At cafes, pho restaurants, and eateries on Ha Noi’s Xa Dan Street during peak hours, it’s common to see bustling venues with customers ordering customized dishes, while staff frantically jot down orders. Even the younger, tech-savvy “Gen Z” employees often struggle with the software, making mistakes and working slowly, much to the chagrin of hungry patrons. Cashiers long for simple instructional videos or images to help them navigate the system more efficiently.

SMALL BUSINESSES STRUGGLE WITH NEW REGULATIONS

The challenges go beyond mere operational issues. Sometimes, the software freezes, especially during busy periods with multiple orders. In the initial days of implementing e-invoicing regulations, software glitches were frequent, and network issues with the tax authority led to duplicate invoices.

“Many software programs freeze or become unstable when generating a large number of invoices. During the first few days of use, system errors were common, sometimes resulting in duplicate invoices due to weak connections with the tax authority. Additionally, the software lacks filters to categorize invoice statuses, making management cumbersome,” shared a cafe owner.

Support services are also overwhelmed, with helplines perpetually busy. According to business owners, this issue is prevalent across different software providers.

During our survey, we observed that software installers often found themselves inadvertently acting as tax consultants, fielding a barrage of questions from small business owners about tax regulations. This burden should ideally rest with the tax authorities.

At a pho restaurant run by a couple in their sixties, the owners have been selling and taking cash payments for decades without any knowledge of invoices or documentation. They are now confused about whether they need to hire professional cashiers or accountants. The current regulations also require recording the tax code or personal identification number of customers on invoices, which owners complain is unnecessary as most customers don’t request invoices.

Each of these minor issues compounds into a significant collective concern. For many small businesses, the shift to electronic invoicing involves not just learning a new tool but also reshaping long-standing habits. Meanwhile, the show must go on—the doors remain open, customers keep coming, and operations must continue seamlessly.

On accounting professional forums, numerous members expressed confusion over implementing Decree 70. For instance, one contentious point is the requirement to record citizens’ identification numbers/tax codes when selling to individual customers.

According to Clause 5, Article 10 of Decree 123/2020/ND-CP, amended and supplemented by Point a, Clause 7, Article 1 of Decree 70/2025/ND-CP, the following information must be included: the name, address, tax code, or individual identification number of the buyer or the code of the unit related to the budget.

However, for businesses like restaurants or drugstores that primarily serve individual customers, it is challenging to ask patrons for their identification numbers or tax codes when they don’t request invoices. Additionally, the tax authority’s requirement to declare the buyer’s identification number/tax code has left businesses perplexed, as the invoice template only includes a field for the tax code. This has led to uncertainty about whether they should enter the tax code or the identification number in the same field.

BENEFITS FOR ALL STAKEHOLDERS

According to experts, while teething issues are inevitable during this transition phase, mandating e-invoices from cash registers offers significant advantages. It enables tax authorities to better manage revenue, expand the tax base, and protect consumers’ rights by ensuring transparency in input-output declarations, compelling businesses to adopt more straightforward practices, and encouraging the use of traceable raw materials.

Electronic invoicing also empowers consumers to hold sellers accountable more effectively. Moreover, it nudges small businesses toward more professional operations, paving the way for their potential transformation into enterprises, ultimately contributing to the economy’s growth.

Mr. Nguyen Van Phung, former Director of the Large Enterprise Tax Department, General Department of Taxation (now the Tax Department – Ministry of Finance), reflected on the era of paper invoices, where invoice creation was an internal matter. With just a piece of paper, sellers could flexibly manipulate dates or alter other details, a practice known as “post-dating invoices.” However, with the introduction of electronic invoicing, everything changed drastically. The exact time of invoice creation is now accurately recorded down to the second, leaving no room for manipulation.

“Accountants had to abandon their flexible ways and embrace absolute precision and accuracy in entering information, be it the right time, person, task, or entity,” Mr. Nguyen Van Phung emphasized.

According to Mr. Phung, while this shift might have initially caused discomfort, it effectively illuminates the dark corners of the economy and, most importantly, rebuilds trust between small businesses, customers, and regulatory bodies.

After the first three days of implementing electronic invoicing from cash registers, KiotViet reported positive feedback from small businesses, especially those who had prepared in advance or gradually embraced technology.

“While there is consensus, some are still hesitant and anxious, mainly due to unfamiliarity with the new process or concerns about additional costs. Some, particularly the elderly or those new to technology, struggle with software operations. This indicates that while there is agreement, more time, communication, and support are needed to foster long-term proactiveness,” shared a KiotViet representative.

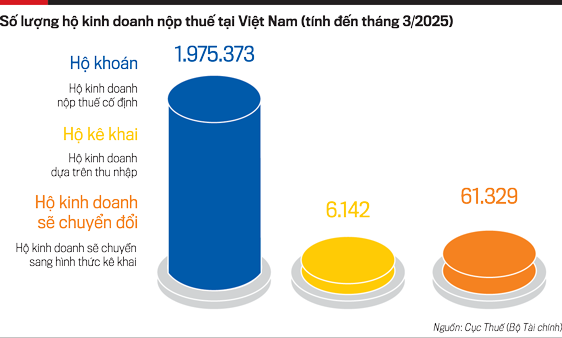

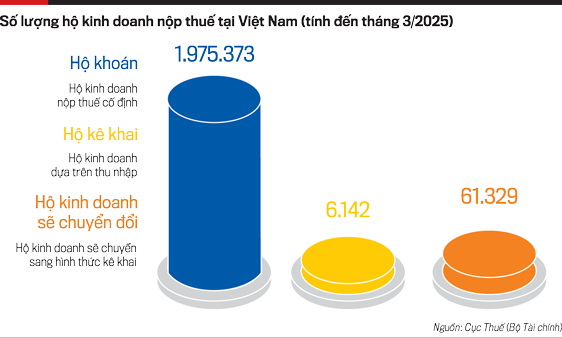

About a week after Decree 70 took effect, on June 5, 2025, the Tax Department (Ministry of Finance) organized a workshop to address the concerns of 30 small businesses out of the 1.975 million operating nationwide (as per the Tax Department’s statistics as of March 2025).

At this conference, Mr. Mai Son, Deputy Director of the Tax Department, assured that the new policies would be implemented with simplicity and efficiency, without imposing additional burdens or procedures on taxpayers.

Free accounting software and declaration support tools will be provided to help small businesses manage their operations without hiring accountants. Tax officials will be directly responsible for specific groups of small businesses, thoroughly understanding their areas and avoiding harassment while preventing tax evasion.

The Tax Department emphasized possessing the tools to promptly identify small businesses exhibiting tax evasion or invoice fraud and taking necessary action. Conversely, compliant businesses will receive maximum support and convenience from the tax authorities.

Electronic Invoicing: 5 High-Risk Tax Scenarios to Look Out For

The new regulations by the Ministry of Finance outline five additional criteria for identifying high-risk taxpayers in relation to electronic invoicing. These criteria are designed to target those who do not operate at their registered address, have a history of fraud, or are involved in the buying and selling of invoices based on tax authority data.

Tax Crackdown: Revenue Targets 25,201 Individuals and Businesses in May 2025

“In the first five months of 2025, the Ministry of Finance reports that tax authorities scrutinized 164,661 taxpayers, resulting in additional tax collections of over VND 416 billion from businesses. Moreover, they pursued tax evasion cases involving 25,201 individuals and households, recovering a total of more than VND 331 billion in taxes.”

The Ultimate Guide to Electronic Invoicing: Unlocking the Power of Digital Billing

The direct-to-consumer business can continue using their registered electronic invoices or switch to using a POS system that integrates with the tax authority.