Vietcombank, alongside VietinBank and BIDV, currently holds over 40% of the total industry credit market share. Photo: N.K |

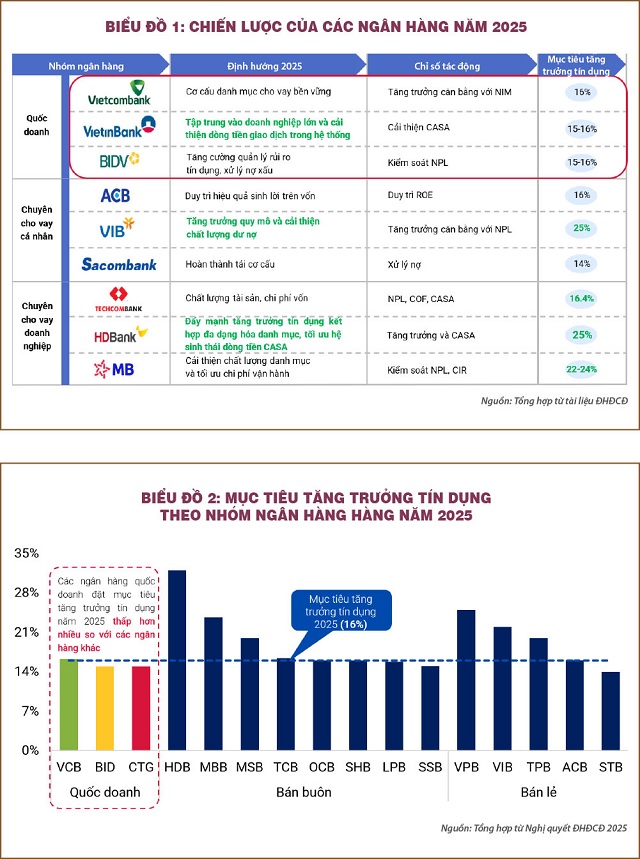

While numerous privately-owned joint-stock commercial banks are accelerating their lending activities to seize opportunities arising from the economic recovery cycle, the state-owned banks are taking a more cautious approach. From restructuring their portfolios and improving their non-term deposit (CASA) ratios to controlling non-performing loans (NPLs) and maintaining moderate credit growth, these banks are opting for a more measured pace rather than chasing market share.

The state-owned bank group, comprising Vietcombank, VietinBank, and BIDV, holds a significant presence in the industry with over 40% of the total credit market share. They play a pivotal role in regulating the flow of credit in the economy. As monetary policy is relaxed to support economic growth targets for 2025, their role in providing capital becomes even more crucial for the country’s economic recovery and expansion. However, instead of accelerating lending activities to align with the expansionary policy, these state-owned banks have set a more conservative target of less than 16% credit growth, noticeably lower than their joint-stock peers, reflecting their prudent strategy for the year.

Strategic Focus for 2025

With the economy expected to rebound strongly and monetary policy remaining accommodative in 2025, most commercial banks are strategizing to accelerate credit expansion. However, the state-owned bank group is charting a distinct path, as evident in their business strategies presented at their annual general meetings. Rather than focusing on size, this group is prioritizing risk management, portfolio restructuring, and operational foundation enhancement. This approach not only aligns with their role as systemic pillars but also demonstrates their proactive stance in maintaining macroeconomic stability during this transitional phase.

Vietcombank continues to assert its position as a top-performing bank in asset utilization with a strategy centered on balancing profitability and portfolio safety. For 2025, the focus is on restructuring its loan portfolio to mitigate credit risk while sustaining a stable net interest margin (NIM) without further significant declines.

Meanwhile, VietinBank is repositioning its operational strategy by aiming to enhance funding efficiency through an improved CASA ratio. This orientation involves developing a comprehensive financial services ecosystem to serve large corporate clients with diverse transaction needs and stable cash flows. Consequently, the bank can reduce funding costs and improve profit margins amidst rising input costs. Additionally, maintaining a reasonable credit growth pace provides VietinBank with the flexibility to proactively enhance asset quality and manage risks.

