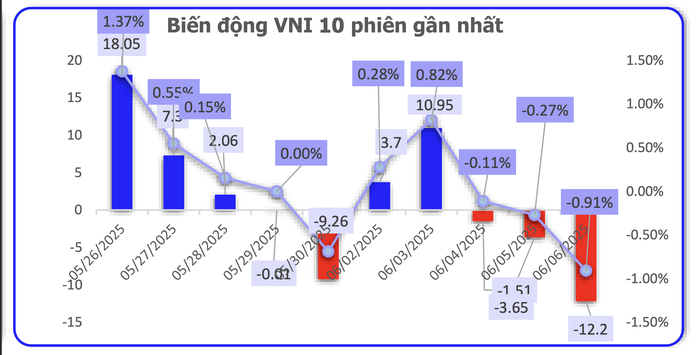

After 4 consecutive weeks of gains that pushed the VN-Index to the 1,340-1,350 range, the highest level in over 3 years, the stock market has started to show signs of slowing down. Selling pressure in the last few sessions of the week caused the main index to fall for 3 consecutive sessions. The VN-Index ended the week slightly lower, down 0.2% to 1,329.89.

According to Mr. Nguyen Thai Hoc, an analyst at Pinetree Securities Company, this is the first week of correction after a long streak of gains. Although the decline was not significant, a look at the money flow and technical signals suggests that the market sentiment has become more cautious.

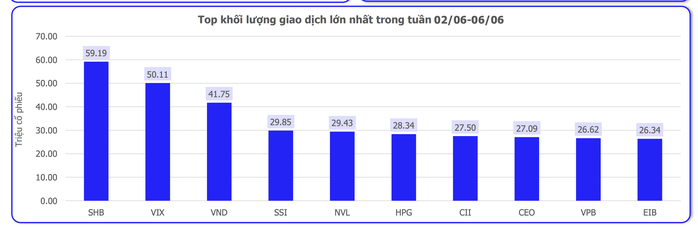

He believes that the risk of short-term correction is becoming clearer, as money flow is currently mainly rotating between large sectors and focusing on a few stocks with their own stories.

In fact, after the group of bank stocks attracted money flow, the focus shifted to real estate, then securities and electricity. However, Mr. Hoc noted that if the pillar stocks, especially those belonging to the Vingroup ecosystem such as VIC, VHM, and VRE, also corrected, the VN-Index could face stronger selling pressure.

The stock market is under pressure to adjust after 4 consecutive weeks of gains

Many investors shared that although the market had risen for 4 straight weeks, their portfolios were still not “safe”. Only in the last few sessions, when the index fell slightly, did the stocks fall, causing anxiety to spread. This reflects the fact that many stocks in the securities, real estate, and banking groups have not recovered to pre-slump levels in early April.

SHS experts believe that the market is entering June – a time when there are many unpredictable factors, as trade and tariff negotiations between the US and other countries are in the final stages. Changes in tax policies could start to affect businesses’ financial performance, thereby affecting stock prices. It is expected that the market will need time to find a new equilibrium price, especially for sectors affected by taxes.

SHS also assessed that the VN-Index could return to test the support area around the 1,300-point mark. Investors are advised to be cautious in disbursement and need to carefully evaluate their short-term portfolios to have a reasonable restructuring plan.

Source: CSI

Mr. Nguyen Thai Hoc emphasized that the market is still in a “holding its breath” state, waiting for clearer supportive information, especially the results of tax negotiations between Vietnam and the US. In this context, the possibility of the index continuing to break through is quite low.

If the market falls into a negative scenario, the VN-Index may fluctuate strongly and fall back to the support zone of 1,280-1,300 points. In that case, selling pressure may increase, especially in large-cap stocks such as banks or stocks belonging to the Vingroup ecosystem. This is a point to note for investors to adjust their strategies accordingly.

Meanwhile, Mr. Dinh Quang Hinh, Head of Macro and Market Strategy Department at VNDIRECT Securities Company, said that the coming period will be a “critical” time with many important events. Notably, the Fed’s policy meeting in mid-June and the tariff negotiation deadline in early July.

Mr. Hinh believes that in this context, the top priority for investors should be to preserve profits and manage portfolio risks. Obviously, after a strong rise, the stock market is entering a challenging phase. Keeping a steady mindset, carefully selecting stocks, and managing the portfolio carefully will be the key to helping investors navigate the upcoming volatile period.

Source: CSI

Expert Opinion: Holding Breath in Pivotal 30 Days – Investors Brace for VN-Index to Breach 1,300 Points

According to Pinetree experts, the market remains highly cautious in the absence of clear supportive information, especially regarding the progress of Vietnam-US trade negotiations, which are closely watched by investors. As a result, the VN-Index is unlikely to break out in the coming week.