Vietnam’s Ministry of Industry and Trade has approved the Master Plan for National Power Development for 2021-2030, with a vision towards 2050 (Power Development Plan VIII Revision).

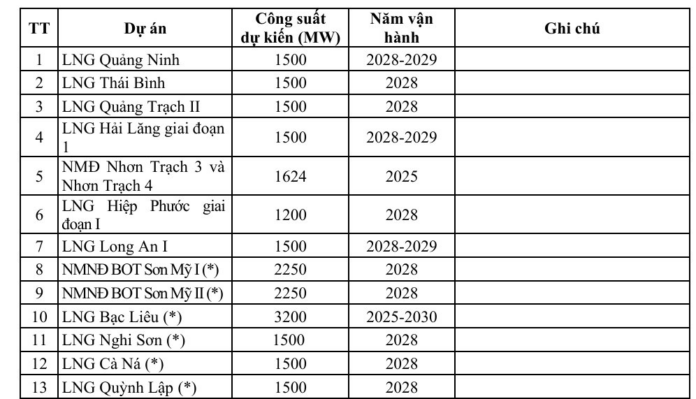

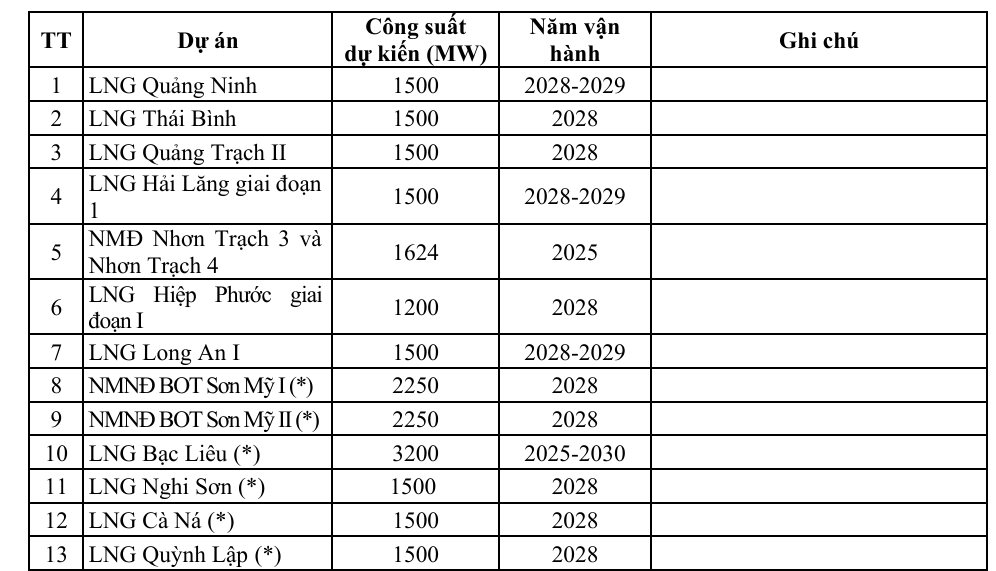

According to this plan, the total capacity of liquefied natural gas-fired power (LNG) by 2030 is targeted at 22,524 MW. The list of prioritized projects in the electricity sector, specifically in the field of LNG power, includes 21 projects.

Only one project, Nhon Trach 3 and 4, is confirmed to be operational by 2025. All other projects have vague operation timelines, with some slated for 2025-2030 (like LNG Bac Lieu) or post-2028.

The revised Power Development Plan VIII sets a goal for 11 projects to be operational by 2028 or 2028-2029: LNG Quang Ninh (1,500 MW), LNG Thai Binh (1,500 MW), LNG Quang Trach II (1,500 MW), LNG Hai Lang Phase 1 (1,500 MW), LNG Hiep Phuoc Phase 1 (1,200 MW), LNG Long An I (1,500 MW), Son My I (2,250 MW), Son My II (2,250 MW), LNG Nghi Son (1,500 MW), LNG Ca Na (1,500 MW), and LNG Quynh Lap (1,500 MW).

