As of the May 30, 2025, data cut-off, FTSE will announce its stock constituents on June 6, while VNM will announce its portfolio on June 13, with both funds completing their portfolio restructuring by June 20.

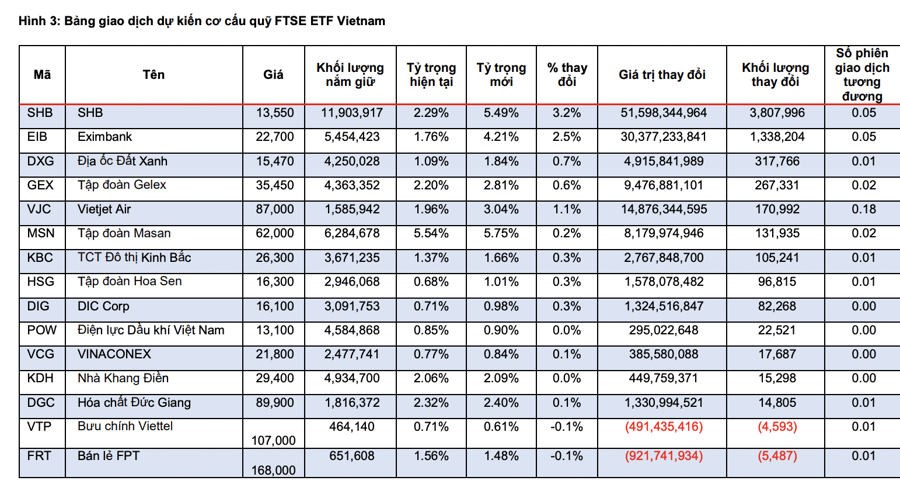

In the upcoming ETF updates, MBS Securities forecasts no changes in the FTSE ETF portfolio, with VIC and VHM facing sell-offs, while SHB and EIB are expected to be bought strongly.

Specifically, as all the stocks meet the liquidity criteria in terms of average trading value and free-float ratio, there will be no deletions, and FTSE will not add any new replacement stocks.

As of May 30, VIC’s weight in the index had reached 16.79%, surpassing the 15% cap for the FTSE Vietnam Index. Thus, VIC and VHM will face reduced weights, creating an opportunity for other stocks to increase their representation. MBS predicts that VIC will see a sell-off of over 2 million shares, while VHM will see an outflow of more than 2.5 million shares. Meanwhile, SHB and EIB will be bought, with 3.8 million and 1.4 million shares, respectively.

