On June 5, the Board of Directors of Masan MEATLife (MML) passed a resolution to transfer the company’s undistributed profits, after fulfilling tax and other financial obligations, to MML Farm Nghe An, totaling VND 380 billion. The latest deadline for this transfer is set for December 31, 2025.

On the same day, the Board resolved to approve plans to increase capital contributions to MEATDeli HN, a wholly-owned subsidiary of MML. The approved additional contribution is up to VND 380 billion.

The additional capital contribution to MEATDeli HN can be executed in multiple installments, depending on MEATDeli’s operational status and the company’s cash flow plans. The completion of this contribution is expected by December 31, 2025.

Currently, MEATDeli HN has a chartered capital of VND 2,386 billion, which is anticipated to increase to a maximum of VND 2,766 billion this year.

Both resolutions entrusted Chairman Danny Le and CEO Nguyen Quoc Trung to carry out the relevant tasks.

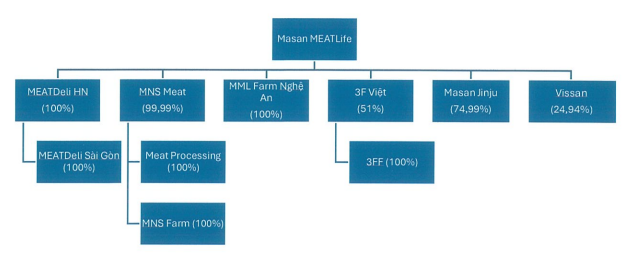

As per the Q1/2025 financial statements, MML directly owns five subsidiaries: MNS Meat, specializing in investment management consulting (excluding financial, accounting, and legal consulting); 3F Viet, engaged in poultry farming; Masan Jinju, primarily involved in meat and meat product processing; MEATDeli HN, focused on meat and meat product processing; and MML Farm Nghe An, dedicated to pig farming and pig breeding.

Through these subsidiaries, MML indirectly owns four additional companies: MNS Meat Processing and MNS Farm through MNS Meat; MEATDeli Saigon through MEATDeli HN; and 3FF through 3F Viet. However, MNS Meat, MNS Meat Processing, and MNS Farm are in the process of dissolution.

Source: MML’s 2024 Annual Report

|

In 2025, MML forecasts revenue between VND 8,250 billion and VND 8,749 billion, representing an increase of 8-14% compared to the same period last year. The company continues its transformation journey to become a meat processing enterprise, deepening its collaboration with WinCommerce. Excluding the farm segment, MML aims for growth of 10-18% in 2025.

At the 2025 Annual General Meeting of Shareholders, CEO Nguyen Quoc Trung shared that the company is focused on developing processed meat products, targeting revenue of VND 2.2 million per WinCommerce store per day, and optimizing the value of pigs.

In the first quarter of 2025, the company achieved encouraging results, with revenue of VND 2,070 billion and a net profit of VND 116 billion. “Many companies in the market have developed branded meat products, while MML, as a leader, focuses on product diversification and prioritizes the high-profit processing segment. These are the areas the company will concentrate on in 2025,” said the CEO of MML.

– 15:28 09/06/2025

“SCS Announces 60% Cash Dividend Plan, Preparing for Potential ACV Collaboration at Long Thanh Airport”

“Saigon Cargo Service Joint Stock Company (HOSE: SCS) has unveiled an ambitious plan, targeting record-high profits and a generous 60% cash dividend. With its eyes set on the future, the company is also actively gearing up to seize opportunities arising from the development of the Long Thanh International Airport.”

“Bầu Đức Encourages Investors to Hold On to HAG Shares for the Long Term”

“With a confident smile, Mr. Đoàn Nguyên Đức, affectionately known as ‘Bầu Đức’, captivated the audience at the 2025 Annual General Meeting of HAGL. As the Chairman, his insights and vision for the company’s future left a lasting impression, offering a glimpse into the strategic mindset that has contributed to his success in the industry.”

“LDG Schedules 3rd Annual General Meeting for 2025”

The LDG Group is pleased to announce that it will be holding its 3rd Annual General Meeting of Shareholders for the year 2025 on June 26, 2025. This important event will be conducted virtually, allowing shareholders to participate and engage with the company’s latest developments from the comfort of their homes.

A Rising Star: Eastspring Vietnam’s Deputy CEO Appointed as Information Disclosure Officer After Just One Month on the Job

Feel free to provide any additional information or further details if you want me to refine or expand upon this title.

On May 27th, Eastspring Investments Fund Management Company Limited (Eastspring Vietnam), a member of Prudential Vietnam Life Insurance, announced the appointment of Mr. Nguyen Quoc Dung as the Authorized Information Disclosure Representative. The decision came shortly after Mr. Dung’s appointment as Deputy General Director on April 28th.