The market witnessed a significant drop in buying interest during the first trading session of the week, resulting in a sea of red and a sudden decline in liquidity. The VN-Index dipped towards the 1320-point level, heavily impacted by the poor performance of two large-cap stocks, VIC and VHM.

The signs of a corrective phase are becoming more evident as the market experienced its fourth consecutive day of losses after failing to break through the 1340-point level. Despite the slow trading pace, the dominant sentiment was one of caution among investors, leading to a “shrinkage” in buying power.

The total matched transactions on the HoSE in the morning reached only VND6,638 billion, a 29% decrease compared to Friday’s morning session. Including HNX, the total liquidity decreased by 30%. This sudden drop in trading activity is concerning.

The VN-Index hit a low of 1321.54 points, a decline of 0.63% (-8.4 points). The market struggled to find direction in the last 30 minutes, with a weak recovery. By the end of the morning session, the index was down 6.72 points, or -0.51%.

The biggest drags on the index were VIC and VHM, which remained in negative territory throughout the session. VIC fell by 1.65%, while VHM dropped by 1.97%, collectively shaving off 2.9 points from the index. For the VN30-Index, these two stocks accounted for a loss of 4.8 points out of the total decline of 8.59 points (-0.61%). However, it would be unfair to blame only these two stocks. Among the VN30 basket, there were 19 declining stocks, including seven that fell by more than 1%.

On a positive note, among the top 10 stocks by market capitalization, FPT managed a slight gain of 0.35%, MBB rose by 0.21%, and HPG inched up by 0.19%. Of the remaining seven stocks in the red, apart from VIC and VHM, the losses were relatively modest. Nonetheless, the situation is far from ideal as these large-cap stocks are gradually sliding downwards. VCB, for instance, started the day in positive territory but ended up shedding 0.71% from its intraday high. GAS declined by 0.94%, CTG by 0.78%, and TCB by 1.15%. At its best, the VN30 basket had 22 gainers. Liquidity for this basket also decreased by 35%. This downward trend can be primarily attributed to weak buying demand.

In fact, this was a common theme across the market today, as investors became hesitant to commit new capital after several failed attempts to breach previous highs. Throughout the session, the number of declining stocks far outnumbered the advancing ones on the HoSE, with 195 stocks in the red compared to only 91 in the green. Among the decliners, 90 stocks fell by more than 1%, accounting for 25.2% of the total matched transactions on the exchange. The low liquidity, coupled with a wide breadth of declining stocks, points to a clear lack of buying support.

Two large-cap stocks stood out with their high liquidity and significant price drops: SHB, which fell by 1.14% with a turnover of VND329.5 billion, and VHM, which declined by 1.97% with a turnover of VND155.8 billion. The only non-large-cap stock among the top liquidity leaders was CII, which witnessed selling pressure of VND118.1 billion, resulting in a price drop of 1.01%. Mid- and small-cap stocks that experienced more substantial declines included VPI (-2.06%), EVF (-1.85%), HAH (-3.16%), KBC (-1.18%), PVD (-1.28%), GMD (-2.09%), and VSC (-1.98%). These stocks had turnovers ranging from VND40 billion to below VND100 billion.

On the bright side, very few stocks managed to buck the downward trend and attract strong buying interest. While there were over 30 stocks that gained more than 1%, the trading activity was concentrated in only about 15 stocks with turnovers above VND10 billion. The top 10 leaders by liquidity included NVL (+2.1% with a turnover of VND282.5 billion), DBC (+2.85% with VND244.7 billion), DIG (+1.67% with VND224.1 billion), FRT (+3.33% with VND78.8 billion), HDC (+1.59% with VND72 billion), KHG (+2.08% with VND42.9 billion), DGW (+3.56% with VND41.8 billion), TCH (+1.01% with VND36.8 billion), HHS (+1.32% with VND32.8 billion), and HVN (+2.87% with VND32.1 billion).

