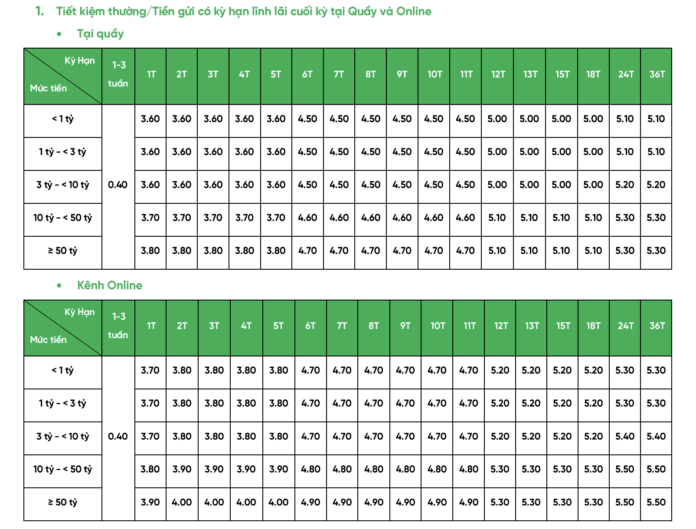

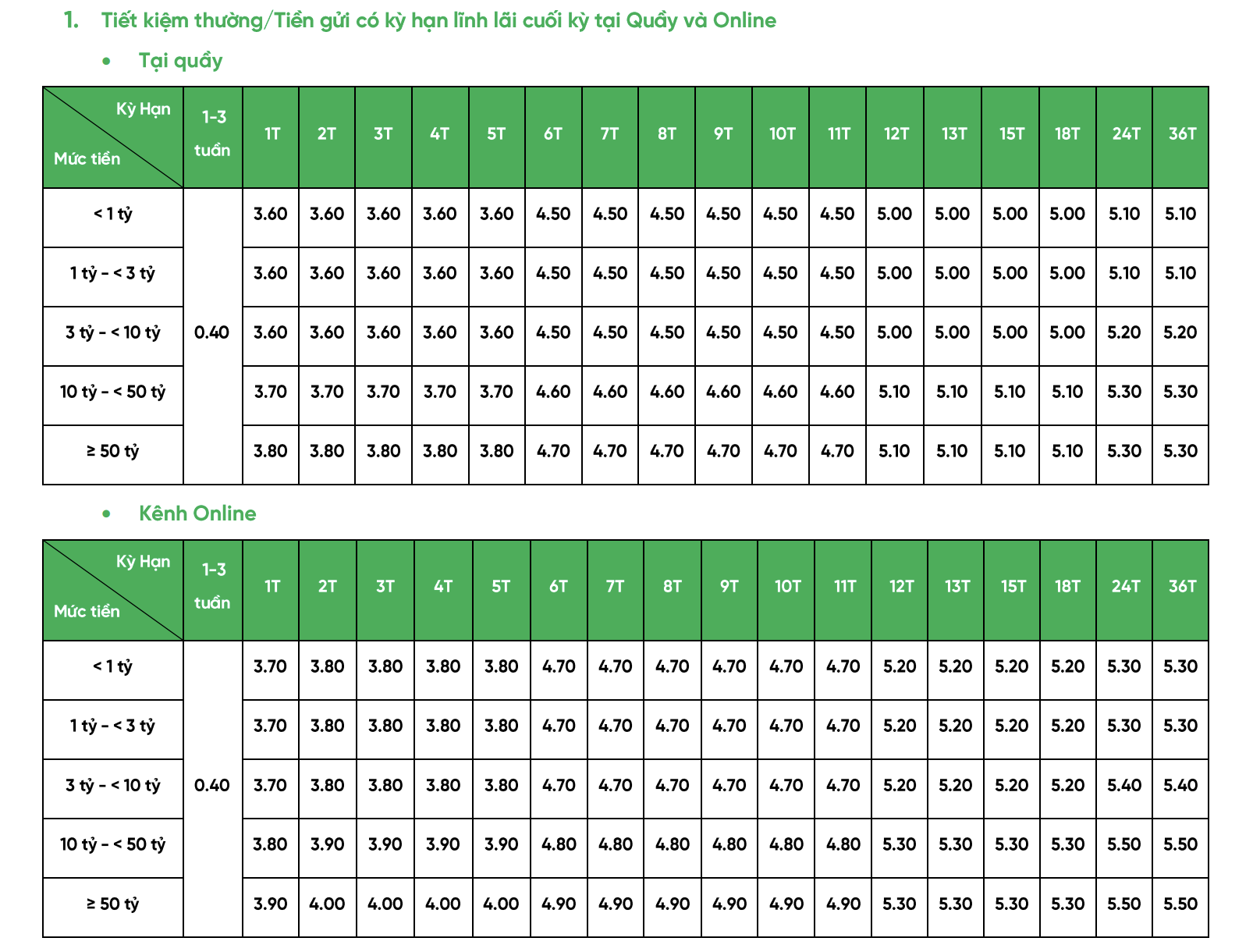

In June, Vietnam Prosperity Joint Stock Commercial Bank (VPBank) offers a range of interest rates on savings accounts for individual customers, ranging from 0.4%/year to 5.5%/year, depending on the term and deposit amount.

VPBank categorizes interest rates into five tiers based on different deposit amounts: below VND 1 billion, from VND 1 billion to below VND 3 billion, from VND 3 billion to below VND 10 billion, from VND 10 billion to below VND 50 billion, and VND 50 billion and above. Online channels offer a slight advantage with higher interest rates ranging from 0.1%/year to 0.2%/year compared to over-the-counter rates, especially for longer-term deposits.

