The post-Tet wave continues as numerous shops and businesses shut down and return their premises.

A stroll along bustling business streets in Ho Chi Minh City such as Phan Dang Luu, Dien Bien Phu, Bach Dang, and Xo Viet Nghe Tinh in Binh Thanh District, or Nguyen Trai and Tran Quang Khai in District 1, Ly Chinh Thang, Nguyen Dinh Chieu, and Vo Van Tan in District 3, will reveal numerous “for rent” and “for lease” signs.

Firstly, a real estate expert observes that the Covid-19 pandemic has altered consumer shopping habits, shifting from physical stores to online platforms and e-commerce sites. To adapt, many businesses have embraced flexibility and transformed their operating models.

Secondly, the rise of shopping malls poses significant competition.

According to Savills Vietnam, street retail is facing intense rivalry from modern retail channels, particularly shopping malls. Malls offer a wider variety of goods and services, attracting a large number of consumers.

Over the past three years, large-scale shopping mall projects such as Thiso Mall Sala, Parc Mall, Vincom Mega Mall Grand Park, and Centre Mall Vo Van Kiet have entered the market with occupancy rates of at least 70%, despite rising vacancy rates in street retail spaces. This shift in consumer behavior and the allure of modern retail models are evident.

Thirdly, the challenging economic climate, coupled with high rental costs, has become unbearable for many businesses.

Notably, despite the stagnant market, some landlords are reluctant to reduce rents to maintain their property values or avoid long-term profit losses. This has led to a paradoxical situation where rental prices remain exorbitantly high even as premises lie vacant.

Some attribute this to the market’s historically high rental rates, set years ago, while consumer prices in Ho Chi Minh City have steadily risen.

Meanwhile, businesses, particularly small and medium-sized enterprises, face significant challenges to their survival and growth.

Economic experts point out that businesses are grappling with heightened production costs, industrial production reliant on global economic recovery, and nascent sectors like the digital economy, green economy, chips, semiconductors, and artificial intelligence, which show improvement but lack distinct progress.

Apart from the wave of premises returns, several well-known brands have announced their permanent closure this year, leaving consumers regretful.

Most recently, Hot&Cold, a renowned tea and skewer brand established in 2011, bid farewell to its customers. On their official fan page with almost 300,000 followers, they wrote: “Parting words are always hard to say. But today, we must say goodbye. In our 14 years together, this is the most difficult letter Hot&Cold has ever had to write. Today, with utmost respect, we announce that Hot&Cold will cease operations, officially concluding our journey on June 30, 2025.”

In their farewell message, the brand reminisced about their journey, starting from a small shop and expanding to over 65 branches nationwide, with a peak of more than 80 locations across Ho Chi Minh City, Binh Duong, Can Tho, My Tho, Ben Tre, and Da Nang. They proudly shared that they had served billions of tea cups and became a cherished memory for generations of customers.

Earlier, the fashion brand Hnoss exited the market after 17 years, attracting attention. This women’s fashion label, founded in 2008, once boasted 36 stores nationwide. Other fashion brands that have entirely ceased operations include Lép, Casta, MỌT, and Elpis.

The F&B Landscape Trend: Why ‘Prime’ Locations Are No Longer a Privilege, and How ‘Alleyway’ F&B Concepts Are Flourishing.

The prime location is no longer a guarantee of success for F&B businesses. A new trend is emerging, favoring “alleyway eateries” – those hidden gems tucked away in alleys and side streets. These establishments offer cost-efficiency, a focused product range, and a savvy online presence to attract customers.

The Power of Words: Crafting Compelling Copy for Online Success

“Unveiling the Secrets to Captivating Customers: Why Choosing the Right Platform Matters, as Shared by the CEO of The Gioi Di Dong”

MWG makes a comeback in the e-commerce arena with the launch of the MWG Shop app, marking a strategic shift in their approach. In a focused effort to leverage their existing retail ecosystem, MWG has decided to forego a presence on TikTok Shop and Lazada. This bold move signals a new chapter in their journey, as they chart a unique path in the competitive world of online retail.

“Leveraging FTAs to Expand Export Markets for Textiles and Footwear”

As the Deputy Director of the Multilateral Trade Policy Department has highlighted, Vietnam’s competitive tax advantages compared to rivals such as Thailand, Malaysia, and Indonesia, are narrowing in markets like the EU, the UK, Canada, and Mexico. Therefore, it is imperative that we act swiftly to capitalize on the existing benefits offered by FTAs, or risk losing this edge over time.

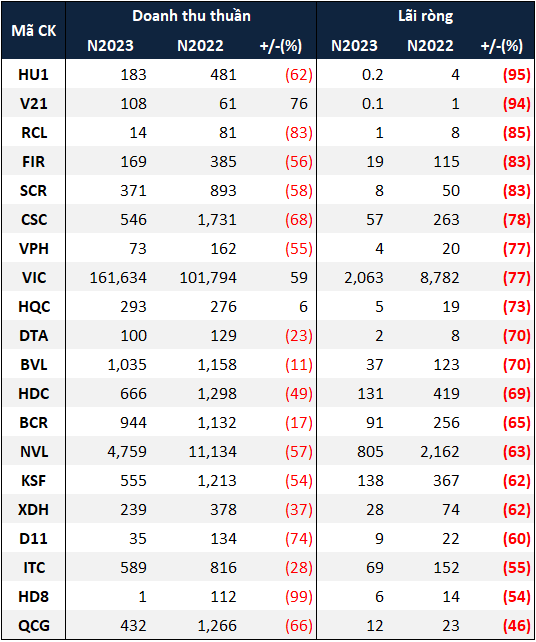

The Challenge of PNJ

The dual challenge of input raw material constraints and soft consumer demand continues to weigh on PNJ’s growth prospects.