As of 10:30 a.m., the VN-Index recorded a 0.45% decline, settling at 1,323 points. The HNX-Index also fell by 0.23%, reaching 228 points. Representative indices of large-cap groups such as VN30 and VS-LargeCap couldn’t escape the downward trend, decreasing by 0.6% and 0.49%, respectively, reflecting concentrated selling pressure on large-cap stocks.

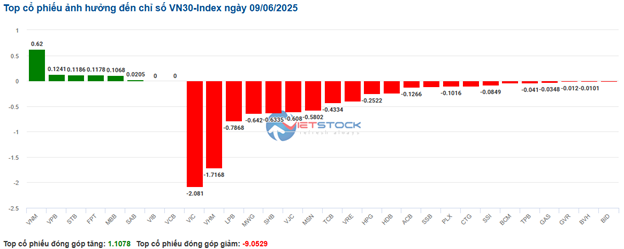

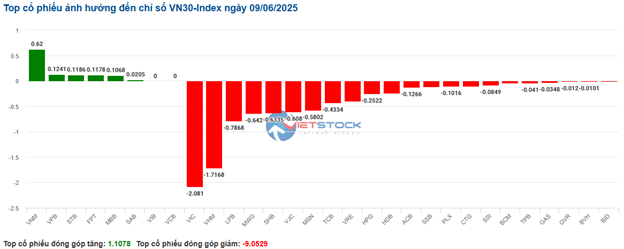

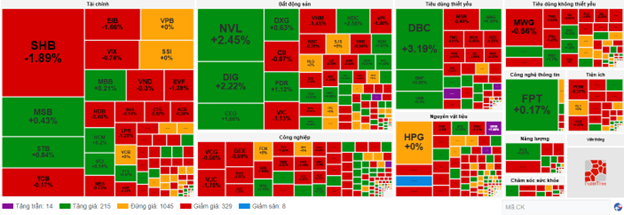

The VN30 basket witnessed a significant divergence, with the number of declining stocks overwhelmingly dominant. Specifically, there were 6 rising stocks, 2 stagnant stocks, and up to 22 falling stocks. The positive momentum was led by VNM, contributing 0.62 points, VPB with 0.12 points, STB with 0.12 points, and FPT with 0.12 points. In contrast, notable downward pressure came from stocks like VIC, which took away 2.08 points, VHM with a loss of 1.72 points, LPB deducting 0.79 points, and MWG losing 0.64 points.

Source: VietstockFinance

|

A strong divergence occurred among sectors. On the declining side, many large-cap sectors faced considerable selling pressure.

The real estate sector witnessed a 0.90% drop. Within this sector, several large-cap stocks like VHM, which fell by 1.46%, PDR decreasing by 1.40%, KDH with a 0.92% loss, and others, exerted pressure on both the market and this group. However, a few stocks moved against the trend, such as NVL, rising by 2.10%, and DIG, increasing by 2.50%.

The banking sector, the market’s pillar, declined by 0.30% as SHB dropped by 1.89% and TCB fell by 0.50%, while a few other stocks witnessed a slight increase: STB rose by 0.45%, BID increased by 0.11%, CTG grew by 0.25%, and VPB climbed by 0.29%.

The materials sector fell by 0.49%, with negative performances from HPG, down 0.38%, HSG, decreasing by 0.44%, NKG, falling by 0.77%, GMD, losing 1.12%, and KBC, declining by 1.18%. Meanwhile, VGS rose by 0.76%.

Notably, the telecommunications sector experienced the most significant decline in the market, falling by 1.91%, led by CTR, which decreased by 0.44%. The Consumer Goods and Decorations sector also fell by 1.39%.

In contrast, a handful of sectors maintained a positive upward trajectory. The semiconductor sector impressively rose by 4.53%, although it is a small-cap sector. The Household and Personal Goods sector also surged by 3.09%. The Pharmaceuticals-Biology sector witnessed a slight increase of 0.26% as DHG rose by the same percentage. The Consumer Services sector climbed by 0.22%. The morning session portrayed a tug-of-war, with selling pressure dominating many critical stock groups, resulting in a highly divergent market picture.

The market’s breadth painting revealed a significant balance among various stocks. Currently, 1,045 stocks are stagnant. There are 215 rising stocks, including 14 that hit the ceiling price. Meanwhile, 329 stocks declined, with 8 touching the floor price.

Source: VietstockFinance

|

Opening: Selling Pressure Gradually Increases in the Early Session

On June 9, 2025, at 9:30 a.m., the VN-Index shifted from positive territory to a decline, settling at 1,327 points. The HNX-Index also witnessed a slight decline, reaching 228 points. Additionally, the stocks within the VN30 basket displayed an uninspiring performance, with red dominating the landscape.

The real estate sector experienced strong divergence in the early session, with a less-than-favorable development as selling pressure concentrated on large-cap stocks like VHM, which fell by 0.53%, VIC, decreasing by 0.82%, VRE, declining by 0.94%, BCM, falling by 0.99%, and others.

Moreover, telecommunications currently lead the market’s decline with a 1.25% drop. Within this sector, the red enveloped stocks like VGI, falling by 1.81%, CTR, decreasing by 0.67%, YEG, down by 0.83%, and ELC, losing 0.22%.

The industrial group, on the other hand, is among the top-performing sectors in the early session, with ACV rising by 1.18%, HVN increasing by 0.78%, VEF climbing by 0.59%, and CTD growing by 0.37%.

The information technology sector also contributed to the overall upward momentum, with FPT rising by 0.96%, CMG increasing by 0.14%, and CMT surging by 1.47%.

– 10:43, June 9, 2025

The Ho Chi Minh City Stock Exchange at 25: Expanding Products and Elevating Listed Companies’ Quality

The Ho Chi Minh Stock Exchange (HOSE) has, over its 25-year history, solidified its position as Vietnam’s pioneering centralized stock exchange and the nation’s largest securities trading platform. Listing on HOSE is a testament to a company’s operational excellence, a declaration of its commitment to transparency, and a demonstration of its adherence to governance standards—all of which contribute to building a robust corporate image and enhancing its value in the eyes of investors and the wider business community.