Source: VietstockFinance

|

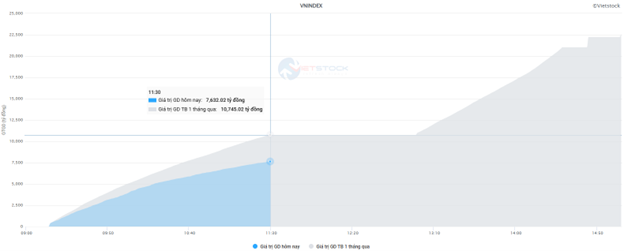

Notable weakness in liquidity indicated investors’ cautious sentiment. The trading value of VN-Index reached only 7.6 trillion VND, nearly 30% lower than the same period in the previous session and the 1-month average.

Source: VietstockFinance

|

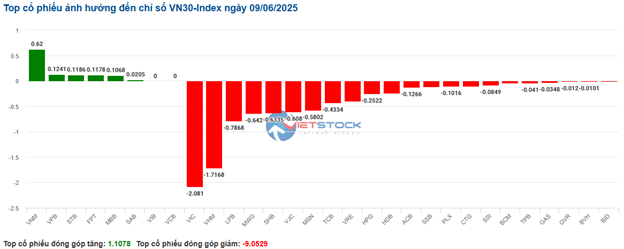

The group of stocks with the most negative impact on the VN-Index mainly came from the VN30 basket. Vingroup’s duo, VHM and VIC, alone took away nearly 3 points from the overall index. In contrast, the top 10 positive contributors brought in just over 1.5 points, demonstrating the dominance of sellers.

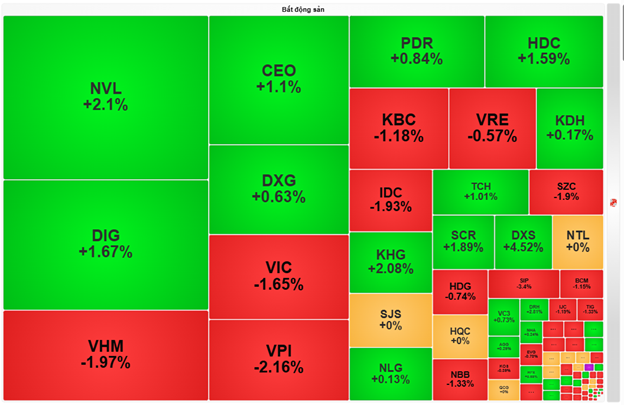

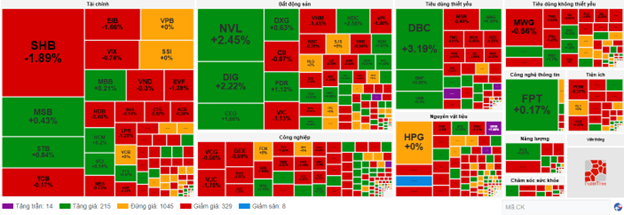

Most sectors were drowned in red. Telecommunications ranked last as it faced significant pressure from VGI, the industry’s largest cap stock (-1.95%). Following closely was the real estate sector, despite some bright spots with actively traded stocks such as NVL (+2.1%), DIG (+1.67%), CEO (+1.1%), HDC (+1.59%), and KHG (+2.08%). However, pressure from leading codes like VIC (-1.65%), VHM (-1.97%), BCM (-1.15%), KBC (-1.18%), and SIP (-3.4%) caused the real estate sector index to still drop by more than 1% in the morning session.

Source: VietstockFinance

|

Information Technology and Healthcare were the only two sectors that managed to stay slightly in the green, mainly due to the support of a few pillars such as FPT (+0.35%); DTP (+14.68%), DBD (+0.56%), DMC (+0.65%), and AGP (+1.59%).

In terms of foreign trading activities, selling pressure continued to dominate with a net sell value of 520 billion VND across all three exchanges. While no particular stock experienced an abrupt sell-off, the selling trend was widespread. PVD and HPG were the two stocks that faced the heaviest selling, with values exceeding 40 billion VND each. On the buying side, BAF topped the net buying list, but the value was only around 30 billion VND.

Open: Market Polarization, Strong Selling Pressure on Large Caps

At the start of the trading session on June 9, 2025, Vietnam’s stock market witnessed a lackluster performance. The correction pressure spread across the board, causing the main indices to retreat. A cautious sentiment was evident on the screens, reflecting the tug-of-war between buyers and sellers.

As of 10:30 am local time, the VN-Index recorded a decrease of 0.45%, settling at the 1,323 level. HNX-Index also declined by 0.23% to 228. Indices representing large-cap stocks, such as VN30 and VS-LargeCap, followed suit with drops of 0.6% and 0.49%, respectively, indicating a concentrated selling pressure on large-cap stocks.

