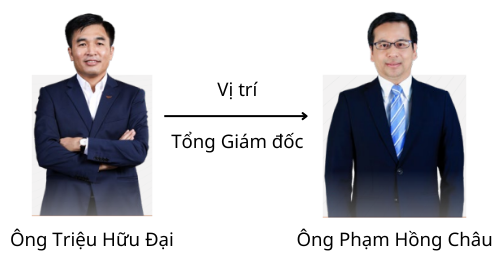

Mr. Dai has stepped down as CEO but remains on the VPI Board of Directors. According to the 2024 Annual Report, VPI introduced Mr. Dai as a Master of Business Administration with over 20 years of experience in the investment and construction industry, and over 15 years of management experience in organizations and enterprises in the field of construction.

Mr. Dai first took on the role of Deputy General Director of VPI on June 15, 2021, and then assumed the position of General Director on August 1 of the same year. In 2022, he was elected to the Board of Directors by the General Meeting of Shareholders as of April 26, 2022.

The new General Director, Pham Hong Chau, holds a Master’s degree in Accounting and has over 25 years of experience in Finance and Investment. Mr. Chau began his tenure as Deputy General Director and Member of the Board of Directors of VPI in 2017, before the company’s listing on the HNX exchange (in 2017), and subsequently moved to the HOSE exchange in 2018.

Also related to the Executive Board, on May 13, the VPI Board of Directors appointed Ms. Phan Le My Hanh as Deputy General Director of the Company.

This change in the Executive Board by the VPI Board of Directors comes as the Company reported positive results for the first quarter of 2025, with nearly VND 249 billion in net revenue and nearly VND 141 billion in net profit, up nearly 97% and 53%, respectively, over the same period last year.

These results were achieved through the recognition of rental income from serviced apartments at the Oakwood Residence Hanoi project, as well as continued revenue recognition from the Terra Bac Giang project and other services. Profit growth did not match revenue growth as in 2024, VPI recorded additional profit from the transfer of investment.

– 13:58 06/09/2025

“VNR Announces 10% Cash Dividend Payout”

The National Reinsurance Corporation of Vietnam (HNX: VNR) announces a shareholder record date for cash dividend distribution for the fiscal year 2024 and the convening of an extraordinary general meeting in 2025. The ex-dividend date is set as June 25th, 2025.

The King of Cooking Oil Ventures into Real Estate: A Mega Project Unveiled

The KIDO Group unveils its strategic initiative to capitalize on its existing land banks to embark on large-scale real estate ventures. With a vision to expand its ecosystem and attract investments, the group is poised to transform these lands into thriving hubs of development, creating opportunities for growth and innovation.

“Dat Xanh Aims to Boost Ownership in an Indirect Subsidiary”

With a vision to expand its horizons, Dat Xanh Group is embarking on a journey to enhance its ownership stake in Dat Xanh Commercial. The group aims to acquire a minimum of 99% of the charter capital through strategic share transfers and additional capital contributions.