The Vietnamese stock market experienced its first week of adjustments after four consecutive weeks of gains, with the VN-Index facing strong selling pressure and reduced buying interest as the index approached previous highs. The market dynamics indicate increasing selling pressure, particularly in stocks that had previously seen significant gains, such as those in the port-transport, textile, and industrial park sectors. This led to a decrease in market liquidity, with trading concentrated in mid- and small-cap stocks. Additionally, foreign investors net-sold strongly in the first week of June.

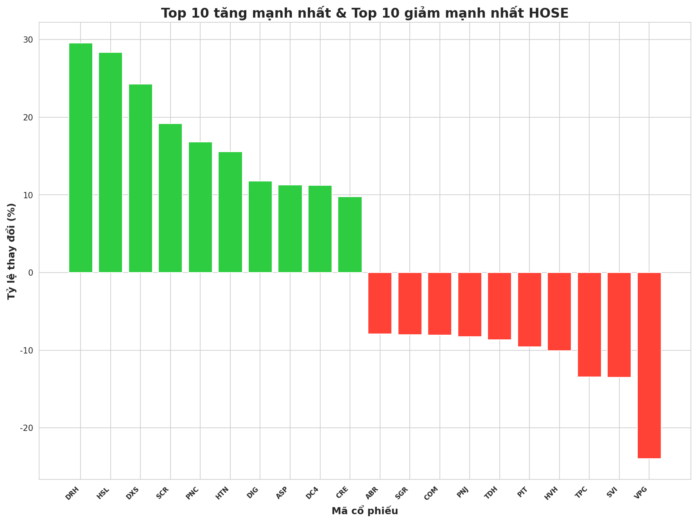

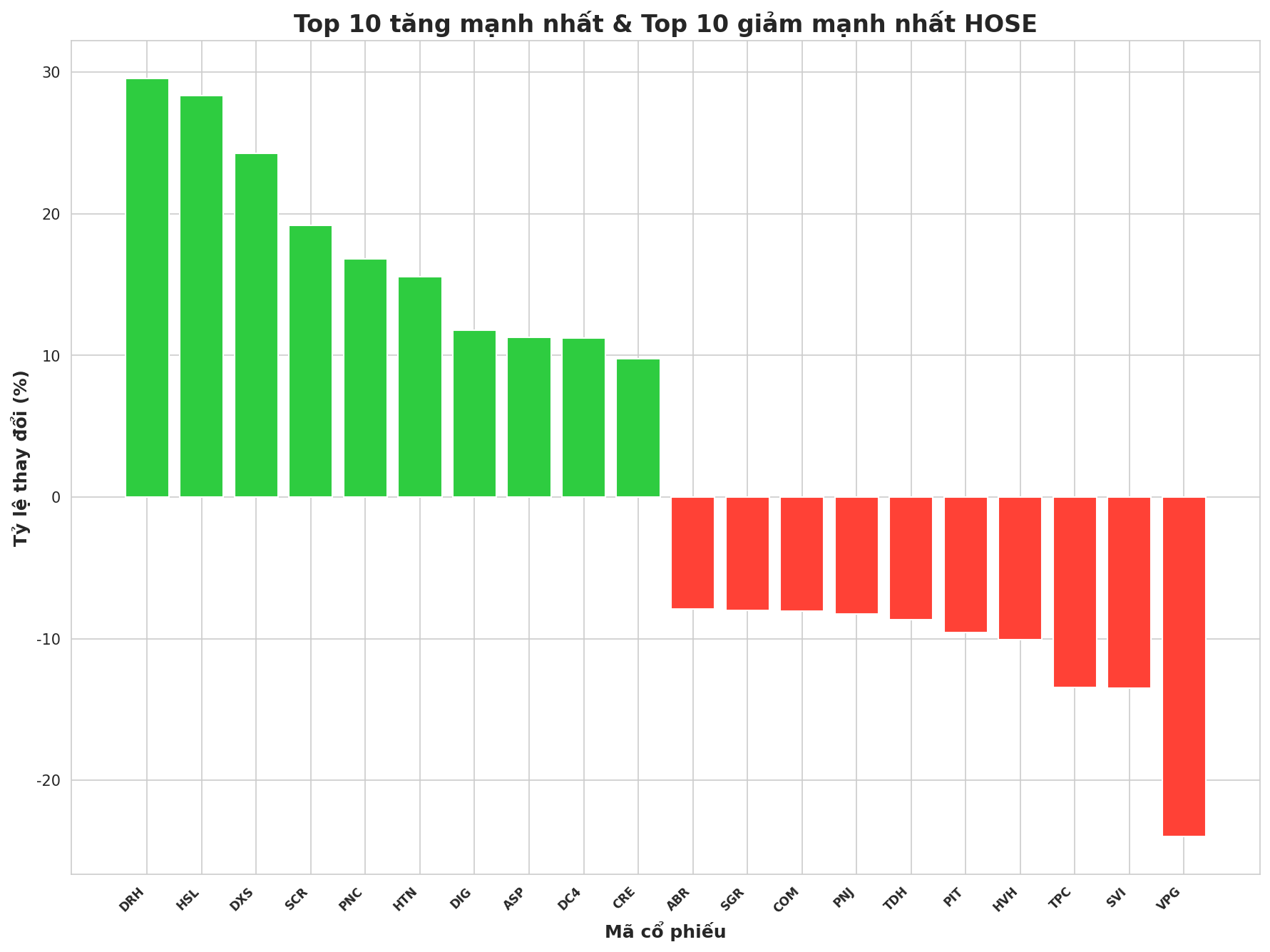

On the HOSE, the group of stocks with the strongest gains significantly outperformed those that declined. The top 10 gainers on the exchange saw increases ranging from approximately 30% to a minimum of 10%.

DRH, the stock of DRH Holdings, was the top performer on the HOSE, with gains in four out of five trading sessions, including one session where it hit the daily limit-up, accompanied by a surge in trading volume. The current share price stands at VND 2,850 per share.

DRH’s strong price movement occurred as the company announced plans to hold its 2025 Annual General Meeting of Shareholders on June 27, 2025. However, DRH Holdings’ financial performance has been less than impressive. In the first quarter of 2025, the company reported a post-tax loss of nearly VND 26 billion, a significant increase from the nearly VND 5 billion loss in the same period last year. Prior to this, DRH had incurred losses in the two preceding years, amounting to VND 103.7 billion in 2023 and VND 203 billion in 2024.

HSL also exhibited positive dynamics, with gains in four out of five sessions, including two sessions where it hit the daily limit-up, reaching VND 5,070 per share. This upward movement in the share price of this livestock company was in line with the performance of its industry peers following allegations against C.P Vietnam for selling sick pigs.

Additionally, stocks like DXS, SCR, and PNC also witnessed positive momentum.

On the downside, numerous stocks on the HOSE witnessed declines ranging from 8% to 13%, with VPG plunging nearly 24% following the indictment of its Chairman and CEO.