The VN30 basket exhibited a clear polarization, with the number of declining stocks far exceeding those in the green. Specifically, there were 6 gainers, 2 stocks unchanged, and a whopping 22 losers. On the positive side, VNM contributed 0.62 points, VPB added 0.12 points, STB contributed 0.12 points, and FPT gave 0.12 points. Conversely, the main drags included VIC with a loss of 2.08 points, VHM taking away 1.72 points, LPB deducting 0.79 points, and MWG removing 0.64 points.

Source: VietstockFinance

|

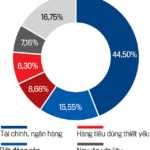

The market witnessed a strong polarization across sectors. On the declining side, many large-cap sectors faced considerable selling pressure.

The real estate sector recorded a drop of 0.90%. Within this sector, large-cap stocks like VHM, which fell by 1.46%, PDR down by 1.40%, and KDH decreasing by 0.92%, exerted significant pressure on both the market and the sector. However, a few stocks swam against the tide, such as NVL, which climbed by 2.10%, and DIG, up by 2.50%.

The banking sector, a market pillar, slipped by 0.30% as SHB declined by 1.89% and TCB fell by 0.50%, while some other stocks edged slightly higher: STB (+0.45%), BID (+0.11%), CTG (+0.25%), and VPB (+0.29%).

The materials sector lost 0.49%, dragged down by HPG‘s 0.38% fall, HSG‘s 0.44% drop, NKG‘s 0.77% decline, GMD‘s 1.12% decrease, and KBC‘s 1.18% slip; meanwhile, VGS rose by 0.76%.

Notably, the telecommunications sector experienced the sharpest decline in the market, plunging by 1.91%, led by CTR‘s 0.44% drop. The Consumer Goods and Decoration sector also fell by 1.39%.

On the flip side, a handful of sectors maintained their upward momentum. The semiconductor sector impressively rose by 4.53%, although it is a small-cap industry. The household goods and personal care sector also surged by 3.09%. The pharmaceutical and biotech sector edged up by 0.26% thanks to DHG‘s 0.26% gain. The consumer services sector climbed by 0.22%. The morning session portrayed a tug-of-war between buyers and sellers, with selling pressure dominating many key stock groups, resulting in a highly polarized market.

The market breadth painted a picture of balance. Currently, there are 1,045 stocks unchanged. Among the gainers, 215 stocks advanced, including 14 at their ceiling prices. On the losing side, 329 stocks retreated, with 8 of them hitting their daily limit downs.

Source: VietstockFinance

|

Open: Selling Pressure Intensifies

On June 9, 2025, the Vietnamese stock market opened on a weak note. By 9:30 am local time, the VN-Index shifted from positive territory to negative, settling at 1,327 points. The HNX-Index also dipped slightly, landing at 228 points. Additionally, the stocks within the VN30 basket struggled to maintain their momentum, with red dominating the screen.

The real estate sector experienced strong polarization in the early hours, with selling pressure concentrated in large-cap stocks like VHM, which fell by 0.53%, VIC down by 0.82%, VRE declining by 0.94%, and BCM slipping by 0.99%…

Meanwhile, telecommunications emerged as the worst-performing sector, plunging by 1.25%. Within this sector, VGI led the decline with a drop of 1.81%, followed by CTR (-0.67%), YEG (-0.83%), and ELC (-0.22%)…

On a brighter note, the industrial sector stood out as one of the top-performing industries, with ACV climbing by 1.18%, HVN rising by 0.78%, VEF gaining 0.59%, and CTD advancing by 0.37%.

The information technology sector also contributed to the overall market’s positive performance, with FPT up by 0.96%, CMG climbing by 0.14%, and CMT surging by 1.47%…

“Navigating the Uncertain Waters of the VN-Index: Strategies for Investors to Stay Afloat”

The pressure to sell stocks intensified as the VN-Index reached peak levels, entering a volatile phase with impending trade negotiation outcomes and tariff imposition delays.

Counterfeiting in the Digital Age: Time to Take Action Against Online Marketplaces

“It is imperative to strengthen the penalties and impose criminal liability on both the manufacturers and the e-commerce platforms themselves if they are found to be in breach of regulations. A stringent enforcement approach is necessary to deter future violations and ensure a safe and trustworthy digital marketplace for all stakeholders involved.”

The Ho Chi Minh City Stock Exchange at 25: Expanding Products and Elevating Listed Companies’ Quality

The Ho Chi Minh Stock Exchange (HOSE) has, over its 25-year history, solidified its position as Vietnam’s pioneering centralized stock exchange and the nation’s largest securities trading platform. Listing on HOSE is a testament to a company’s operational excellence, a declaration of its commitment to transparency, and a demonstration of its adherence to governance standards—all of which contribute to building a robust corporate image and enhancing its value in the eyes of investors and the wider business community.