Mr. Dao Nam Hai, the former Chairman and CEO of Petrolimex, Vietnam’s leading petroleum company, has stepped down from his position.

“Thuduc House Faces Tax Enforcement of Over 88.9 Billion VND”

Thuduc House, a prominent real estate company, faced consequences for delinquent tax payments. With taxes overdue by more than 90 days past the deadline, the company was subject to enforcement measures. The authorities imposed a halt on their usage of invoices, with the enforced tax amount totaling over 88.9 billion VND.