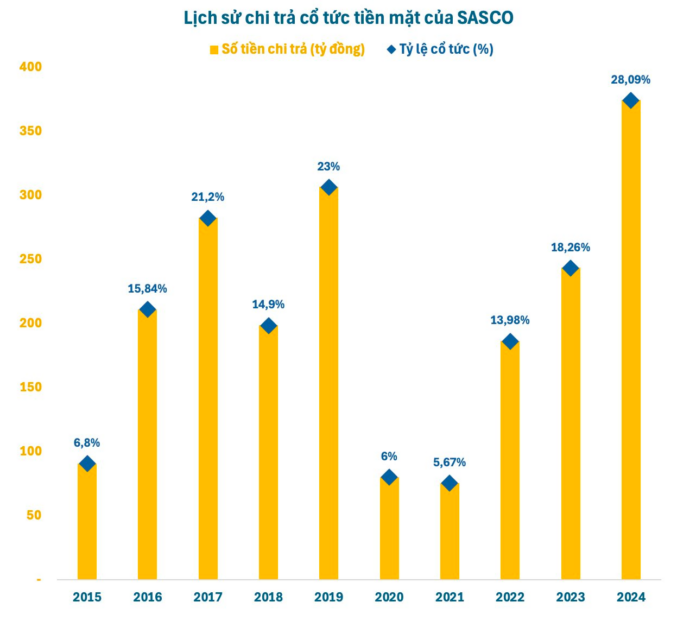

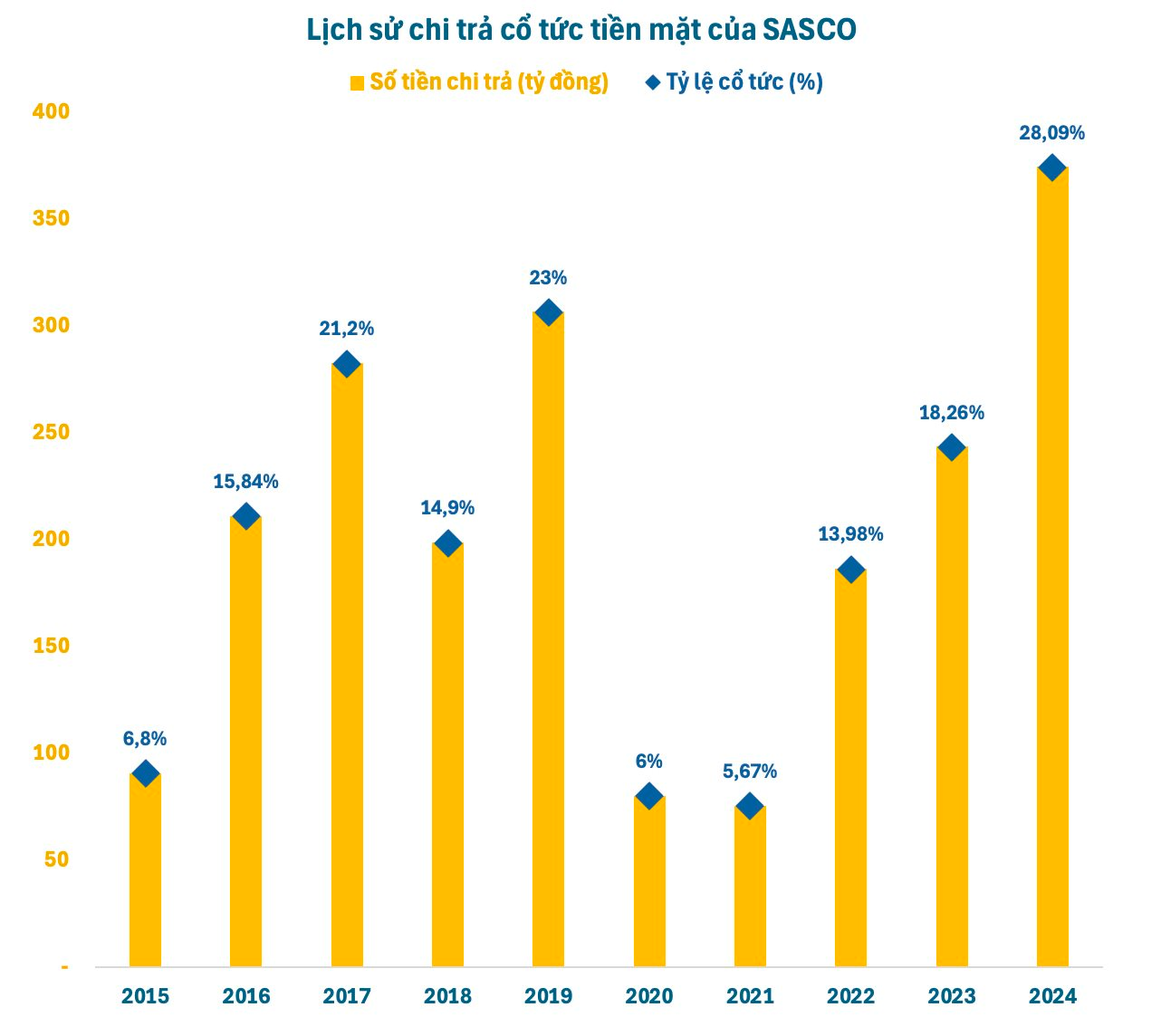

Tan Son Nhat Airport Services Joint Stock Company (SASCO – code SAS) has just announced the documents of the 2025 Annual General Meeting of Shareholders, expected to take place on June 26. Notably, the company plans to pay a record-high cash dividend of 28.09% (VND 2,809 per share) for the fiscal year 2024.

With approximately 133.5 million outstanding shares, SASCO is expected to distribute nearly VND 375 billion in dividends for 2024. The company has already paid the first installment of 6% last September. The second installment, amounting to 22.09%, will be distributed at a time to be decided by the Board of Directors.

Vietnam Airports Corporation (ACV), SASCO’s largest shareholder with a 49% stake, will receive approximately VND 184 billion in dividends. Meanwhile, a group of shareholders related to Mr. Johnathan Hanh Nguyen, Chairman of SASCO’s Board of Directors and holding a combined 46.5% stake, will receive about VND 174 billion.

