Illustration: AI

In May, Asia Commercial Joint Stock Bank (ACB) received approval from the State Bank of Vietnam to increase its charter capital by nearly VND 6.7 trillion through a dividend payout ratio adjustment.

Following this issuance, ACB’s charter capital will increase from VND 44,666 billion to over VND 51,366 billion, approaching Agribank’s charter capital of VND 51,638 billion, according to Tuoi Tre newspaper. Accordingly, ACB will issue a maximum of nearly 670 million new shares to pay dividends to shareholders at a ratio of 15%. This means that for every 100 shares owned, ACB shareholders will receive 15 new shares. The total value of the issuance at par value is nearly VND 6.7 trillion.

The bank expects to complete the capital increase in Q3 2025.

At the 2025 Annual General Meeting of Shareholders, ACB’s leadership shared that the capital increase is an urgent task to supplement medium and long-term capital for credit activities and government bond investments. The additional capital will also be used to invest in the bank’s physical infrastructure and strategic projects.

Mr. Tran Hung Huy, Chairman of ACB’s Board of Directors, emphasized that in the medium and long term, competition for customers among banks in Vietnam will intensify, along with higher requirements for operational compliance and the risk of cyber attacks.

“Therefore, to achieve our strategic goals, ACB will focus on investing in three aspects: strengthening our retail advantage, expanding into the enterprise customer segment to complete the aspects of a full-fledged bank, and continuing to change our operating model and develop new ones to transform our business model towards sustainability. We will also focus on enhancing our information technology infrastructure. In the next phase, ACB will evolve from being good to being outstanding. I firmly believe that ACB will reach new heights,”

said Mr. Tran Hung Huy.

In terms of financial performance, ACB reported a pre-tax profit of VND 4.6 trillion in Q1 2025, a 6% decrease compared to the same period in 2024. ACB attributed the profit decline to proactive interest rate support programs for customers to stimulate economic growth. Despite the slight decrease in profit, the bank’s ROE remained above 20%.

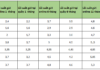

As of the end of March 2025, ACB’s credit balance reached VND 590 trillion, up 3.1% year-on-year. The bank’s total capital mobilization, including customer deposits and debt securities, reached VND 664 trillion, a 4% increase from the previous year. The loan-to-deposit ratio (LDR) stood at 79.8%, the ratio of short-term capital used for medium and long-term loans was 18.8%, and the consolidated capital adequacy ratio (CAR) was above 11%, well above the minimum requirement of 8% under Basel II standards.

For 2025, ACB has set a pre-tax profit target of VND 23 trillion, a 9.5% increase compared to the VND 21,006 billion profit achieved in 2024. Thus, the bank has accomplished 20% of its annual target after the first quarter of 2025.

Unlocking Homeownership: Empowering Young Buyers with Credit Solutions

Introducing an exciting opportunity for young homebuyers: Nine leading banks are now offering exclusive loan packages with unprecedented interest rates for those under 35 looking to purchase social housing. This is a game-changer for aspiring homeowners, offering a pathway to secure their dream home with unparalleled financial support.

A Luxury Bay Development Fined: Mr. Nguyen Duc Chi’s Crystal Bay Faces Penalties and Bond Extension

On June 1st, Crystal Bay JSC, where Mr. Nguyen Duc Chi serves as Chairman of the Board of Directors and legal representative, was fined VND 50 million by the State Securities Commission of Vietnam (SSC) for a delay in publishing its semi-annual financial statement for 2022 as mandated by regulations.

“FPT Retail to Release Over 34 Million Dividend Shares for 2024”

FPT Retail is set to release approximately 34.1 million bonus shares as a dividend payout for the fiscal year 2024, amounting to a 25% dividend ratio. The issuance of these shares is scheduled for no later than the third quarter of 2025.