According to S&P Global, Cargill, a leading American agricultural company, has exited the aquafeed business in Vietnam since early May 2025. Cargill is currently working with its employees on this transition.

Cargill Vietnam Shuts Down Two Aquafeed Mills in Dong Thap and Long An

On the professional social media platform LinkedIn, several employees of Cargill Vietnam also shared their departure from the company. Subsequently, in the Vietnamese Livestock Journal, Mr. Maxime Hilbert, Acting General Director of Aquaculture Nutrition, Cargill Thailand & Vietnam, stated that this decision aims to focus investments on markets and animal species that Cargill considers a priority in its long-term business strategy.

Cargill will be closing two aquafeed mills in Dong Thap and Long An provinces and an aquaculture technology application center in Tien Giang province.

In December 2024, Cargill announced a 5% global workforce reduction as part of a long-term strategy.

Prior to its exit from the aquafeed industry, Cargill had invested approximately $160 million in Vietnam, operating 12 aquafeed and livestock feed mills with a capacity of 1.6 million tons per year.

S&P Global also revealed that Cargill’s aquafeed business in Vietnam has been underperforming in the past two years, facing intense competition in the industry.

Forbes’ 2024 rankings showed a 10% decline in Cargill’s fiscal 2024 revenue (from $177 billion to $160 billion). Despite this, Cargill retained its top position, far surpassing renowned names such as Valve ($5 billion) and Elon Musk’s SpaceX ($8.7 billion).

Cargill has had a presence in Vietnam since February 1995 and currently employs over 1,500 people across various facilities in the country. In Vietnam, Cargill operates in multiple sectors, including animal nutrition and health, food and beverage ingredients, agriculture, specialty feed ingredients, and food products.

How Has Cargill Vietnam Been Performing?

Regarding Cargill’s business performance in Vietnam, data from Vietdata indicates that the company’s revenue has consistently increased from 2020 to 2022.

Specifically, in 2020, Cargill Vietnam’s revenue exceeded VND 17,000 billion. In 2021, the company’s revenue surged by 56% compared to 2020 and further increased by 7% in 2022, reaching nearly VND 28,500 billion.

While revenue consistently grew from 2020 to 2022, Vietdata notes that Cargill Vietnam’s after-tax profit fluctuated during this period.

Specifically, in 2020, Cargill Vietnam reported a net profit of nearly VND 940 billion. This increased to nearly VND 1,100 billion in 2021, a 15% rise. However, in 2022, Cargill Vietnam’s after-tax profit decreased by 18% to nearly VND 890 billion.

According to statistics from the General Statistics Office, Vietnam’s aquafeed production has been on a continuous upward trajectory since 2021 (the peak of COVID-19 control measures) until now. In the first five months of 2025 alone, production increased by 7.8% to 3.64 million tons.