The concentration of liquidity in a handful of stocks highlights the limited opportunities for investors to find strong performers. Given the overall weak buying sentiment, those stocks that managed to attract buying interest and outperform the market stood out even more. However, not all investors hold these stocks in their portfolios, and the allocation of capital to these stocks is relatively low compared to the overall market.

Foreign investors continued to be net sellers across all three exchanges, with a total net sell value of over VND500 billion on the HoSE alone, the highest in the last six morning sessions. It’s important to note that the increase in net selling value is not due to a sudden surge in selling pressure but rather a decrease in buying activity. Specifically, foreign investors’ net buy value on the HoSE stood at VND557.1 billion, the lowest in the last 31 sessions.

The stocks that witnessed the most significant net selling pressure were PVD (-VND45.1 billion), HPG (-VND42.4 billion), HSB (-VND35.2 billion), DIG (-VND32.9 billion), VHM (-VND32 billion), HAH (-VND31.2 billion), NVL (-VND29.1 billion), and VCI (-VND23.6 billion). On the buying side, BAF (+VND29.7 billion) and GEX (+VND25.3 billion) were the only notable stocks.

With the VN-Index posting losses for the fourth consecutive session, the possibility of a market top is becoming more apparent, or at the very least, a period of consolidation around the previous high. Currently, the index is testing the support level around 1320 points and has not breached it yet. However, even if a trading range of 1320-1340 points is established, it may not attract significant buying interest. Investors may choose to remain on the sidelines, waiting for a decisive breakout or more attractive valuation levels.

Technical Analysis for June 9: Caution Prevails

The VN-Index and HNX-Index both witnessed a slight dip in the morning session, with a decrease in trading volume, indicating a cautious sentiment among investors.

Market Beat: A Pulse Check on Investor Sentiment

The market witnessed a lackluster performance in the morning session, with no significant recovery efforts. The subdued participation of cash flow, coupled with persistent pressure from the pillar group, painted a gloomy picture. VN-Index hovered at 1,323.17 points, reflecting a 0.51% decline, while HNX-Index mirrored this sentiment with a 0.52% drop, settling at 227.42. The market breadth further emphasized the bearish trend, with 386 declining stocks outweighing the 222 advancing ones.

Market Beat June 9th: A Divided Market, Heavy Selling Pressure on Large Caps

The Vietnamese stock market opened on a negative note this morning. A wave of selling pressure swept across the board, causing the benchmark indices to retreat. A sense of caution was palpable on the trading floor, as investors grappled with a tug-of-war between buying and selling forces.

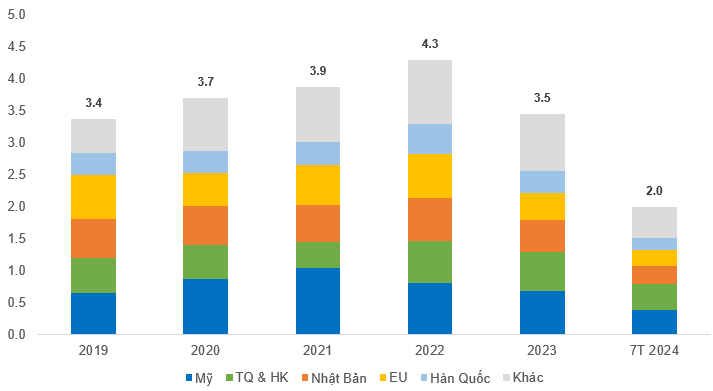

The Ho Chi Minh City Stock Exchange at 25: Expanding Products and Elevating Listed Companies’ Quality

The Ho Chi Minh Stock Exchange (HOSE) has, over its 25-year history, solidified its position as Vietnam’s pioneering centralized stock exchange and the nation’s largest securities trading platform. Listing on HOSE is a testament to a company’s operational excellence, a declaration of its commitment to transparency, and a demonstration of its adherence to governance standards—all of which contribute to building a robust corporate image and enhancing its value in the eyes of investors and the wider business community.