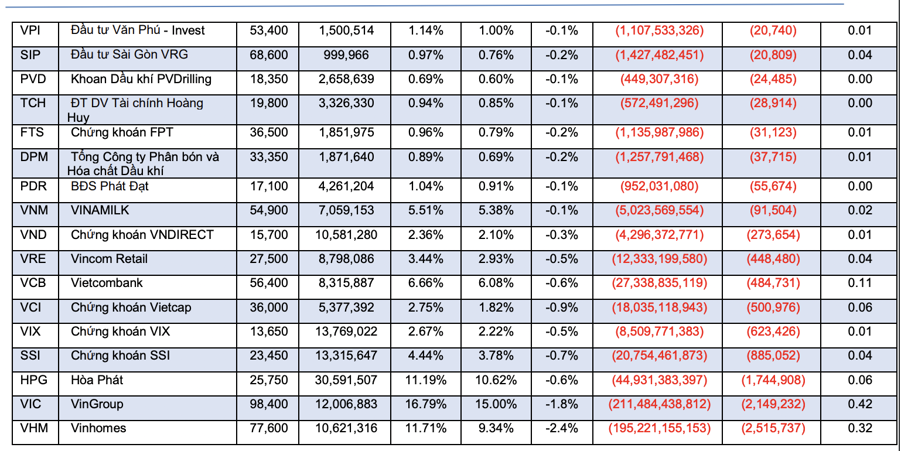

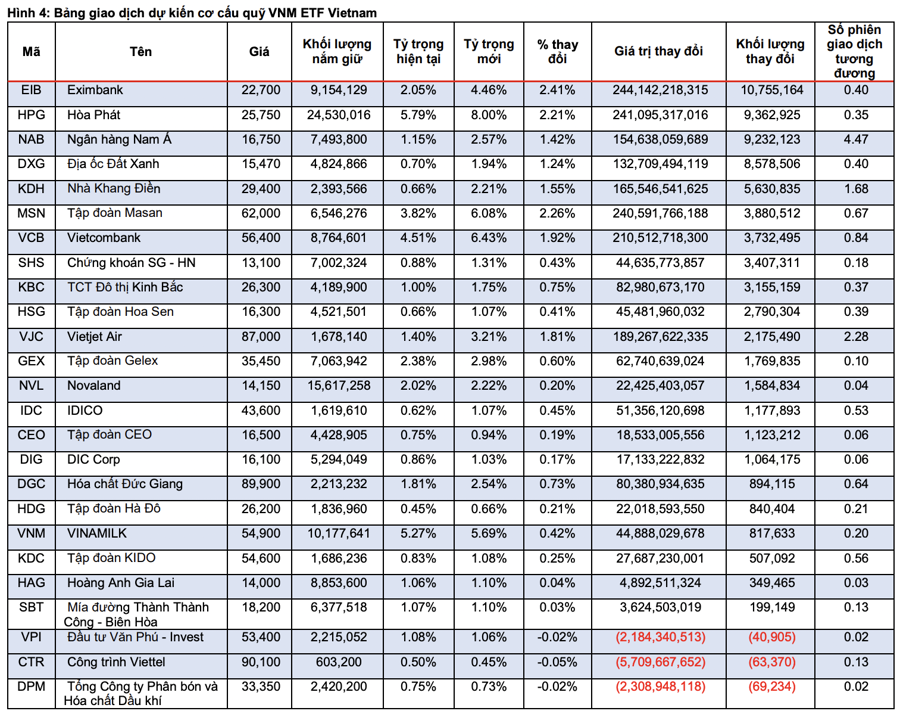

MBS also forecasts no changes in the VNM ETF portfolio, with VIC, VHM, VND, and VCI facing significant sell-offs, while EIB, HPG, and NAB are expected to be bought back. The stocks in the current VNM ETF portfolio continue to meet the evaluation criteria, including a market cap of over VND 3,600 billion, an average three-month trading value of over USD 1 million, and a minimum foreign ownership limit of 5%.

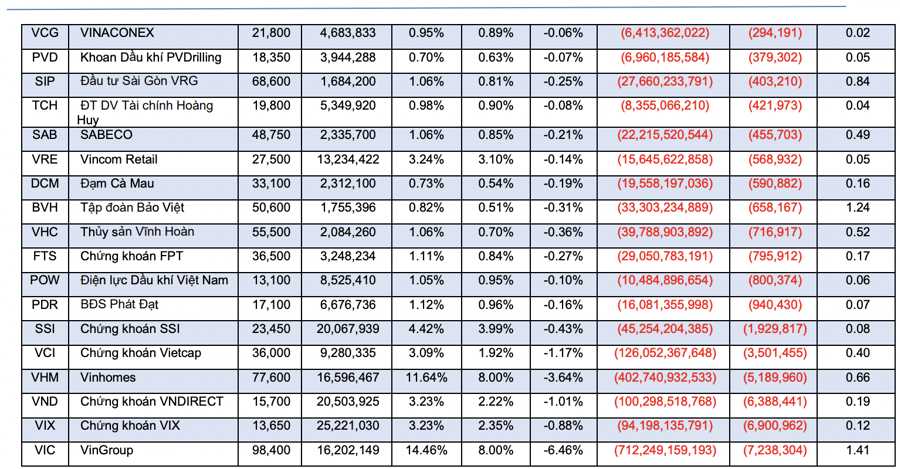

Given their recent strong performance, VIC and VHM have likely exceeded the 8% cap and will face reduced weights this period. With the reduction in VIC and VHM, the two stocks will lead the sell-off, with outflows of 7.2 million and 5.1 million shares, respectively. VND and VCI will also see outflows of 6.3 million and 3.5 million shares, respectively, while EIB, HPG, and NAB will be bought, with 10.7 million, 9.3 million, and 9.2 million shares, respectively.

In terms of fund flows, there is a net withdrawal trend from ETFs operating in the Vietnamese market. Since the beginning of the year, the eight major ETFs have seen net outflows of over USD 262 million. Specifically, FTSE has experienced net outflows of more than USD 19 million, while VNM has seen outflows of nearly USD 62 million.

Currently, the FTSE ETF, which tracks the FTSE Vietnam Index, has total assets of VND 7,100 billion. Since the beginning of 2025, the fund’s net asset value has increased by 6.5%, and the NAV per fund unit has grown by 15%. However, the number of fund units has decreased by 7% to 9.5 million.

The V.N.M ETF has a scale of VND 11,050 billion. Since the beginning of the year, its net asset value has decreased by 0.25%, while the NAV per fund unit has increased by 16.8%. The number of fund units has decreased by nearly 15% to 30.6 million.

The Arrest of VPG’s Leadership Leaves Stock ‘Stranded’

The recent indictment of its leadership has sent shares of Viet Phat Import-Export Trading Investment Joint Stock Company, known as VPG, into a tailspin. Today’s session (June 4th) witnessed a frantic sell-off as investors offloaded their holdings at any price, yet they remained trapped with over 7.6 million VPG shares still on offer at the floor price.

Market Pulse, June 6: Steel Stocks Surge Amidst Gloomy Markets

The morning session ended on a lackluster note, with recovery efforts failing to make a significant impact. The VN-Index concluded the morning at 1,336.5 points, a decline of 0.42%, while the HNX-Index snapped its winning streak with a 0.72% adjustment, landing at 229.53 points. Sellers maintained their dominance, with 407 declining stocks outweighing 227 advancing ones as the market headed into the afternoon session.

Market Pulse June 6th: Financial Stocks Take a Hit, PVD Maintains Recovery Trajectory

The prevailing dilemma keeps the key indices fluctuating around the reference mark. As of 10:40 am, the VN-Index dipped by 7.49 points, hovering around 1,334 points. Simultaneously, the HNX-Index witnessed a decline of 1.8 points, lingering at approximately 229 points.