On July 28, 2000, the Ho Chi Minh City Securities Trading Center (the predecessor of the Ho Chi Minh City Stock Exchange) officially commenced operations with the first two stock codes, REE and SAM. After 25 years of establishment and development, the Ho Chi Minh Stock Exchange (HOSE) has become a reputable listing venue, home to the highest-quality listed companies in the Vietnamese stock market.

Listing on HOSE helps enterprises affirm their reputation, brand, transparency in operations, enhance competitiveness, and expand access to domestic and foreign capital sources.

HOSE – A GATHERING PLACE FOR MANY LEADING COMPANIES

From the initial two stock codes, by the end of April 2025, HOSE had 391 stock codes, 21 fund certificates (including 17 ETF fund certificates), and 201 covered warrant codes, with 178.4 billion securities, corresponding to a market capitalization of VND 5,120 trillion, accounting for nearly 94% of the total market capitalization of listed stocks, equivalent to 44.5% of Vietnam’s GDP in 2024.

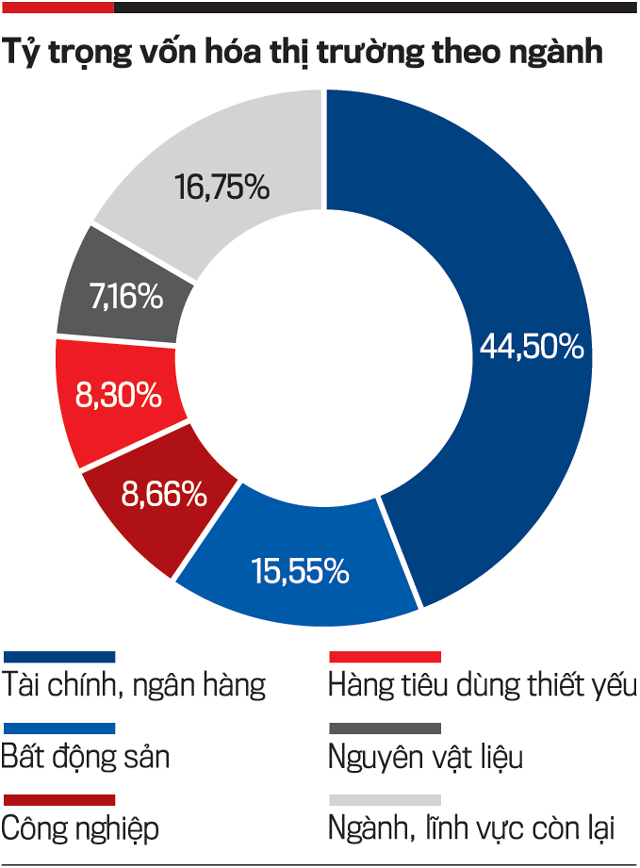

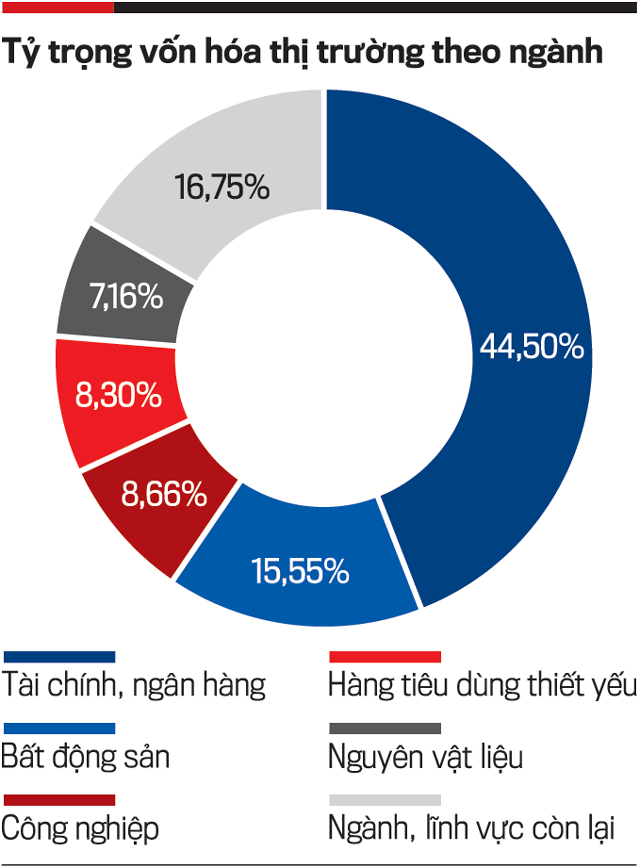

The listed companies on HOSE are very diverse in terms of industries and scales, focusing on large and leading enterprises with stable business operations. Currently, HOSE classifies industries according to the GICS standard with 11 sectors. As of the end of April 2025, the four sectors with the highest proportions were finance, real estate, consumer staples, and industrials, accounting for more than 75% of the total market capitalization, of which the financial sector accounted for the largest proportion with nearly VND 2,280 trillion (44.5% of the total capitalization); there