Starting in 2025, the method for calculating retirement benefits can be divided into two phases:

Before July 1, 2025: The Social Insurance Law of 2014 is still in effect

According to Article 56 of the 2014 Social Insurance Law, from January 1, 2018, the monthly retirement benefit for eligible workers is calculated as 45% of the average monthly social insurance contribution and corresponds to the number of years of social insurance contribution as follows:

a) For male workers retiring in 2018, the required number of years is 16; in 2019, it is 17 years; in 2020, it is 18 years; in 2021, it is 19 years, and from 2022 onwards, it is 20 years;

b) For female workers retiring from 2018 onwards, the required number of years is 15.

For each additional year thereafter, the workers specified in points a and b of this article will receive an additional 2%; the maximum amount is 75% of the monthly salary contribution to social insurance.

According to Articles 56 and 74 of the 2014 Law on Social Insurance, retirement benefits for workers are determined by the following general formula:

Monthly retirement benefit = Benefit rate x Average monthly salary/income for social insurance contribution

The average monthly salary for social insurance contributions (for those participating in compulsory social insurance) or monthly income for social insurance contributions (for those participating in voluntary social insurance) will depend on the monthly salary or income of the worker and will be multiplied by the corresponding price fluctuation coefficient.

From July 1, 2025: The Social Insurance Law of 2024 is applied

Article 66 of the 2024 Social Insurance Law specifically stipulates the monthly retirement benefit for eligible workers. Specifically:

– For female workers: The monthly retirement benefit is 45% of the average monthly salary on which social insurance contributions are based, as specified in Article 72 of this Law, corresponding to 15 years of social insurance contributions. For each additional year of contribution, an additional 2% is calculated, up to a maximum of 75%.

– For male workers: The monthly retirement benefit is 45% of the average monthly salary on which social insurance contributions are based, as specified in Article 72 of this Law, corresponding to 20 years of social insurance contributions. For each additional year of contribution, an additional 2% is calculated, up to a maximum of 75%.

In the case of male workers with a social insurance contribution period of between 15 and less than 20 years, the monthly retirement benefit is 40% of the average monthly salary on which social insurance contributions are based, as specified in Article 72 of this Law, corresponding to 15 years of social insurance contributions. For each additional year of contribution, an additional 1% is calculated.

In other words, instead of only female workers with a mandatory social insurance contribution period of at least 15 years being eligible for retirement benefits under the 2014 Social Insurance Law, from July 1, 2025, the 2024 Social Insurance Law has introduced an additional method for calculating retirement benefit rates for male workers with a social insurance contribution period of between 15 and less than 20 years.

Based on Articles 66 and 72 of the 2024 Social Insurance Law, the monthly retirement benefit for compulsory social insurance participants is calculated using the following formula:

Monthly retirement benefit = (Monthly retirement benefit rate) x (Average monthly salary for social insurance contribution)

For workers subject to the state-regulated salary scheme, if their entire social insurance contribution period falls under this scheme, the average monthly salary for social insurance contributions is calculated based on the following periods:

– For social insurance participation before January 1, 1995: The average monthly salary for social insurance contributions is calculated based on the average of the last 5 years of contributions before retirement.

– For social insurance participation from January 1, 1995, to January 1, 2000: The average monthly salary for social insurance contributions is calculated based on the average of the last 6 years of contributions before retirement.

– For social insurance participation from January 1, 2001, to December 31, 2006: The average monthly salary for social insurance contributions is calculated based on the average of the last 8 years of contributions before retirement.

– For social insurance participation from January 1, 2007, to December 31, 2015: The average monthly salary for social insurance contributions is calculated based on the average of the last 10 years of contributions before retirement.

Thus, for female workers retiring in 2025, if they have contributed for 22 years, they will receive a retirement benefit at a rate of 59% of their monthly salary contribution.

For male workers , if they have contributed for 22 years, they will receive a retirement benefit at a rate of 49% of their monthly salary contribution.

