Joining the Billion-Dollar Club

Thiên Long Group (code: TLG) , a leading office supplies company, is showcasing its ambitious expansion plans by venturing into the lucrative book distribution market valued at billions of dollars through its acquisition of the Phương Nam bookstore chain.

In late May, Thiên Long announced its subsidiary, Tân Lực Miền Nam, would invest in the Phương Nam system, marking a significant move in the publishing and cultural industry due to the scale of the network with nearly 50 bookstores, over a third of which are located in Ho Chi Minh City. Phương Nam is regarded as one of the top two players in the bookstore industry, alongside Fahasa (code: FHS).

Mr. Nguyễn Đình Thứ, Director of Strategy and Investment at Thiên Long , shared that M&A has been a longstanding strategy for the company. The acquisition of Phương Nam is the first dominant deal to be announced after careful evaluation and a cautious approach to investments.

By investing in Phương Nam, Thiên Long expands its value chain vertically and gains insights into consumer trends and demands through this distribution channel.

This deal also enables Thiên Long to swiftly and cost-effectively scale up its existing Clever World toy and lifestyle stores, aligning with its long-term strategic direction.

The company’s management team anticipates that this M&A with PNC will create growth momentum and open new opportunities.

Previously, Thiên Long’s M&A plans were also shared at the 2025 Annual General Meeting, indicating a concrete deal was imminent, although details were not disclosed.

The publishing, distribution, and book sales market is a relatively stable “playing field,” with a total market size of billions of dollars. According to Vietdata, the total market revenue in 2023 reached VND 99,700 billion (approximately $4 billion). Publishing houses (including Fahasa, Phương Nam, and Nhã Nam…) accounted for VND 4,000 billion in revenue, while printing and publishing contributed VND 92,000 billion and VND 3,700 billion, respectively.

Selling Pens by the Thousands, Reaping Billions in Profit

Thiên Long’s ambition is not limited to M&A strategies; its financial performance showcases its true potential, serving as a solid foundation for its future endeavors.

According to the 2024 financial report, Thiên Long’s revenue reached VND 3,759 billion, a 9% increase year-over-year. Export revenue accounted for over VND 1,000 billion, while domestic revenue contributed more than VND 2,700 billion.

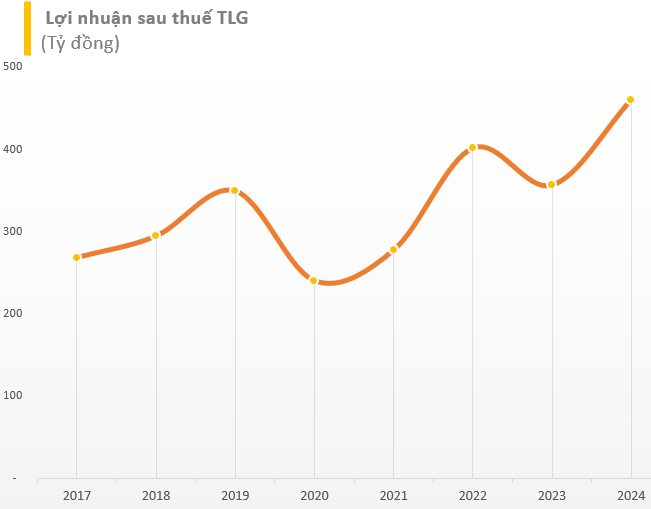

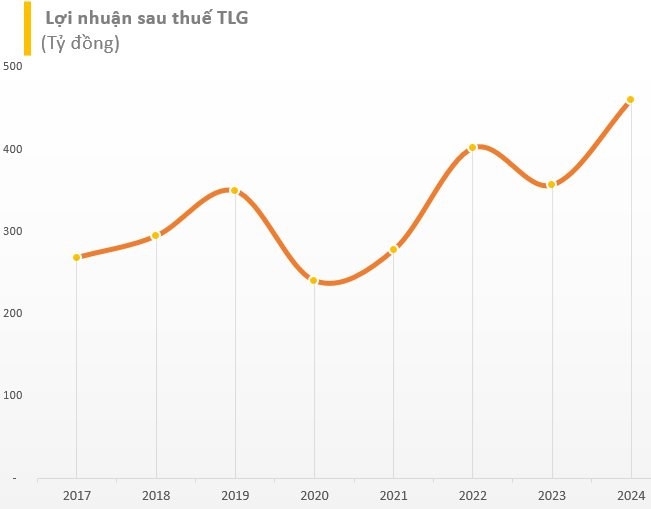

After deducting expenses, the company’s post-tax profit for 2024 was VND 461 billion, a remarkable 29% increase, translating to a daily profit of VND 1.26 billion.

These impressive results are attributed to the company’s focus on modern production technology. According to the 2024 annual report, the automation rates at the Nam Thiên Long and Thiên Long Long Thành factories were 78.7% and 66.1%, respectively. This has contributed to improved efficiency, optimized costs, enhanced competitiveness, and reduced product prices.

Recently, the company reported its business results for the first four months of the year, with net revenue reaching VND 1,092 billion, a 1.1% increase year-over-year. Gross profit reached VND 468 billion, maintaining a stable gross profit margin of 42.8%.

Thiên Long shared that after a quiet period in January and February due to seasonal factors and distributor inventory, revenue rebounded in March and April, signaling a positive start to the upcoming peak business season.

With the peak season approaching in May and June, Thiên Long has ensured sufficient inventory across domestic trade channels, and its shelves have been updated with new product identifications.

Expanding Export Market Share

Building on its strong financial performance, Thiên Long is poised to expand its global presence, with exports remaining the primary growth driver.

For exports, the company aims to expand its market share in key regions such as Southeast Asia, the EU, and the US. TLG also plans to gradually increase its average selling price by transitioning to higher-value product lines.

Compared to Chinese competitors, Thiên Long enjoys a significant advantage due to its extensive distribution network, deep understanding of the domestic market, and strong brand recognition among Vietnamese consumers. TLG’s products are currently used by 61% of Vietnamese consumers, despite over 70 competing brands in the market.

According to a recent report by Vietcap Securities , analysts expect exports to resume their growth trajectory after a lackluster Q1/2025, continuing to be a key growth driver in 2025. In Q1/2025, export revenue (36% of total revenue) decreased by 8% year-over-year due to disrupted demand in some ASEAN markets (such as Myanmar and Thailand) caused by natural disasters.

However, Vietcap forecasts an export revenue recovery in the upcoming quarters, supported by the dissipation of natural disaster impacts, improved consumer spending in key markets, and TLG’s continued expansion into the ASEAN region.

Additionally, the gross profit margin is predicted to remain stable at 44.6%, backed by TLG’s product mix shift towards higher-margin categories and continued operational improvements.

With its strategy to expand its education ecosystem and impressive financial performance, Thiên Long demonstrates strong growth potential. The acquisition of Phương Nam, coupled with the momentum in exports, is expected to open new horizons for the company in the next phase of its journey.

The Ultimate Vietnamese Delicacy: Savoring a Tasty, Nutritious, and Affordable Treat that Thailand, South Korea, and Russia Adore

The food industry is a lucrative business, and one particular food product has been raking in the profits with a significant increase in export earnings since the beginning of the year.

“From Billion-Dollar Unicorn Dream to a Mere $10 Million Valuation: The Fall of Tiki”

After 15 years of existence and growth, Tiki has fallen behind as its sales and market share plummet.