Taking a real-life example from the convenience store channel, a rapidly growing retail channel in Vietnam. When a store notices that its inventory levels are low, they will send a request to order more stock (raise PO) to the brand. However, instead of receiving the stock immediately, the brand’s replenishment system usually follows a fixed schedule. This leads to a significant gap between the “time of need” and the “time of actual replenishment.”

WHEN REPLENISHMENT CAN’T KEEP UP WITH CONSUMPTION

To make it easier to understand, let’s imagine the following scenario: On June 1st, a store notices that product A is selling quickly and sends an order request to the brand. But the scheduled delivery date is not until June 4th. As a result, the shelf is empty for three days, which means lost revenue because there is no stock to sell.

In this case, the average selling time is still recorded as normal (based on the order placed on June 1st), but in reality, the product has been out of stock before that. This creates a “data blind spot”: The system thinks the product is still selling, while customers have turned away and chosen another brand because they can’t find the product on the shelf.

From this situation, it can be seen that the traditional replenishment model does not accurately reflect the actual consumption rhythm at the point of sale. While fixed-schedule replenishment is easy to control and saves operating costs, it causes delays in the supply chain, distorts performance data, and loses opportunities for sales growth.

With an ever-expanding product portfolio and rapidly changing consumer behavior, the inability to synchronize consumption and replenishment rhythms will make the entire system less flexible, less accurate, and difficult to optimize costs.

REDESIGNING THE ENTIRE DISTRIBUTION STRATEGY WITH A NEW REPLENISHMENT METHOD

In this context, a new approach is gaining attention: Instead of trying to trace “when the product was sold,” CEOs are shifting their focus to monitoring the “time between replenishments.” This is an indirect measure but one that closely reflects actual consumer behavior.

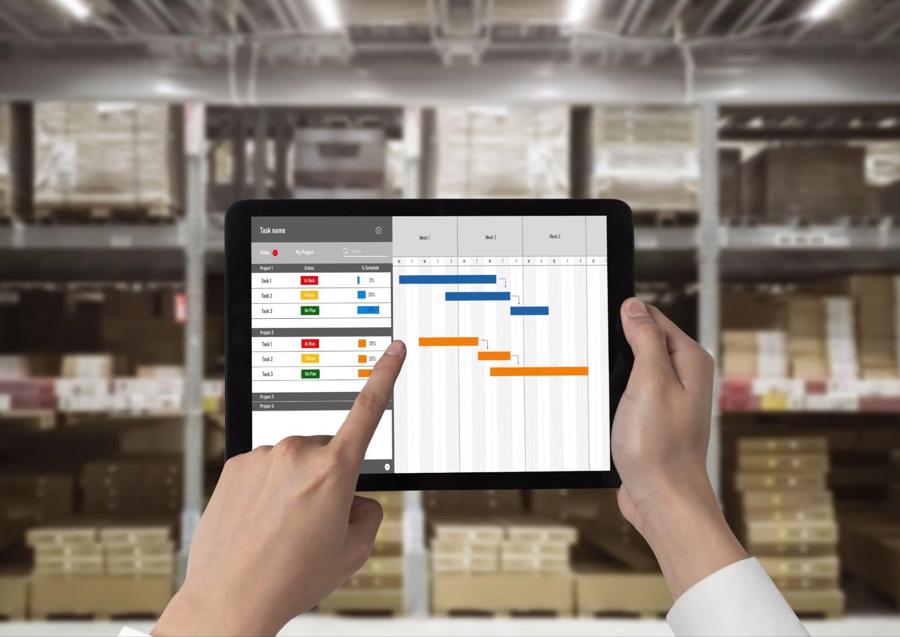

This is also the approach taken by Ninja B2B Stock Replenishment Solutions, a replenishment platform designed specifically for the retail industry, to help brands solve problems that traditional distribution systems have not been able to answer. With an infrastructure built on e-commerce operations, this model can track each replenishment to each point of sale. Through this, a dashboard of replenishment rhythm, product turnover, and consumption performance is formed.

By eliminating intermediaries that disrupt the flow of information, Ninja B2B Stock Replenishment Solutions connects directly from the center to the point of sale – thanks to a system that includes 5 regional warehouses, more than 500 delivery stations, and 5,000 drivers nationwide. Each replenishment is fully recorded with a clear timestamp, helping enterprises determine the interval between replenishments and, from there, the actual “stockout” speed at each point of sale.

This data not only helps evaluate the performance of the point of sale but is also the basis for classifying stores by consumption speed, adjusting the frequency of replenishment according to the actual rhythm, estimating product turnover, and supporting the allocation of marketing budgets in a smarter and more efficient way.

Sharing the data advantage of this model, Mr. Phan Xuan Dzung, Chairman of Ninja Van Vietnam, concluded: “Data should not stop at the warehouse but must reach the sales rhythm of each point. Only by knowing how the stock turns over can enterprises truly master their growth.”

With the philosophy of “One order goes, a thousand shelves are filled,” this model not only streamlines the replenishment chain but also creates a new data platform for CEOs and CFOs to re-evaluate their entire distribution strategy. In a market where speed is an advantage and information is power, accurately measuring the average selling time can be the key difference between operating to maintain and operating to grow.

Ninja Van’s “Ninja B2B Stock Replenishment Solutions” brings an optimal replenishment solution to the retail industry, with the ability to deliver from just 5kg. A flexible delivery frequency of 3-5 times a week ensures that shelves are filled in sync with actual consumption.

In addition, data is recorded according to each point of sale, helping enterprises accurately forecast demand, reduce the risk of stockouts or excess inventory. The model also supports full documentation and payment, helping to shorten the revenue recognition cycle and efficiently release cash flow.

Especially, “Ninja B2B Stock Replenishment Solutions” also expands access to county/commune-level sales points, helping brands reach further without investing in an additional distribution system.

For more information, please visit: ninjavan.co/vi-vn/services/b2b-restock

The CP Group: A Portrait of the World’s Leading Animal Feed Producers

As of the Bloomberg Billionaires Index, Dhanin and his family’s wealth stands at an impressive $44.1 billion. This remarkable fortune places them at a global ranking of 19th and a prestigious second place in Asia, just behind India’s Ambani clan.