Ms. Pham Thi Lan, Member of the Board of Directors of VKC Holdings JSC (UPCoM: VKC), has just registered to sell her entire holding of nearly 1.2 million VKC shares, equivalent to over 6.2% of the charter capital. The transaction is expected to take place from June 10 to July 3, 2025, to address personal needs. If the sale is successful, Ms. Lan will withdraw from the list of VKC shareholders. Based on the latest closing price of VND 700 per share on June 6, 2025, Ms. Lan could potentially receive approximately VND 838 million.

This is the second time that Ms. Lan has intended to sell her entire stake in VKC. Previously, she had registered to sell during the period from March 7 to April 4, 2024, but was unsuccessful due to unfavorable market conditions. Ms. Lan became a major shareholder of VKC on March 1, 2024, after purchasing an additional 214,000 VKC shares, increasing her total holdings to nearly 1.2 million shares. The estimated value of this acquisition was approximately VND 192 million, averaging VND 900 per share.

Another member of the Board of Directors, Ms. Ta Ngoc Bich, has also completely divested her holdings of 380,100 VKC shares (representing 1.975% ownership) during the registration period from March 14 to March 28, 2024, and is no longer a shareholder of the Company.

On the stock exchange, VKC shares are restricted from trading due to the auditor’s refusal to express an opinion on the financial statements for the years 2022-2023, along with negative equity. Prior to the trading restriction, VKC shares fluctuated between VND 1,000 and VND 2,000 per share, before plummeting to a low of VND 600 per share in late May 2025. Since its peak of over VND 28,000 per share in September 2021 – following a rapid increase from VND 7,500 per share within one month – VKC’s market price has eroded by 98%.

Source: VietstockFinance

|

Accumulated losses exceed VND 470 billion, and the auditor has declined to express an opinion

VKC’s financial situation is currently dire. The company incurred losses for three consecutive years from 2022 to 2024 and continued to post a loss of over VND 9 billion in the first quarter of 2025. As of March 31, 2025, accumulated losses amounted to more than VND 472 billion, and shareholders’ equity was negative at over VND 250 billion. On a quarterly basis, VKC has been loss-making for 12 consecutive quarters. Quarterly revenue has dwindled to just a few billion dong, a far cry from the average annual revenue of VND 800-1,000 billion during the period of 2013-2021.

| VKC’s Financial Performance for the Last 10 Years |

Notably, VKC’s 2024 audited financial statements were once again subject to a disclaimer of opinion from the auditing firm, as the Company failed to assess the recoverability of its receivables, make sufficient provisions, complete debt confirmation with partners, and resolve issues related to land use rights extension.

Additionally, VKC was found to have misappropriated funds from its bond issuance, using a portion of the proceeds as a deposit for a share purchase, even though the transaction was not finalized, and the collateral was not properly secured.

The auditors expressed significant doubt about VKC’s ability to continue as a going concern, given the company’s substantial accumulated losses, negative working capital, and numerous overdue payments.

By: The Manh

– 1:03 PM, June 9, 2025

“Court Orders Pomina Steel to Pay Over $640,000 to PV GasD”

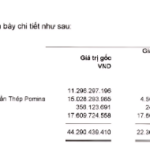

The Vietnam Low-Pressure Gas Distribution Corporation (PV GasD, HOSE: PGD) has announced a decision by the People’s Court of Di An City, Binh Duong Province, regarding a dispute with Pomina Steel Joint Stock Company (UPCoM: POM).