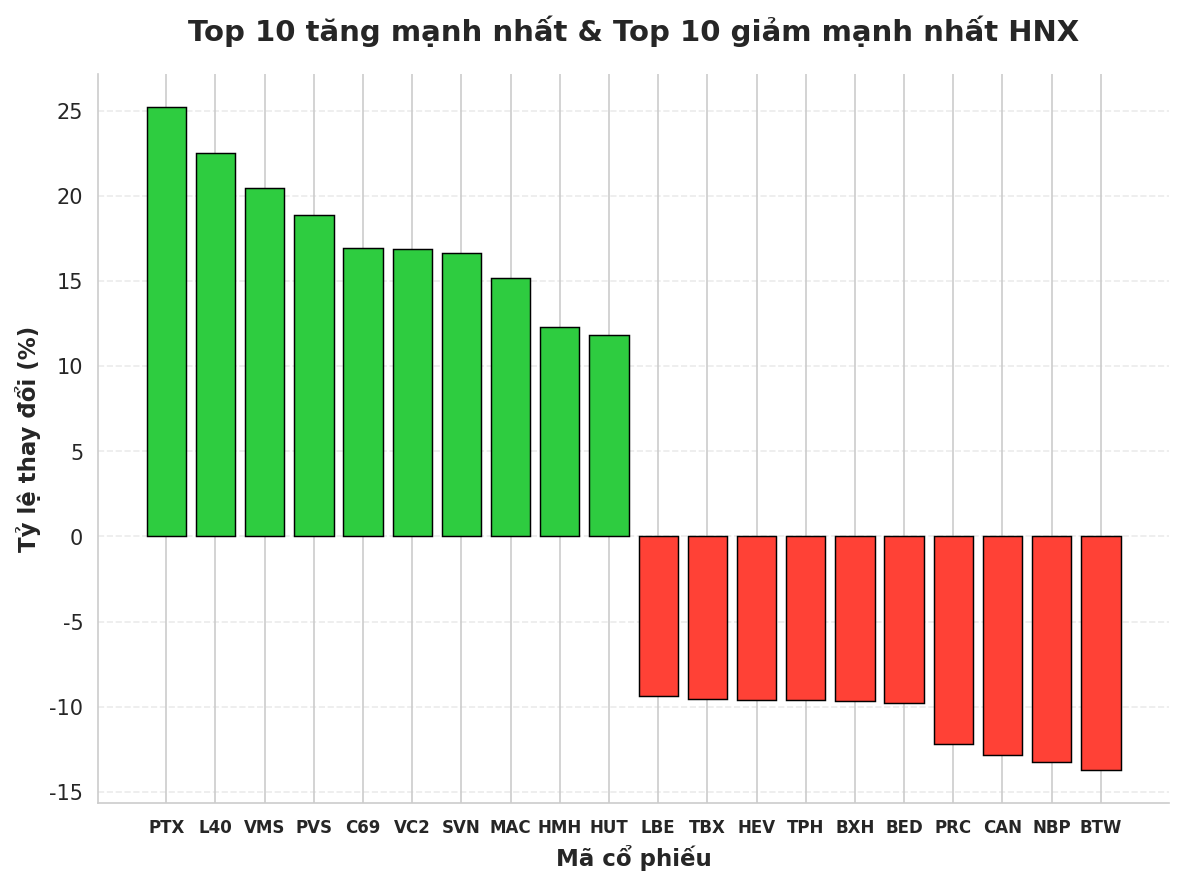

Turning to the HNX, the top 10 gainers also witnessed increases ranging from 12% to 25%. The stocks that increased were primarily small-cap, speculative plays.

Notably, PTX, the stock of Petrolimex Nghe Tinh Transportation and Services Joint Stock Company, surged with two limit-up sessions during the past week, pushing its share price up 25% to VND 25,800 per share. On June 10, PTX will finalize the list of shareholders to implement a 24% cash dividend payment for 2024 (equivalent to VND 2,400 per share) – the highest dividend payout in the company’s history.

On the downside, several stocks on the HNX also witnessed declines ranging from 9% to 14% during the week.