are 18 large banks listed on HOSE with a market capitalization of VND 2,040 trillion (accounting for 40% of the total capitalization); more than 40 listed companies on HOSE have a market capitalization of over USD 1 billion. Nearly 50% of listed companies on HOSE are state-owned enterprises that have been equitized.

Notably, 45 out of the 100 largest private enterprises in Vietnam in 2024 (according to VNR statistics) and 24 out of the 30 largest private enterprises in tax payment in Vietnam in 2024 (according to tax statistics) are currently listed on HOSE.

After 25 years, HOSE has affirmed its position as the first centralized securities trading floor and the largest trading market in the country. Listing on the HOSE floor is a testament to the quality of operations, meeting the highest listing standards of the market; it is a declaration of transparency, a standard of governance to build the image and value of enterprises in the securities market.

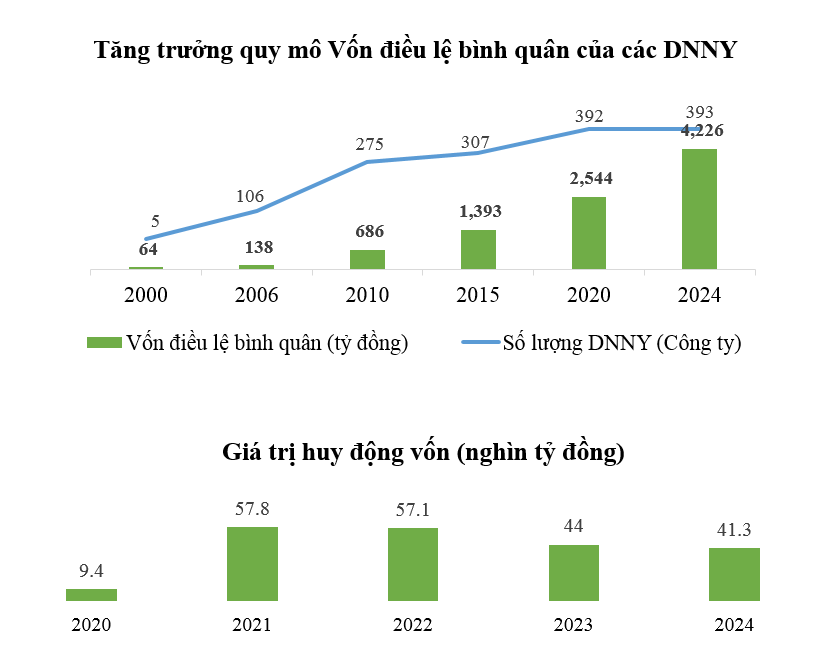

For enterprises, listing on HOSE is not only a milestone that affirms their position and brand but also opens up access to medium and long-term capital sources. Therefore, HOSE has become the first choice of listed companies in the capital mobilization strategy. By the end of 2024, the average charter capital of listed companies reached more than VND 4,200 billion, an increase of more than 3 times compared to 2015. In 25 years, the total value of mobilized capital through additional share issuances has exceeded VND 520,000 billion, with more than 1,000 issuances with cash collection, of which the financial sector alone has brought in more than VND 230,000 billion.