Projects scheduled to come online later include LNG Hai Phong Phase I (1,600 MW), LNG Hiep Phuoc Phase II (1,500 MW), LNG Long Son (1,500 MW), LNG Long An II (1,500 MW), LNG Hai Phong Phase II (3,200 MW), LNG Vung Ang III (1,500 MW), and LNG Quang Trach III (1,500 MW).

Most of the LNG power projects in Vietnam are either international collaborations or undergoing a bidding process. For instance, the LNG Thai Binh project has a consortium of investors, including Tokyo Gas (Japan), Kyuden (Japan), and Truong Thanh Vietnam (Vietnam). Meanwhile, Son My I and Son My II are invested in by AES (USA).

Some projects with purely Vietnamese investment include Nhon Trach 3 and Nhon Trach 4, backed by PV Power, LNG Quang Trach II by the Vietnam Electricity Group (EVN), LNG Hiep Phuoc by Hai Linh LLC, and LNG Hai Phong proposed by Vingroup.

Nhon Trach 3 and 4 LNG Power Plants Are Expected to Start Commercial Operations by the End of This Year

Currently, the first two LNG-fired power plants in Vietnam, Nhon Trach 3 and Nhon Trach 4, are being developed by PV Power (HoSE: POW) with a total investment of $1.4 billion. These plants are expected to supply approximately 9-12 billion kWh of electricity annually to the national grid once they commence commercial operations.

This amount meets 60% of Dong Nai’s total electricity consumption, currently the fourth-largest electricity consumer in the country.

Among these two plants, Nhon Trach 3 successfully synchronized with the national grid on February 5th, achieving a capacity of 50MW during its initial power generation. The Nhon Trach 3 Power Plant is expected to commence commercial operations in August 2025, followed by the Nhon Trach 4 Power Plant in November 2025.

Vietnam Offers Incentives for LNG-fired Power Projects

Vietnam is also creating favorable conditions for LNG businesses, including a reduction in the import tax on LNG from 5% to 2%, as per Decree 73/2025/ND-CP.

Another incentive for LNG power projects is the guaranteed offtake of their output. Decree 100/2025/ND-CP, issued in early May, stipulates the minimum long-term electricity contract volume for LNG-fired power projects. According to the decree, this volume should not be lower than 65% of the average annual electricity output of the LNG-fired power project.

The import of LNG from the United States is identified by the Prime Minister as a key focus to maintain sustainable trade balance with the US, especially amid the tariff countermeasures imposed by the Trump administration. Another product in this context is aircraft.

The Arch Steel Bridge: Unveiling the 850 Billion VND Marvel in Quang Ngai

By the end of June 2025, the Tra Khuc 3 Bridge, the first steel arch bridge in Quang Ngai, is expected to be completed. This state-of-the-art structure is set to become a landmark in the region, offering a unique and modern design that is sure to impress locals and visitors alike. With its sleek, curved shape and sturdy steel construction, the Tra Khuc 3 Bridge will not only provide a vital transport link but also stand as a symbol of progress and innovation in Quang Ngai.

Market Beat: A Pulse Check on Investor Sentiment

The market witnessed a lackluster performance in the morning session, with no significant recovery efforts. The subdued participation of cash flow, coupled with persistent pressure from the pillar group, painted a gloomy picture. VN-Index hovered at 1,323.17 points, reflecting a 0.51% decline, while HNX-Index mirrored this sentiment with a 0.52% drop, settling at 227.42. The market breadth further emphasized the bearish trend, with 386 declining stocks outweighing the 222 advancing ones.

Counterfeiting in the Digital Age: Time to Take Action Against Online Marketplaces

“It is imperative to strengthen the penalties and impose criminal liability on both the manufacturers and the e-commerce platforms themselves if they are found to be in breach of regulations. A stringent enforcement approach is necessary to deter future violations and ensure a safe and trustworthy digital marketplace for all stakeholders involved.”