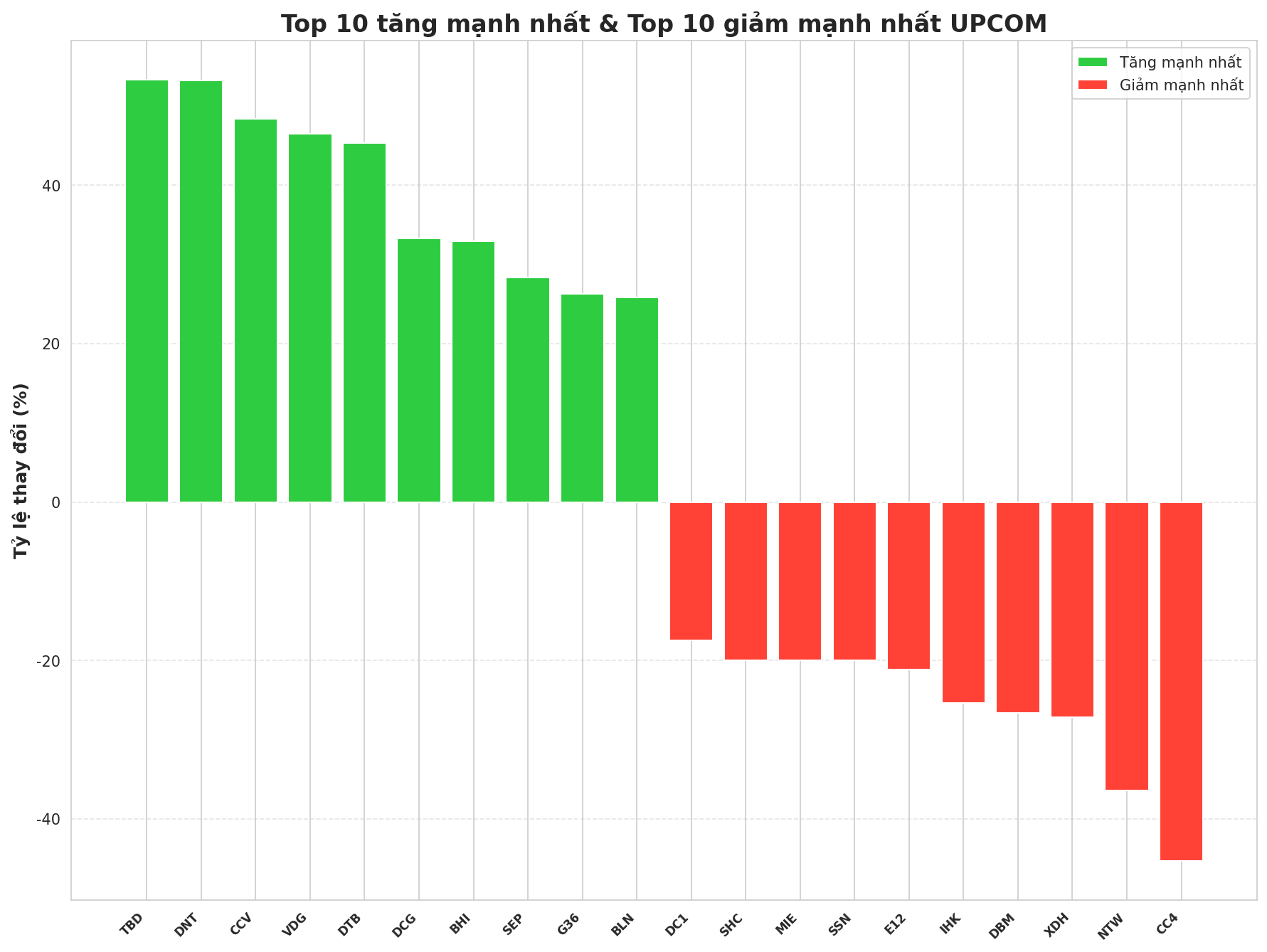

Moving to the UPCOM, the wider trading range resulted in several stocks surging by 26% to 53% during the week.

TBD of Dong Anh Electrical Equipment Corporation – Joint Stock Company and DNT of Dong Nai Tourism Joint Stock Company emerged as the top performers, with gains exceeding 53%.

Conversely, numerous stocks on the UPCOM also witnessed steep declines, ranging from 18% to 45% during the week.

What Happened to the Stock Market Today?

The VN-Index fell by over 12 points, retreating to 1,334.5 points – its lowest level in almost two months. Selling pressure intensified across most sectors, plunging the market into a sea of red during today’s session (June 6th).

“Market Meltdown: VN-Index Plunges Below 1330 Points as Investors Bail Out”

Selling pressure soared in the afternoon session, plunging numerous mid and small-cap stocks into the red. While 107 tickers on the HoSE fell by over 1% in the morning, this number skyrocketed to 160 by the closing bell. The drop in the VN-Index fails to convey the full extent of the damage inflicted on individual stocks.