Guide to checking retirement benefits and social insurance allowances on VssID

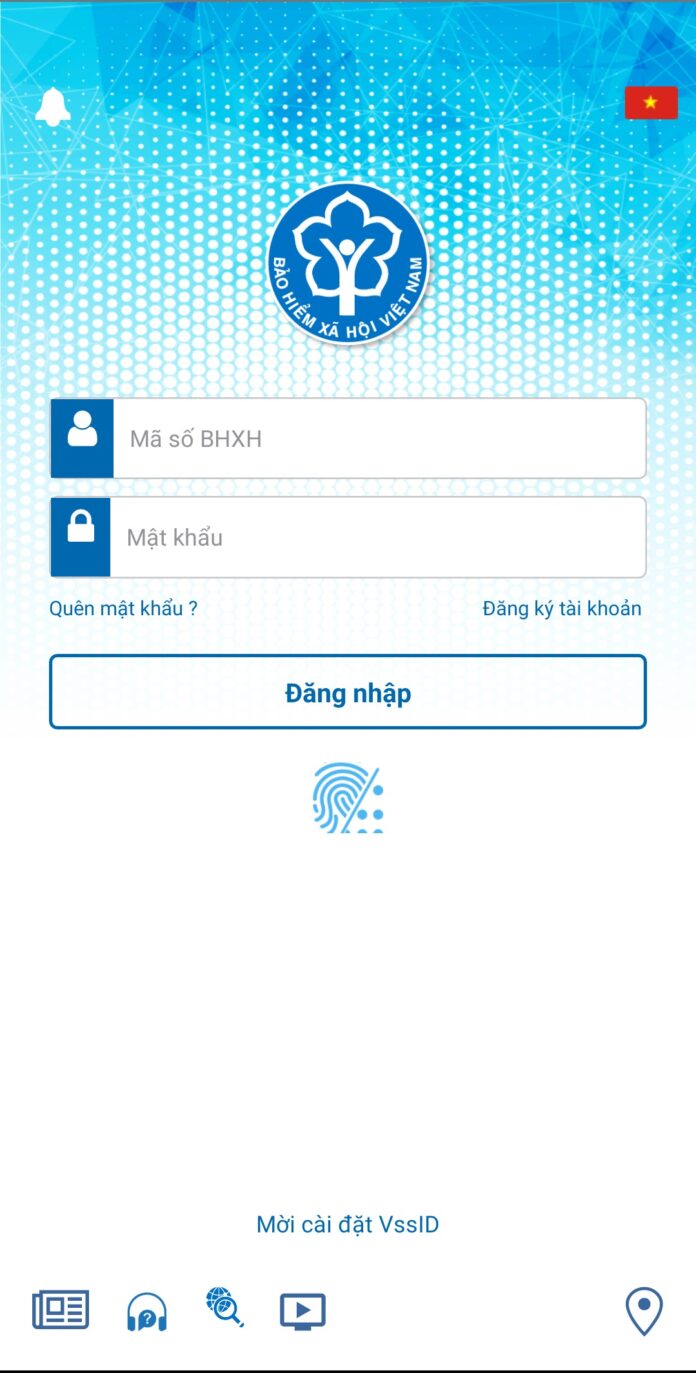

Step 1: Log in to the VssID application

Open the VssID application and log in to the system using your provided username and password.

