ACB’s Deposit Interest Rates for June 2025

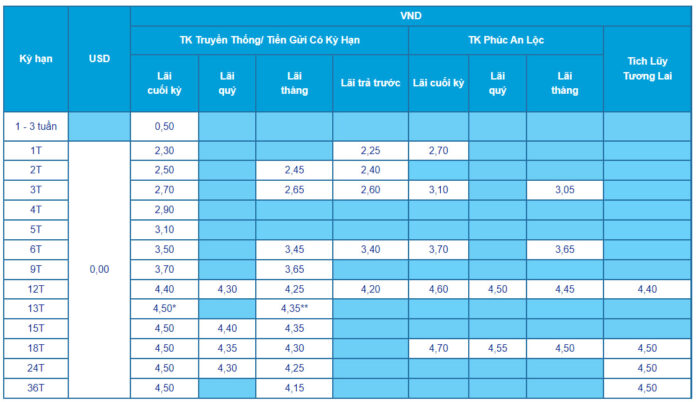

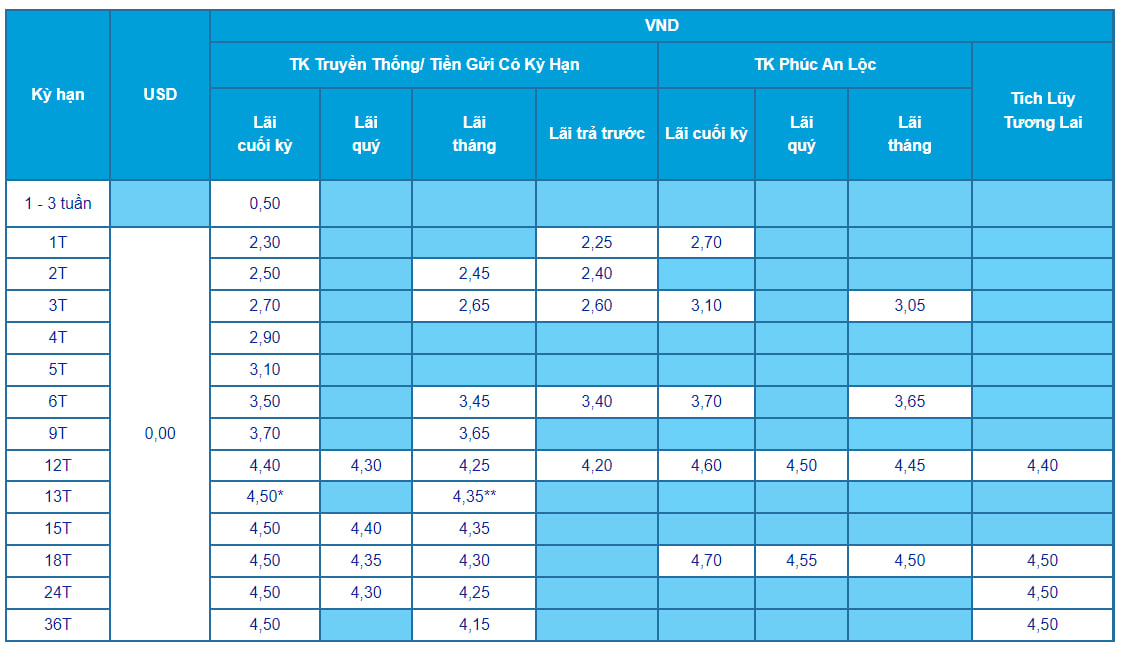

As of June 6, 2025, Asia Commercial Joint Stock Bank (ACB) offers deposit interest rates for customers making deposits at the counter, with interest payable at maturity, ranging from 0.5% to 4.5% per annum.

ACB offers an interest rate of 0.5% per annum for tenors of 1-3 weeks. The interest rate for a 1-month tenor is 2.3% per annum, while the rate for a 2-month tenor is 2.5% per annum. For a 3-month tenor, the interest rate is 2.7% per annum, and for a 4-month tenor, it is 2.9% per annum. The interest rate for a 5-month tenor is 3.1% per annum, and for a 6-month tenor, it is 3.5% per annum. ACB offers an interest rate of 3.7% per annum for a 9-month tenor and 4.4% per annum for a 12-month tenor.

ACB offers an interest rate of 4.5% per annum for long-term tenors ranging from 13 to 36 months. For the 13-month tenor, customers depositing 200 billion VND or more will enjoy a preferential interest rate of 6.0% per annum.

ACB’s Deposit Interest Rates for Counter Deposits – June 2025

Source: ACB

In addition to the option of receiving interest at maturity, ACB offers flexible interest payment options. These include quarterly interest payments with rates ranging from 4.30% to 4.4% per annum, monthly interest payments with rates ranging from 2.45% to 4.35% per annum (for a 13-month tenor, a minimum deposit of 200 billion VND earns an interest rate of 5.9% per annum), and advanced interest payments with rates ranging from 2.25% to 4.2% per annum.

ACB also offers the Phúc An Lộc and Tích Lũy Tương Lai savings packages for customers to choose from, with the highest interest rate offered being 4.7% per annum.