AN EFFECTIVE CAPITAL MOBILIZATION CHANNEL, PROMOTING EQUITIZATION

Each development phase marks a boom: from 2010-2015, when the economy was restructured, the amount of mobilized capital increased more than 5 times compared to the 2004-2009 period; the period 2016-2020 witnessed a series of large enterprises such as VHM, PLX, VJC, VRE, and private banks (VPB, TCB, ACB) listed simultaneously, creating a strong attraction for domestic and foreign capital. The charter capital of many companies has grown remarkably compared to the time of their initial listing, typically enterprises such as VCB (74 times); HPG (48 times), VIC (47 times), CTG (44 times); REE (31 times); FPT (24 times); GMD (24 times); VNM (13.1 times).

Besides its role as a capital mobilization channel, HOSE also plays an important role in the equitization of state-owned enterprises through auction activities, initial public offerings, or private placements to raise capital. More than 50% of the enterprises listed on the HOSE floor are equitized state-owned enterprises, a vivid manifestation of HOSE’s role in equitization associated with listing, improving the efficiency of state capital divestment, and information transparency according to market mechanisms.

From 2005 up to now, HOSE has conducted 584 auctions, selling more than 4.8 billion shares and more than 130 million share purchase rights, thereby collecting more than VND 240,000 billion for the owners; including 352 initial public offerings of state-owned enterprises, collecting more than VND 74,800 billion for the state. Some typical auctions and state capital divestments include: SAB (more than 115 thousand billion VND), VCB (over 10 thousand billion VND), and VNM (more than 9.5 thousand billion VND), which not only reflect financial efficiency but also mark a turning point in improving governance capacity and information transparency.

HOSE has gradually built trust for the market, reflecting the market’s confidence in reputable and efficient enterprises. Equitization associated with listing has created opportunities for many state-owned enterprises to restructure their operations, transform strongly, attract strategic investors, apply governance in accordance with international practices, and move towards a more efficient and modern operating model.