If you don’t have an account, please see the registration guide here

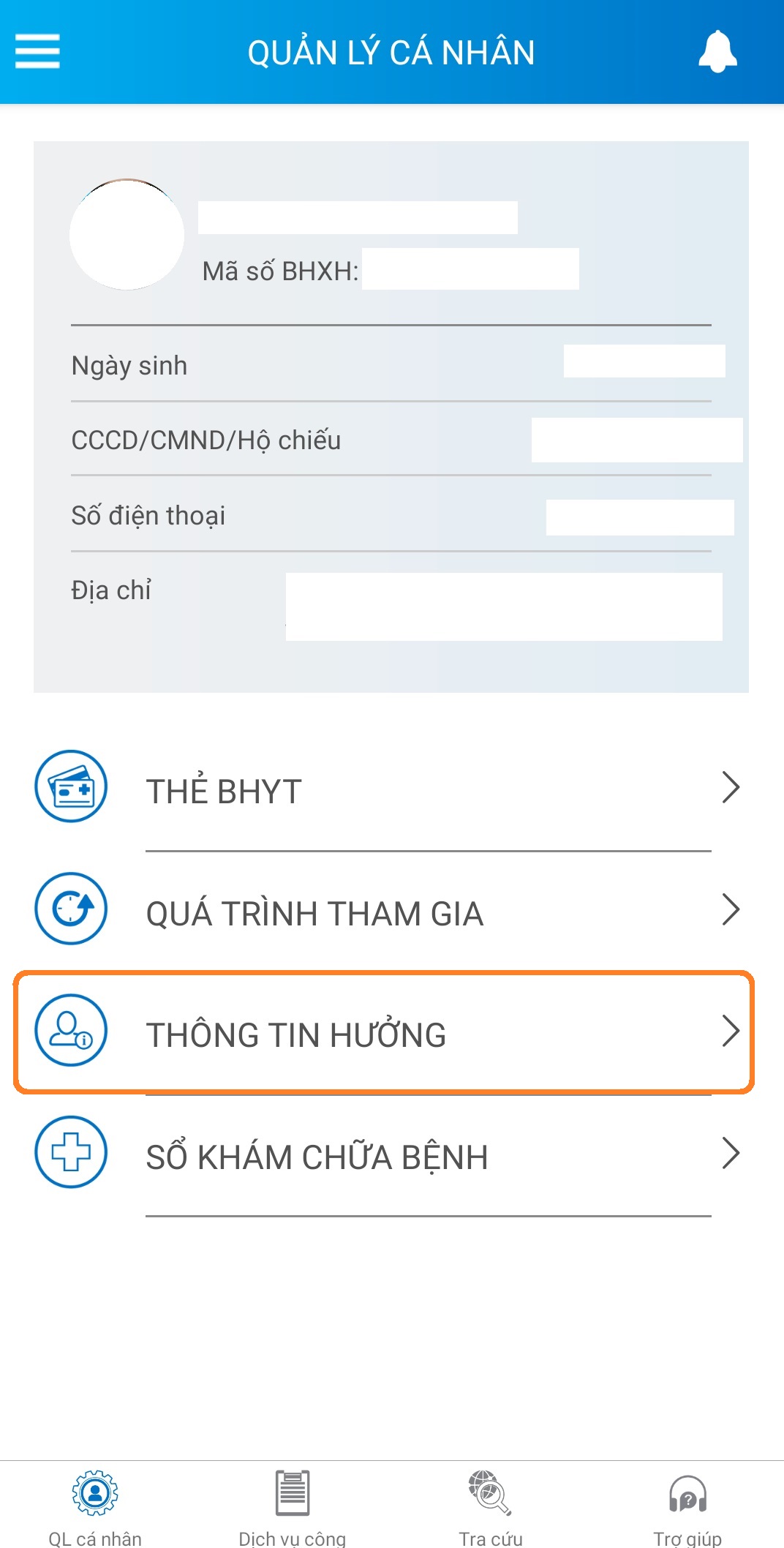

Step 2: View Entitlement Information

On the “Personal Management” home page, select the “Entitlement Information” section.

Step 3: Check retirement benefit and social insurance allowance information

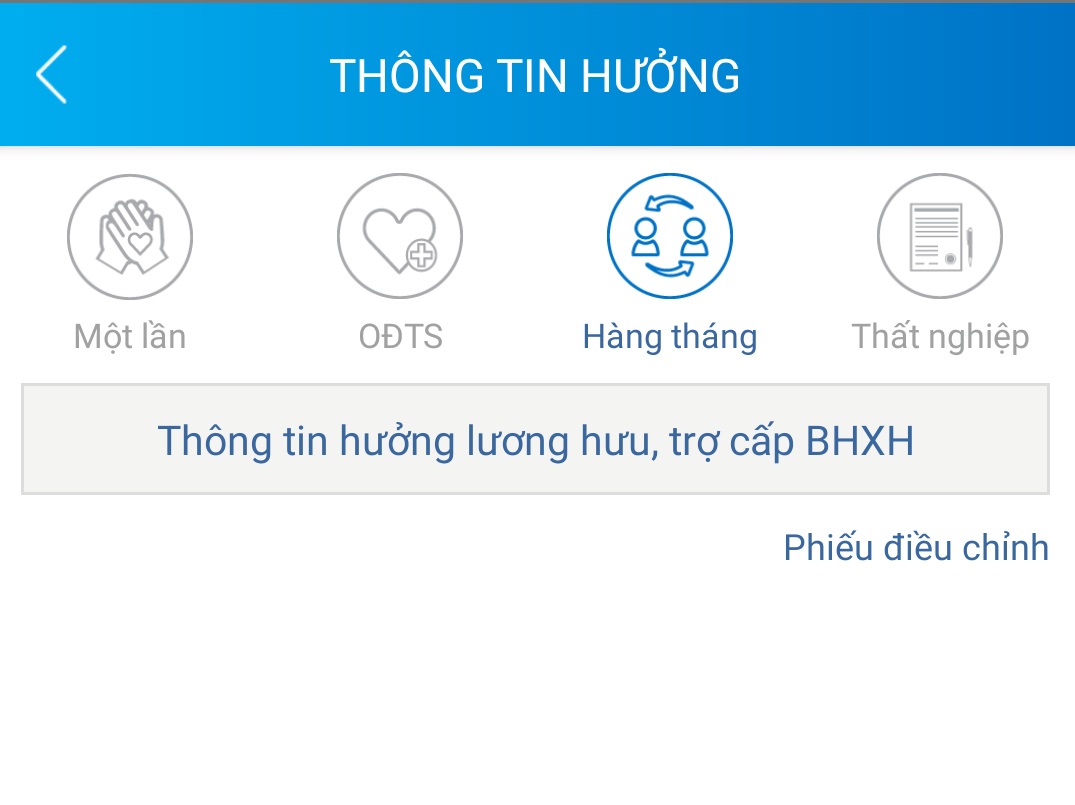

After selecting “Entitlement Information”, the system will switch to the information section.

This section of the app will display the following:

-

Information on one-time social insurance benefits;

-

Information on sick leave and maternity benefits;

-

Information on monthly retirement benefits and social insurance allowances;

- Information on unemployment insurance.

Step 4: Select “Monthly” to view information about retirement benefits and social insurance allowances.