A name change to T-Cap to support international business strategy

One notable item on the agenda was the approval of the name change from Trí Việt Securities Joint Stock Company to T-Cap Securities Joint Stock Company.

When asked about the reason for this decision, the company representative explained that the change to T-Cap is in line with internationalization trends and the search for strategic partners abroad. As the company plans to shift its focus to international business, the name Trí Việt is no longer deemed suitable. Additionally, T-Cap is concise, catchy, and easier for clients to remember.

Along with the name change, the company will also undergo organizational restructuring. Instead of having a Supervisory Board, there will be an Audit Committee under the Board of Directors. According to the company, this model is more effective, practical, and aligns with their current human resources. It also mirrors the structure of larger securities companies such as SSI and FPTS.

Regarding personnel changes, with the dissolution of the Supervisory Board, its members, including Ms. Lê Thị Quý, Ms. Phạm Thị Thùy, and Ms. Nguyễn Phan Việt Trà, have been relieved of their duties.

At the Board of Directors level, the shareholders approved the dismissal of Mr. Nguyễn Đức Thanh from his position as a member for the 2024-2027 term and elected Mr. Trần Vũ Hoàng Sơn to the Board.

The restructuring process is in its final stage

Explaining the frequent leadership changes in 2024, a TVB representative stated that the company’s strategy involves restructuring, streamlining, and efficient cost management. With the new business orientation, a suitable leadership team and staff are required. Currently, the company is in the final phase of restructuring and is gradually stabilizing, with the next focus being on business development.

With its current staff of 26 people, TVB plans to recruit an additional 20-25 people for its investment analysis department. Moreover, the company is benefiting from support provided by its parent company.

During the meeting, a “hot” question was raised regarding any restrictions or legal issues faced by TVB, as well as the handling of the consequences of two previous cases.

According to TVB‘s representative, the company is not currently facing any restrictions or legal issues related to its operations. They emphasized that this would be the last time they would respond to similar questions from shareholders. The company has also undertaken various tasks to address the fallout from the two cases (Louis Holding stock manipulation and TVB – TVC stock manipulation).

A conservative business plan with the addition of derivatives business to mitigate risks

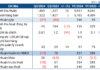

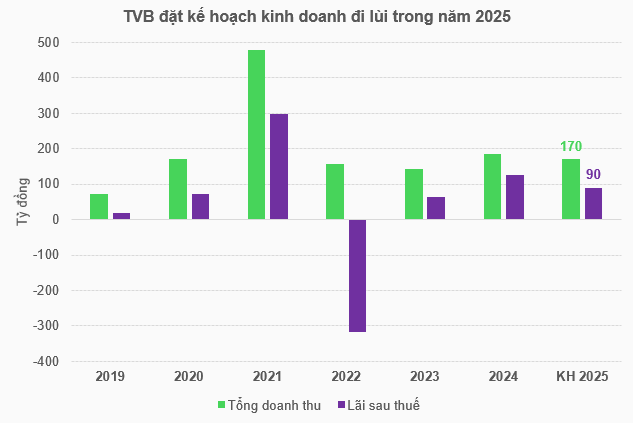

The meeting approved a conservative business plan for 2025, with targets lower than the previous year’s performance. Specifically, the total revenue and after-tax profit goals are set at VND 170 billion and VND 90 billion, respectively, representing a 9% and 29% decrease.

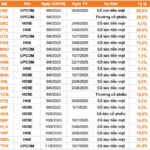

Source: VietstockFinance

|

According to TVB‘s management, the conservative plan is due to the unpredictable macroeconomic landscape in 2025, particularly the impact of US trade policies and trade wars on economic development. The investment context is also expected to be much more challenging, prompting the company to be cautious and prioritize sustainable development.

In 2025, the revenue and profit structure will mainly comprise proprietary trading and margin lending, while the brokerage and consulting segments are being reviewed and redirected, and thus, will not contribute significantly to revenue and profit.

The company’s leadership has identified proprietary trading as the focus for resource allocation in 2025, with a maximum capital utilization of 70% of equity, equivalent to more than VND 800 billion. The portfolio will be allocated following the money flow trends and market fluctuations.

“The market may continue to fluctuate due to tariff developments, but we are studying the possibility of investing in sectors such as banking, securities, steel, real estate, and public investment”, shared the TVB representative.

In response to a shareholder’s inquiry about the concentration on HPG and MWG stocks, the company explained that these are fundamentally strong stocks with solid competitive advantages in their industries, aligning with the company’s investment strategy. They affirmed their commitment to maintaining this investment direction, as implemented in previous years.

The meeting also approved the addition of derivatives business (brokerage, proprietary trading, and investment consulting for derivatives securities) and settlement and payment services for derivatives securities transactions.

Derivatives have been mentioned by the company’s leadership as a tool to mitigate risks in the event of a prolonged market downturn.

Issuing over 33.6 million shares in Q4 and paying dividends of up to 6%

The meeting approved the plan to offer over 33.6 million shares to existing shareholders at a ratio of 100:30 (for every 100 shares owned, shareholders have the right to buy 30 new shares). The offering is expected to take place in Q4/2025, with a minimum price of VND 10,000 per share, aiming to raise over VND 336 billion to supplement business activities, enhance financial capacity, and expand the scale of the enterprise.

Regarding profit distribution, TVB has no plans for fund allocation or dividend payments for 2024. For 2025, the company expects to pay dividends of up to 6% of charter capital.

The meeting also approved a resolution allowing Trí Việt Asset Management Group Joint Stock Company (HNX: TVC) and TNHH MTV Tùng Trí Việt Company to acquire transferable shares of TVB without having to make a public offer.

– 13:58 09/06/2025

“Dividend Payment Schedule for June 9-13: Top Cash Dividends Over 40%, State-Owned Enterprise Allocates Approximately VND 1,500 Billion for Dividend Payments”

Introducing the top-performing stocks that offer lucrative cash dividends! 32 companies stand out with their generous cash payouts, ranging from a remarkable 41% to a solid 1.6%. These figures showcase a diverse range of opportunities for investors seeking steady income streams and strong returns. This impressive lineup underscores the potential for substantial gains in the stock market, providing a compelling proposition for those looking to grow their wealth.

Investing in Saigon VRG: Upcoming Release of 31.6 Million Dividend Shares

“Saigon VRG Corporation plans to issue approximately 31.6 million dividend shares for its 2024 dividend payout, offering a generous 100:15 allocation ratio to its shareholders. The record date for this allocation is expected to fall within July 2025, marking an important milestone for investors.”