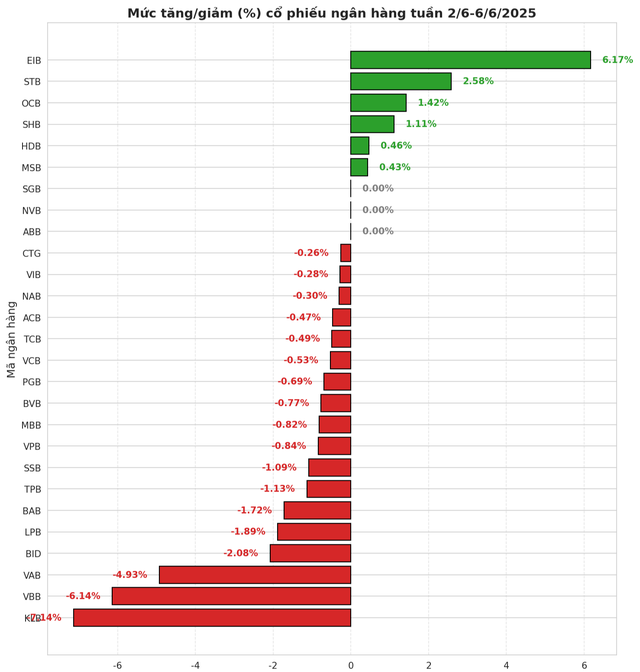

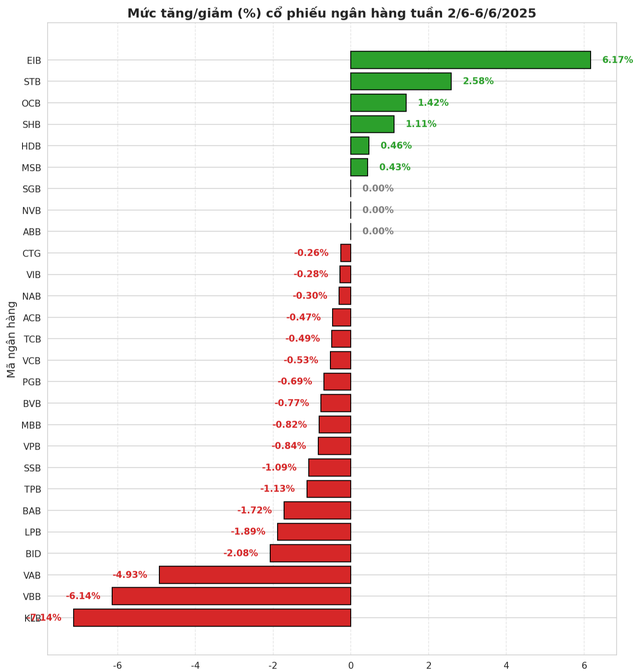

Out of the 27 bank codes surveyed, only 6 codes saw price increases, with EIB from Eximbank being the most notable gainer, rising by 6.17%. Some other codes that experienced modest gains include HDB (HDBank), STB (Sacombank), and OCB.

Three codes remained unchanged for the week: PGB (PGBank), NVB (NCB), and ABB (ABBank). In contrast, most of the remaining bank stocks witnessed price declines, with KLB from Kienlongbank experiencing the sharpest drop, falling by 7.14% last week. This stock reversed course after surging more than 30% in the previous week.

The total matched trading value of the 27 bank codes reached approximately VND 20,857 billion, a decrease compared to the previous week (May 26 to May 30, 2025) when the trading value stood at approximately VND 24,288 billion.

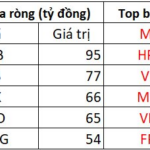

In terms of foreign investor dynamics, foreign investors demonstrated significant interest in the banking group, maintaining a net buying status in many large codes. SHB was the stock with the strongest net buying by foreign investors, with a value of over VND 205 billion. EIB also saw net buying of over VND 104 billion, followed by VIB, MBB, and TPB.

On the opposite side, the codes that experienced the highest net selling by foreign investors included STB, VCB, MSB, HDB, and VPB.

“June Starts With a Bang: Foreign Blocks and a Near 2,000 Billion VND Weekly Selling Spree – What’s the Focus Now?”

The foreign transactions were a notable downside during the week of June 2-6, with significant net selling, especially in the final trading session.

“Foreign Sell-Off Eases, but Blue-Chip Stock Still Takes a Hundred Billion Hit”

The foreign sector continued its net selling trend, but the pressure eased compared to previous sessions.