Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 718 million shares, equivalent to a value of more than VND 16.3 trillion; HNX-Index reached over 86 million shares, equivalent to a value of more than VND 1.4 trillion.

In the afternoon session, VN-Index witnessed strong selling pressure, causing the index to drop sharply and remain at a low level until the end of the session, indicating a very negative market sentiment and overwhelming selling force. In terms of impact, VIC, VHM, TCB, and GVR were the codes with the most negative influence on the VN-Index, with an 11.98-point drop. On the other hand, FPT, HPG, FRT, and GAS remained in the green and contributed more than 1.1 points to the overall index.

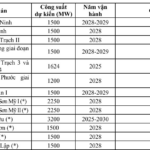

| Top 10 stocks with the most significant impact on the VN-Index on 09/06/2025 |

Similarly, the HNX-Index also had a rather pessimistic performance, with the index negatively impacted by the codes KSV (-4.6%), HUT (-3.52%), IDC (-3.13%), and THD (-2.65%)…

|

Source: VietstockFinance

|

The real estate industry was the group with the sharpest decline in the market, falling by 4.34%, mainly due to codes VIC (-6.91%), VHM (-6.97%), VRE (-3.58%), and BCM (-1.97%). This was followed by the telecommunications and materials sectors, which fell by 2.63% and 1.23%, respectively. On the other hand, the information technology industry was the only group to record a gain, rising by 0.94%, mainly driven by the code FPT (+1.04%), CMT (+0.74%), VTB (+0.5%), and VBH (+14.89%).

In terms of foreign trading, foreigners continued to sell a net amount of more than VND 349 billion on the HOSE exchange, focusing on codes SHB (VND 75.07 billion), HAH (VND 71.59 billion), VCI (VND 58.21 billion), and PVD (VND 55.89 billion). On the HNX exchange, foreigners bought a net amount of more than VND 33 billion, mainly in the code PVS (VND 24.32 billion), TFC (VND 12.01 billion), CEO (VND 6.09 billion), and IDC (VND 5.02 billion).

| Foreign Trading Buy – Sell Net |

Morning Session: Increasing Caution

No significant recovery efforts were seen by the end of the morning session as trading participation remained subdued while pressure from large-cap stocks showed no signs of easing. The VN-Index stood at 1,323.17 points (-0.51%) at midday, while the HNX-Index fell by 0.52% to 227.42 points. The market breadth showed 386 declining stocks versus 222 advancing ones.

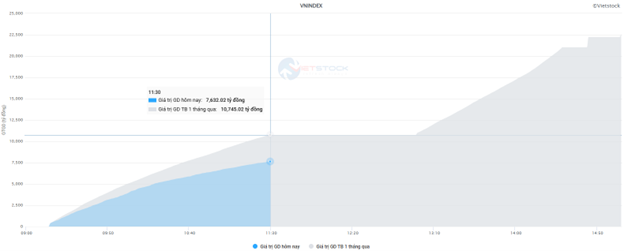

Source: VietstockFinance

|

The lackluster liquidity indicated a cautious sentiment among investors. The trading value of the VN-Index reached only VND 7.6 trillion, a decrease of nearly 30% compared to the same period in the previous session and the average of the past month.

Source: VietstockFinance

|

The stocks with the most negative impact on the VN-Index were mainly from the VN30 basket. The duo of Vingroup, VHM and VIC, alone took away nearly 3 points from the overall index. In contrast, the top 10 positive contributors brought back just over 1.5 points to the VN-Index, demonstrating the dominance of sellers.

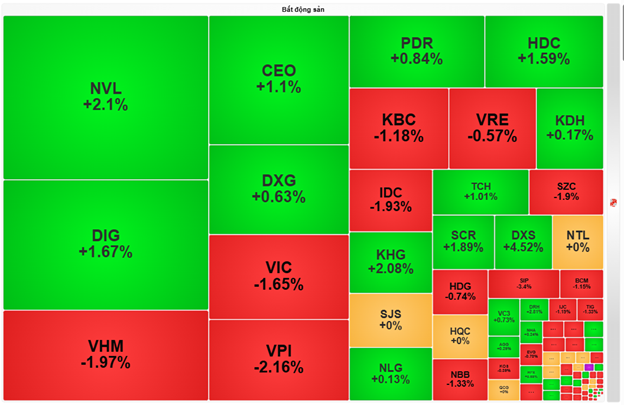

Most sectors were drowned in red. The telecommunications group ranked last as it faced significant pressure from VGI (-1.95%), the industry’s largest capitalization stock. Following was the real estate sector, despite witnessing some bright spots with actively traded stocks such as NVL (+2.1%), DIG (+1.67%), CEO (+1.1%), HDC (+1.59%), and KHG (+2.08%). However, pressure from large-cap codes like VIC (-1.65%), VHM (-1.97%), BCM (-1.15%), KBC (-1.18%), and SIP (-3.4%) caused the real estate index to fall by more than 1% in the morning session.

Source: VietstockFinance

|

Information technology and healthcare were the only two sectors that managed to stay in the green, supported by a few pillars such as FPT (+0.35%); DTP (+14.68%), DBD (+0.56%), DMC (+0.65%), and AGP (+1.59%).

Regarding foreign trading, selling pressure continued to dominate with a net sell value of VND 520 billion across all three exchanges. While no particular stock experienced a dramatic sell-off, the selling trend was broad-based. PVD and HPG were the two stocks that faced the heaviest selling, with values exceeding VND 40 billion each. On the buying side, BAF topped the net buy list, but the value was only around VND 30 billion.

Opening: Market Divergence, Strong Selling Pressure in Large Caps

At the start of the trading session on June 9, 2025, the Vietnamese stock market witnessed a lackluster performance. The adjustment pressure spread across the board, causing the major indices to retreat. A cautious sentiment was evident on the screens, reflecting the tug-of-war between buyers and sellers.

