The Hanoi Stock Exchange (HNX) reported a significant decrease in trading activities in the derivatives market during May 2025.

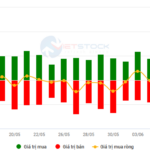

Specifically, the average trading volume of VN30 index futures contracts reached 184,904 contracts per session, a 29.96% decline, while the corresponding average trading value decreased by 24.02% to VND 25,605 billion per session (in notional contract value) compared to the previous month.

The trading session on May 26, 2025, stood out with the highest trading volume, reaching 264,527 contracts.

In terms of open interest (OI), the last trading session of the month recorded an OI of 44,328 contracts, a 17.56% increase from the previous month. The highest OI during the month was observed on May 7, 2025, with 53,674 contracts.

A breakdown of the market participants’ structure revealed a slight decrease in proprietary trading of securities companies in the derivatives market, accounting for 2.16% of the total market, compared to 2.43% in April 2025. Conversely, foreign investors’ trading activities picked up, with their trading volume accounting for 3.64% of the total market volume.

The Hunt for Whale Money: Proprietary Traders Scoop Up $400 Billion on HOSE, Foreigners Turn Net Buyers

The market rebounded from a series of adjustments, with a harmonious flow of capital from proprietary and foreign investors. Trading centered on large-cap stocks such as HPG, FPT, EIB, and VIX, indicating a strong presence of institutional investors and a positive outlook for the market’s future trajectory.

“Markets Rise with Caution: Vietstock Daily Overview for June 10, 2025”

The VN-Index pared its gains and failed to reclaim its March 2025 highs (1,320-1,340 points). Trading volumes remained below the 20-day average, indicating investor caution. The Stochastic Oscillator continued its downward trajectory, providing a sell signal and exiting the overbought territory. Meanwhile, the MACD echoed a similar sentiment, with the gap between the MACD line and the signal line widening, suggesting that the risk of a correction persists.

A Premium Price, But Who Will Buy Lilama’s Shares?

LILAMA has officially launched a public auction for the entire stake in Hua Na Hydropower Joint Stock Company (HOSE: HNA), with an opening bid set at VND 34,400 per share, a premium of 38% over HNA’s current market price. This transaction is expected to bring in at least VND 300 billion and marks the beginning of a series of capital transfers at several member units of LILAMA in the second quarter of 2025.