TOWARDS A FAIR, TRANSPARENT, AND SUSTAINABLE MARKET

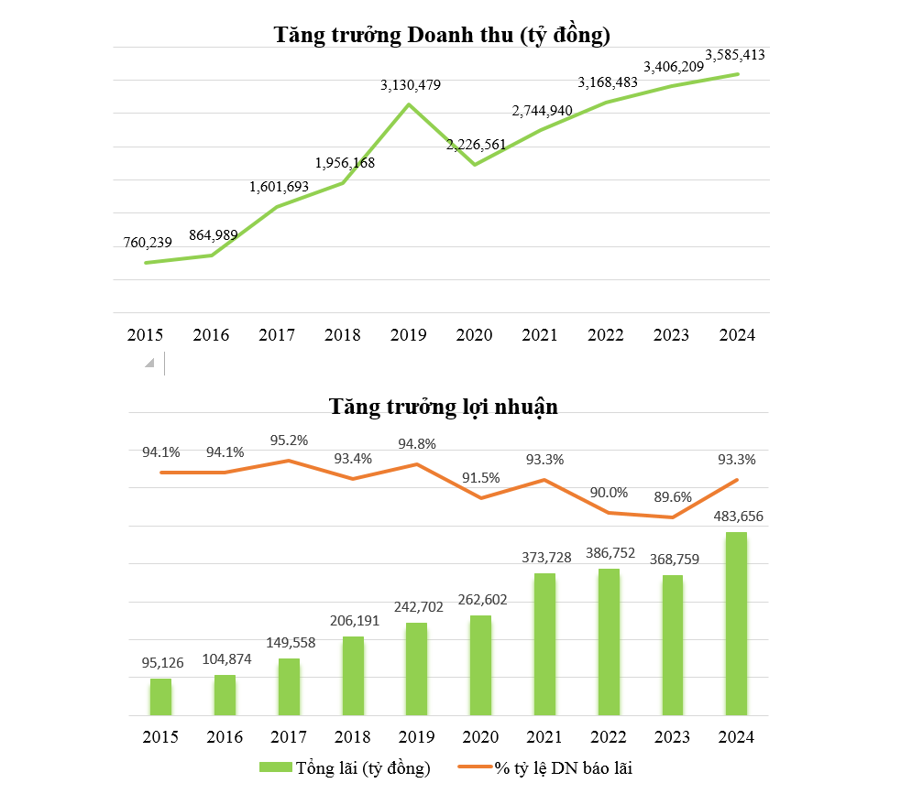

In the journey of 25 years of development, HOSE has created a foundation for listed companies to develop remarkably in both scale and quality, maintaining a sustainable growth momentum. Data for the period 2015–2024 shows that the revenue and profit of listed companies tend to improve significantly over time. The ratio of profitable enterprises remains stable, reflecting the efficiency of capital use after listing as well as positive changes in governance and development strategy.

In its role as the front line in supervision, HOSE continuously improves its mechanisms towards proactiveness, transparency, and consistency. Violations in information disclosure are strictly handled, promptly contributing to enhancing market discipline. In the past 10 years, the number of enterprises violating information disclosure regulations has decreased by nearly 80%; since 2022, 13 enterprises have been delisted due to serious violations of information disclosure regulations, a figure that shows a significant improvement in compliance, contributing to enhancing the quality of listed securities.

In parallel with supervision, HOSE also promotes activities to support enterprises in effectively implementing information disclosure. The deployment of the Electronic Document Management System (ECM) helps eliminate paperwork, saves time, and improves the efficiency of disclosure file management.

HOSE also encourages enterprises to strengthen Investor Relations (IR) activities and enhance connectivity with the investing community. A notable step forward since 2025 is that 100% of enterprises on HOSE have implemented periodic information disclosure in English, of which more than 98% have complied with the deadline for financial statements and documents of the General Meeting of Shareholders. This is an important foundation to enhance access for foreign investors and elevate the market’s position.

Closely linked to the goal of improving governance quality, the Vietnam Listed Company Awards (VLCA) is one of the outstanding highlights throughout the development journey. Not just limited to evaluating annual reports, VLCA also serves as an objective measure of governance quality, from the structure of the Board of Directors, financial transparency to sustainable development strategies. Over the years, participating enterprises have continuously improved the quality of sustainability reports significantly, with many units having applied GRI guidelines with well-structured and highly reliable reports.

Although the average corporate governance score of the whole market is currently only about 50%, the corporate governance scoring criteria in the past 2 years of VLCA have been built to be closer to international practices, with the weight of good governance practices in corporate governance having increased to 40%, and the weight of compliance decreased to 60%. The results of the awards show that large-cap companies tend to achieve outstanding scores and are shaping new standards for the market.

Over 25 years of establishment and development, accompanying the ups and downs of the market, HOSE has continuously improved and grown strongly, becoming an important supply and demand connection point for the economy.

Entering the “New Era”, the “Era of Vietnam’s Rise”, the journey ahead will be challenging. With the motto “Enhancing Value – Strengthening Trust”, with the youthfulness of its 25 years and the achievements in the past years, HOSE needs to transform itself for the new journey, be more proactive and professional, always listen to the market participants, and accompany them to build a transparent and sustainable Vietnamese stock market.

Expert Alert: Navigate Market Risks by Trimming Positions to Safe Levels

As of May 12, 2025, excluding the four Vingroup stocks (VIC, VHM, VRE, and VPL) from calculations, the VN-Index (excluding the Vingroup cluster) would be trading around the 1,300-point level. This highlights the significant impact that the Vingroup cluster has on the overall index.

What Happened to the Stock Market Today?

The VN-Index fell by over 12 points, retreating to 1,334.5 points – its lowest level in almost two months. Selling pressure intensified across most sectors, plunging the market into a sea of red during today’s session (June 6th).

“Market Meltdown: VN-Index Plunges Below 1330 Points as Investors Bail Out”

Selling pressure soared in the afternoon session, plunging numerous mid and small-cap stocks into the red. While 107 tickers on the HoSE fell by over 1% in the morning, this number skyrocketed to 160 by the closing bell. The drop in the VN-Index fails to convey the full extent of the damage inflicted on individual stocks.