As of 10:30 am, the VN-Index recorded a decrease of 0.45%, standing at the 1,323-point threshold. The HNX-Index also fell by 0.23% to 228 points. Indices representing large-cap groups, such as VN30 and VS-LargeCap, followed suit with declines of 0.6% and 0.49%, respectively, indicating selling pressure concentrated in large-cap stocks.

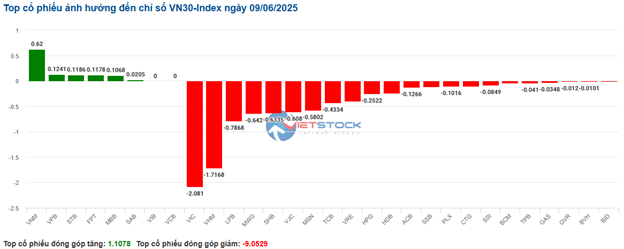

The VN30 basket showed divergence, with the number of declining stocks far exceeding those in the green. Specifically, there were 6 rising stocks, 2 unchanged stocks, and 22 falling stocks. On the positive side, VNM contributed 0.62 points, VPB added 0.12 points, STB contributed 0.12 points, and FPT brought in 0.12 points. Conversely, negative impacts came mainly from VIC, which took away 2.08 points, VHM with a 1.72-point drop, LPB deducting 0.79 points, and MWG reducing the index by 0.64 points.

Source: VietstockFinance

|

The divergence was prominent across sectors. On the declining side, many large-cap industries faced notable selling pressure.

The real estate sector witnessed a 0.90% drop. Within this industry, large-cap stocks like VHM, which fell by 1.46%, PDR decreasing by 1.40%, and KDH slipping by 0.92%, exerted pressure on the overall market and this group. However, a few stocks swam against the tide, such as NVL, which climbed by 2.10%, and DIG, rising by 2.50%.

The banking industry, a market pillar, fell by 0.30% as SHB declined by 1.89% and TCB slipped by 0.50%, while some other stocks edged slightly higher, including STB (+0.45%), BID (+0.11%), CTG (+0.25%), and VPB (+0.29%).

The materials sector lost 0.49%, dragged down by HPG (-0.38%), HSG (-0.44%), NKG (-0.77%), GMD (-1.12%), and KBC (-1.18%). Meanwhile, VGS rose by 0.76%.

Notably, the telecommunications sector posted the steepest decline in the market, plunging by 1.91%, led by CTR, which fell by 0.44%. The Consumer and Decoration Goods sector also dropped by 1.39%.

On the flip side, a handful of sectors maintained their upward trajectory. The Semiconductor industry impressively rose by 4.53%; however, this sector has a small market capitalization. The Household and Personal Goods sector also surged by 3.09%. The Pharmaceutical and Biological industry edged up by 0.26%, driven by DHG, which climbed by 0.26%. The Consumer Services sector inched up by 0.22%. The morning session reflected a tug-of-war between buyers and sellers, with selling pressure dominating many crucial stock groups, resulting in a highly divergent market landscape.

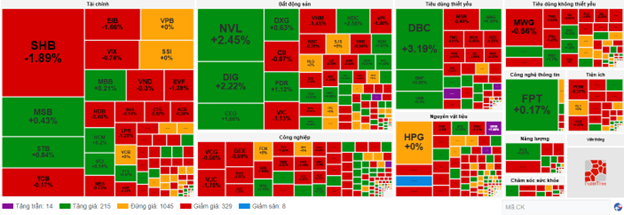

The market breadth showcased a notable balance, with 1,045 stocks standing unchanged. There were 215 rising stocks, including 14 that hit the ceiling price, while 329 stocks declined, and 8 touched the floor price.

Source: VietstockFinance

|

Opening: Selling Pressure Intensifies

On June 9, 2025, at 9:30 am, the VN-Index shifted from positive territory to a decline, falling to 1,327 points. The HNX-Index also dipped slightly, landing at 228 points. Additionally, the stocks within the VN30 basket displayed a lackluster performance, with the red hue dominating.

The real estate sector experienced notable divergence at the opening, with selling pressure concentrated in large-cap stocks. VHM fell by 0.53%, VIC dropped by 0.82%, VRE slipped by 0.94%, and BCM decreased by 0.99%…

Meanwhile, telecommunications was the group with the steepest decline in the market, plunging by 1.25%. Within this sector, VGI sank by 1.81%, CTR fell by 0.67%, YEG dropped by 0.83%, and ELC slipped by 0.22%…

On a positive note, the industrial sector was among the top-performing groups in the early session, with ACV climbing by 1.18%, HVN rising by 0.78%, VEF gaining 0.59%, and CTD inching up by 0.37%.

The information technology sector also contributed to the overall upward momentum, driven by stocks like FPT, which advanced by 0.96

Stock Market Enters Uncertain Phase: What’s the Best Course of Action?

The VN-Index fell for the third consecutive session, slipping below the 1,330-point mark. Analysts suggest that the stock market is at a precarious juncture, nearing previous peaks as trade negotiations draw to a close, with tariff imposition on hold.

Market Beat: A Pulse Check on Investor Sentiment

The market witnessed a lackluster performance in the morning session, with no significant recovery efforts. The subdued participation of cash flow, coupled with persistent pressure from the pillar group, painted a gloomy picture. VN-Index hovered at 1,323.17 points, reflecting a 0.51% decline, while HNX-Index mirrored this sentiment with a 0.52% drop, settling at 227.42. The market breadth further emphasized the bearish trend, with 386 declining stocks outweighing the 222 advancing ones.