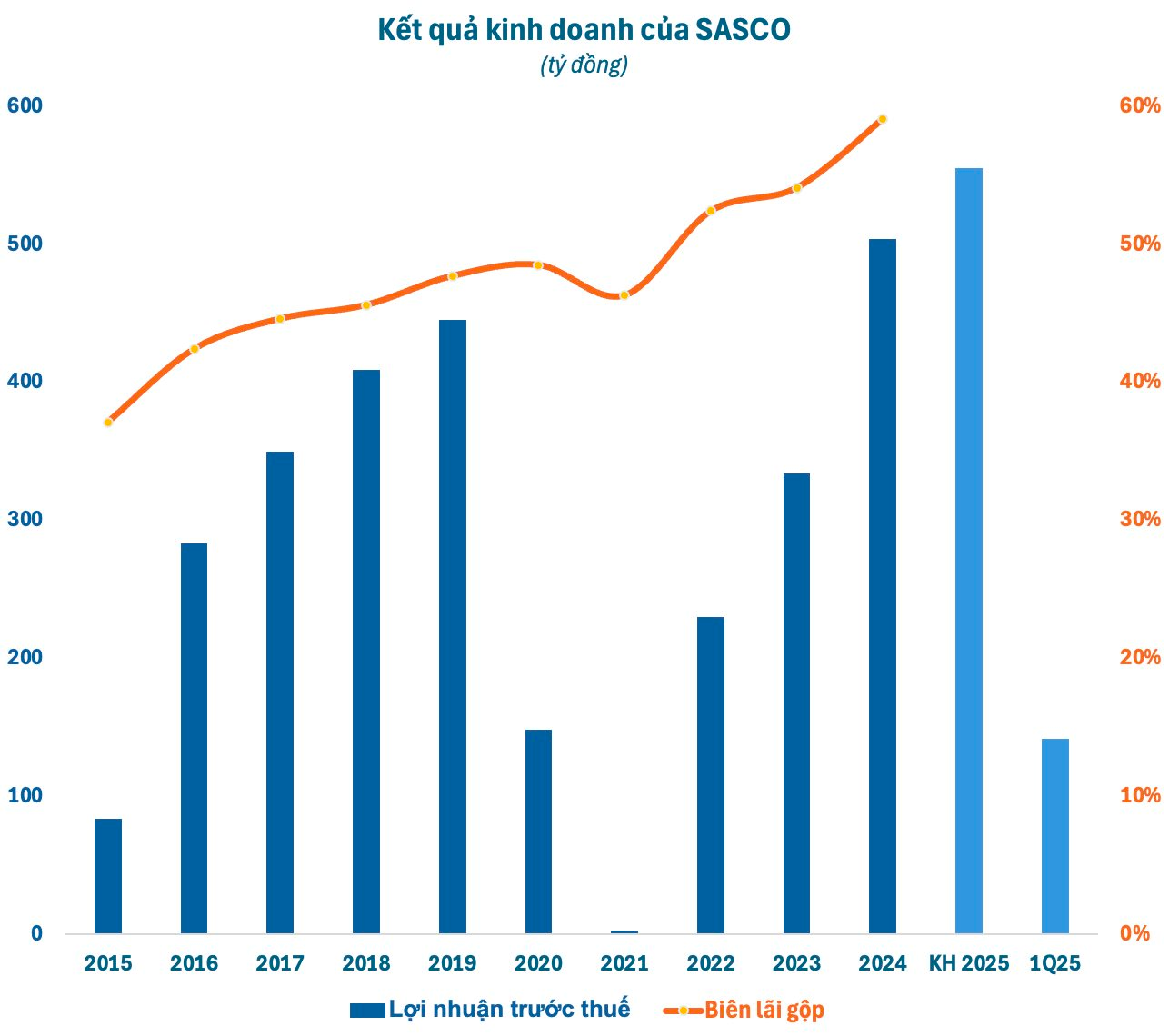

SASCO is known for its consistent and generous dividend payouts, usually above 10% and based on the company’s annual profits. This policy is underpinned by the company’s stable financial performance (except during the Covid pandemic), with gross profit margins trending upwards annually and reaching an impressive 60% in 2024.

At the upcoming General Meeting, SASCO will present its 2025 business plan, targeting a 3% year-on-year increase in net revenue to VND 3,183 billion and a 10% rise in pre-tax profit to VND 555 billion. If achieved, these figures would surpass the company’s pre-Covid performance and set a new record.

In the first quarter of 2025, SASCO reported a 12% year-on-year increase in revenue to VND 764 billion. The main source of revenue was the airport lounge services, generating nearly VND 230 billion, followed by duty-free shops and the commercial center. Net profit for the period stood at nearly VND 113 billion, a significant increase of 145% compared to the same period in 2024.

According to SASCO, the business plan is based on ACV’s estimated passenger volume for Tan Son Nhat Airport in 2025, which is expected to reach 42 million passengers, a 5% increase compared to 2024. This includes an estimated 16.8 million international passengers and 24.7 million domestic passengers.

SASCO highlights that 2025 marks an important transition year with the opening of the T3 Domestic Terminal in April, presenting both opportunities and challenges with the entry of new competitors in non-aviation services. The company’s management asserts that they are well-prepared for operations at the T3 Domestic Terminal and are poised to seize growth opportunities at the Long Thanh International Airport.

“Selling Real Estate to Settle Debts: The Strategic Move by Thiên Nam Group”

“Thien Nam Group is set to transfer ownership of three prime real estate properties located in Ho Chi Minh City, with a total value of VND 60 billion. The move is part of the company’s strategic decision to offset outstanding debts, showcasing their proactive approach to financial management and commitment to maintaining a robust balance sheet.”

A Sewing Brand is Unraveling: 50 Years of Threads Snipped and Over 2,500 Jobs at Risk.

With a robust financial standing, a generous dividend policy, and a nearly 50-year operational history, the 29/3 Garment and Textile Joint Stock Company, better known as Hachiba (UPCoM: HCB), stands apart from the myriad of companies that have delisted due to unforeseen circumstances or losses. Hachiba’s departure from the stock exchange is simply a consequence of its evolving shareholder structure, marking a shift towards a more closed-off business model.