BIDV is the only state-owned bank that has singled out NPL control as its strategic focus for 2025. With many real estate-related loans potentially impacting the industry’s asset quality, BIDV is prioritizing the resolution of overdue loans over new credit extensions. Furthermore, the bank is actively bolstering its risk buffers by strengthening loan loss provisions and refining its credit assessment processes. Compared to the other two state-owned banks, BIDV is in a phase of financial foundation consolidation, making its strategy of stability and portfolio quality management well-suited to its current position.

2025 Credit Growth Targets

The credit growth targets for 2025 highlight a clear divergence in approaches between the state-owned and private banks. While private banks like HDBank, VPBank, and VIB aim for credit growth above 20%, Vietcombank, BIDV, and VietinBank maintain plans around 15%. This target is significantly lower than the average expectation of listed banks, forecasted to range between 18-20%. The decision by state-owned banks, holding over 40% of the system’s total credit, to pursue lower growth reflects a long-term strategic choice that carries implications for their positioning and systemic roles.

At the core of this orientation is the unique function of state-owned banks within the national financial system. Beyond being mere profit-seeking entities, they are tasked with market stabilization, capital flow regulation, and systemic safety during turbulent times. Moreover, their involvement in critical areas such as the bond market, interbank transactions, and large corporate financing necessitates a high level of stability, rendering aggressive short-term growth strategies incompatible. Thus, maintaining moderate credit growth not only serves as a defensive maneuver but also ensures stability and efficiency for the entire financial sector.

However, this cautious growth strategy by state-owned banks will create opportunities for market share reallocation in the coming years. Private banks can seize the initiative in segments like retail, personal consumer, and small and medium-sized enterprise lending, which are not the primary focus of state-owned banks. Nonetheless, this does not diminish the dominant role of state-owned banks in key areas such as financing large conglomerates, interbank lending, and government bond markets. This emerging tiered structure within the banking system may foster a more balanced and stable financial ecosystem where different groups of banks play complementary rather than competitive roles.

The 2025 business strategies of state-owned banks, with a focus on risk management, cost optimization, and prudent credit growth, underscore their systemic vision. Amid macroeconomic uncertainties in this transitional economy, their cautious approach not only safeguards their internal financial strength but also contributes to the overall market’s resilience. Consequently, the state-owned bank group reinforces its pivotal role in macroeconomic development, standing alongside the State Bank in conducting monetary policy and stabilizing the nation’s financial system.

Lê Hoài Ân – Võ Nhật Anh

– 07:00 09/06/2025

The Bank That Pays an Average of $1,600 in Monthly Salaries to Its Employees, but Still Has a Turnover of Nearly 1,000 Per Year—and an Even More Surprising Number of New Hires.

The talented team at this bank boasts an impressive average; each employee generates over VND 1.7 billion in pre-tax profits and VND 1.4 billion in post-tax profits annually.

“Dollar and Yuan Dance to Different Tunes: A Tale of Contrasting Fortunes.”

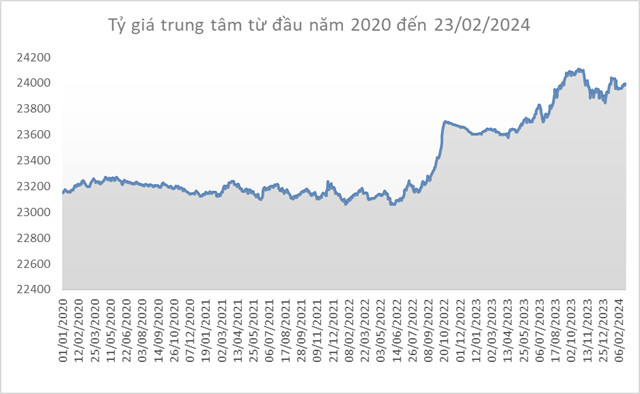

“As of 8:30 a.m. on June 2nd, the USD exchange rate at Vietcombank and BIDV was set at 23,850-23,210 VND/USD for buying and selling, respectively. This marks an increase of 20 VND in both buying and selling rates compared to the morning of May 30th, indicating a slight strengthening of the USD against the VND in the interbank market.”

Streamlining VietinBank’s Network for Smarter Transactions

Deep digitization of products and services, redesigning business processes, trimming the traditional transaction network, and harnessing the power of data – these are the key focus areas that VietinBank has, is, and will be undertaking to accelerate comprehensive digital transformation.