ACB’s Online Deposit Interest Rates for June 2025

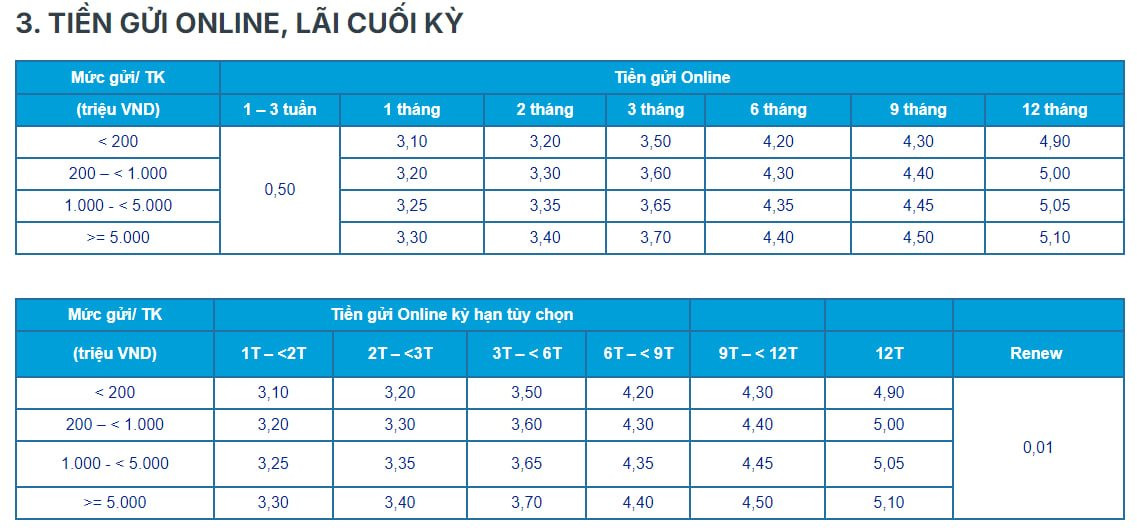

For online deposits made through the banking app, ACB offers interest rates ranging from 0.5% to 5.1% per annum for deposits with interest payable at maturity.

Specifically, ACB offers an interest rate of 0.5% per annum for tenors of 1-3 weeks. For other tenors, the interest rates vary depending on the amount deposited. The details are as follows:

For deposits below 200 million VND: The interest rate for a 1-month tenor is 3.1% per annum, 2-month tenor is 3.2% per annum, 3-month tenor is 3.5% per annum, 6-month tenor is 4.2% per annum, 9-month tenor is 4.3% per annum, and 12-month tenor is 4.9% per annum.

For deposits ranging from 200 million VND to less than 1 billion VND: The interest rate for a 1-month tenor is 3.2% per annum, 2-month tenor is 3.3% per annum, 3-month tenor is 3.6% per annum, 6-month tenor is 4.3% per annum, 9-month tenor is 4.4% per annum, and 12-month tenor is 5.0% per annum.

For deposits ranging from 1 billion VND to less than 5 billion VND: The interest rate for a 1-month tenor is 3.25% per annum, 2-month tenor is 3.35% per annum, 3-month tenor is 3.65% per annum, 6-month tenor is 4.35% per annum, 9-month tenor is 4.45% per annum, and 12-month tenor is 5.05% per annum.

For deposits of 5 billion VND or more: The interest rate for a 1-month tenor is 3.3% per annum, 2-month tenor is 3.4% per annum, 3-month tenor is 3.7% per annum, 6-month tenor is 4.4% per annum, 9-month tenor is 4.5% per annum, and 12-month tenor is 5.1% per annum.

Thus, the highest online deposit interest rates offered by ACB for a 12-month tenor range from 4.9% to 5.1% per annum, depending on the deposit amount.

ACB’s Online Deposit Interest Rates for June 2025

Source: ACB

What Are the Best High-Yield Savings Accounts of 2025?

The once-plummeting deposit interest rates have now stabilized. As of the beginning of this month, only Bac A Bank, HDBank, and Vikki Bank offer interest rates above 6% per year, mainly for deposits of over 13 months and large amounts.

Latest HDBank Interest Rates for June 2025: Which Term Deposit Offers the Best Returns?

As of early June 2025, HDBank offers a maximum interest rate of 6.1% per annum for regular deposits. This competitive rate positions HDBank as a leading player in the industry, providing customers with an attractive option for their savings and investments. With this offering, HDBank demonstrates its commitment to delivering value and helping its customers grow their wealth.

The Insurance Business is Missing Out on Investment Opportunities

In the first quarter of 2025, the low-interest-rate environment made deposit investments less appealing, significantly impacting the financial profits and overall profit growth of numerous non-life insurance companies.

“Bank Interest Rates on May 28: Unveiling the Top-Tier Institutions with the Highest Yields”

With a substantial deposit to invest, ranging from hundreds of billions to trillions of VND, customers can now take advantage of an attractive interest rate of 7.5%-9.65%. This opportunity is presented by four prominent banks: ABBank, PVcomBank, HDBank, and Vikki Bank. It’s time to make your money work harder for you!