For deposits below VND 1 billion, over-the-counter interest rates start at 3.6%/year for terms of 1, 2, and 3 months, increasing to 4.5%/year for 6 and 7 months, 4.6%/year for 8 months, 4.7%/year for 9 months, 4.8%/year for 10 months, 4.9%/year for 11 months, and reaching 5.0%/year for 12, 13, 15, and 18 months, before peaking at 5.1%/year for 24 and 36 months.

Online deposits offer slightly higher rates, with 3.7%/year for a 1-month term, 3.8%/year for 2 and 3 months, 4.0%/year for 4 months, 4.1%/year for 5 months, 4.7%/year for 6 and 7 months, 4.8%/year for 8 months, 4.9%/year for 9 months, 5.0%/year for 10 months, 5.1%/year for 11 months, 5.2%/year for 12, 13, 15, and 18 months, and peaking at 5.3%/year for 24 and 36 months.

For deposits ranging from VND 1 billion to below VND 3 billion, over-the-counter interest rates are similar to those below VND 1 billion, starting at 0.4%/year for terms of 1-3 weeks, 3.6%/year for 1, 2, and 3 months, 4.5%/year for 6 and 7 months, 5.0%/year for 12 months, and reaching 5.1%/year for 24 and 36 months.

Online channels offer slightly higher rates of 3.7%/year for 1 month, 3.8%/year for 2 and 3 months, 4.7%/year for 6 and 7 months, 5.2%/year for 12 months, and 5.3%/year for 24 and 36 months.

For deposits ranging from VND 3 billion to below VND 10 billion, over-the-counter interest rates start at 0.4%/year for terms of 1-3 weeks, 3.6%/year for 1, 2, and 3 months, increasing to 4.5%/year for 6 and 7 months, 4.6%/year for 8 months, 4.7%/year for 9 months, 4.8%/year for 10 months, 4.9%/year for 11 months, 5.0%/year for 12 months, and peaking at 5.2%/year for 24 and 36 months.

Online channels offer competitive rates, starting at 0.4%/year for 1-3 weeks, 3.7%/year for 1 month, 3.8%/year for 2 and 3 months, 4.7%/year for 6 and 7 months, 4.8%/year for 8 months, 4.9%/year for 9 months, 5.0%/year for 10 months, 5.1%/year for 11 months, 5.2%/year for 12 months, and reaching 5.4%/year for 24 and 36 months.

VPBank’s June 2025 Interest Rates for Counter and Online Deposits

For deposits ranging from VND 10 billion to below VND 50 billion, over-the-counter interest rates start at 3.7%/year for terms of 1-3 weeks, 3.7%/year for 1, 2, and 3 months, increasing to 4.6%/year for 6 and 7 months, 4.7%/year for 8 months, 4.8%/year for 9 months, 4.9%/year for 10 months, 5.0%/year for 11 months, 5.1%/year for 12 months, and peaking at 5.3%/year for 24 and 36 months.

Online channels offer slightly higher rates of 3.8%/year for 1-3 weeks and 1, 2, and 3 months, 4.8%/year for 6 and 7 months, 4.9%/year for 8 months, 5.0%/year for 9 months, 5.1%/year for 10 months, 5.2%/year for 11 months, 5.3%/year for 12 months, and 5.5%/year for 24 and 36 months.

For deposits of VND 50 billion and above, over-the-counter interest rates start at 3.8%/year for terms of 1-3 weeks, 3.8%/year for 1, 2, and 3 months, increasing to 4.7%/year for 6 and 7 months, 4.8%/year for 8 months, 4.9%/year for 9 months, 5.0%/year for 10 months, 5.1%/year for 11 and 12 months, and peaking at 5.3%/year for 24 and 36 months.

Online channels offer competitive rates, starting at 3.9%/year for 1-3 weeks, 3.9%/year for 1 month, 4.0%/year for 2 and 3 months, 4.9%/year for 6 and 7 months, 5.0%/year for 8 months, 5.1%/year for 9 and 10 months, 5.2%/year for 11 months, 5.3%/year for 12 months, and reaching the highest rate of 5.5%/year for 24 and 36 months.

Thus, in June 2025, the best interest rates are offered for terms of 24 and 36 months with deposits of VND 50 billion and above through online channels, reaching 5.5%/year, or 5.6%/year for customers eligible for preferential rates.

Customers are advised to utilize online channels to optimize their returns. VPBank’s online channels currently offer interest rates that are 0.2%/year higher than over-the-counter rates for terms of 12 months and above.

“June 4th: The State Bank Raises Central Exchange Rate Past 25,000 VND for the First Time, Bank USD Rates Hit Ceiling Again.”

The US dollar rate at banks has surged to a record high, despite the State Bank of Vietnam’s move to increase the central exchange rate by 22 VND, surpassing the 25,000 VND/USD mark for the first time.

Save with Hong Leong Vietnam – Enjoy Luxurious Getaways

From May 19th to July 31st, 2025, Hong Leong Bank Vietnam (“Hong Leong Vietnam”) has partnered with Anantara Vacation Club to launch an exclusive promotion, “Privilege of Savings”, offering luxurious vacation prizes to show appreciation to their valued customers who have trusted the bank with their financial planning and long-term savings goals.

Governor’s Delight: Special Interest Rates for Under-35s to Buy Social Housing

With this program, you can enjoy significantly lower interest rates for the first 5 years, at 2% less per year, and for the subsequent 10 years, rates will be 1% lower annually compared to the conventional long-term VND lending rates.