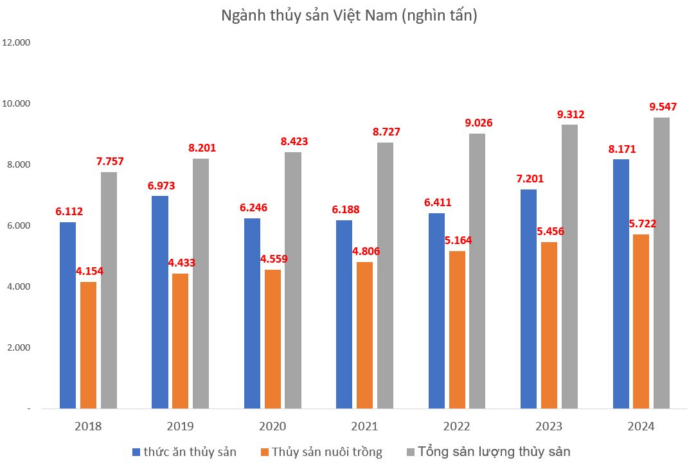

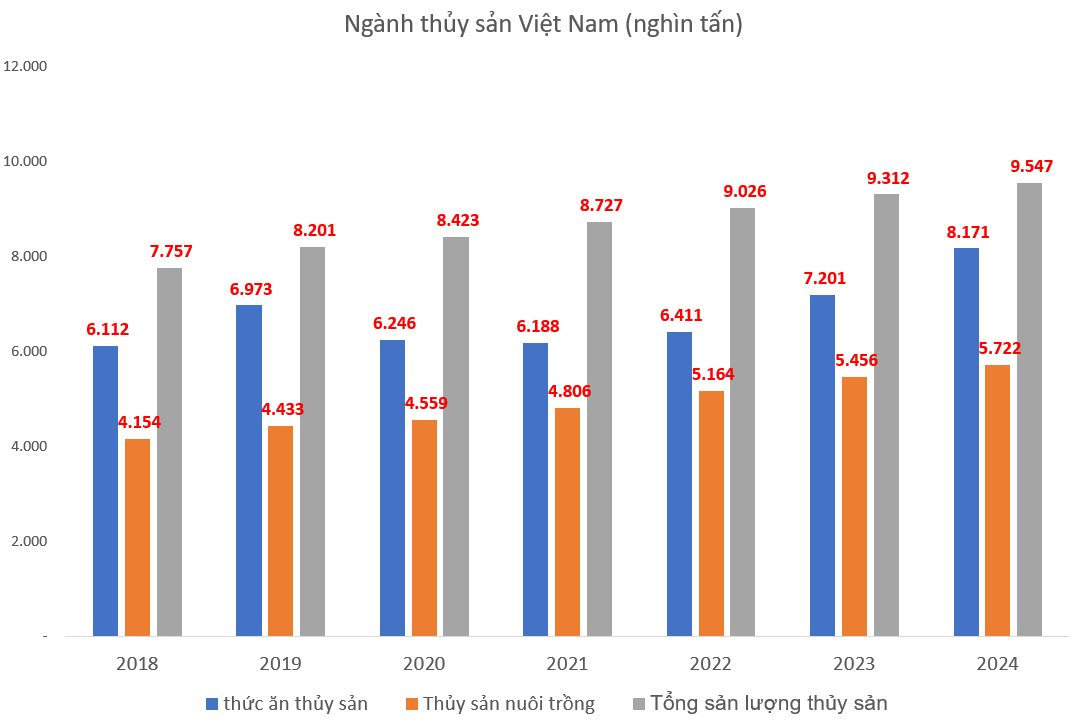

Data from the General Statistics Office shows that annual aquatic production (from both farming and fishing) has been steadily increasing over the years. The proportion of farmed aquatic production has also been growing, rising from 53.6% in 2018 to 60% in 2024.

Aquafeed production has generally increased but declined in 2020 and 2021, the peak years of COVID-19 control measures.

Vietnam’s aquafeed industry is highly competitive, with the presence of renowned companies such as C.P. (Thailand), Grobest (Taiwan, China), Japfa (Indonesia), BioMar (Vietnam-Australia), Sunjin (South Korea), CJ (South Korea), Uni-President (Taiwan, China), YueHai (China), and Thang Long Group (Vietnam-China).

Some well-known Vietnamese companies in this market include Sao Mai Group (HoSE: ASM), Mavin, and Greenfeed.

Notable recent projects in the industry include the Thang Long Group’s inauguration of its Hai Duong factory in May 2024, increasing its annual capacity to 700,000 tons, and YueHai’s construction of a new factory in Vinh Long in April 2024 with a capacity of 200,000 tons per year.

Before Cargill’s exit from the aquafeed industry, Tong Wei (China) had reduced the capacity of its factory in Tien Giang from 300,000 tons per year to 220,000 tons per year in 2015.

Clearing the Market of Drugs and Supplements: A Wave of Voluntary Recalls

In recent weeks, dozens of businesses have voluntarily recalled their medicines, health supplements, and cosmetics. This could be a demonstration of their social responsibility and ethical business practices. However, amidst the ongoing crackdown on counterfeit and substandard goods, it also raises questions about whether some companies are simply attempting to avoid regulatory scrutiny or potential penalties for non-compliance.

The First $1.4 Billion LNG-to-Power Plant in Vietnam Sets a Date to Power Up, Enough to Light Up 60% of Dong Nai Province

Nhơn Trạch 3 and Nhơn Trạch 4 power plants are set to boost Vietnam’s electricity supply significantly. With a combined annual output of 9 to 12 billion kWh, these power plants will contribute a substantial amount to the national grid, meeting the energy demands of Đồng Nai province, which currently accounts for the fourth-highest electricity consumption in the country. This equates to an impressive 60% of the province’s total electricity consumption, showcasing the immense impact these power plants will have on Vietnam’s energy landscape.

The Arch Steel Bridge: Unveiling the 850 Billion VND Marvel in Quang Ngai

By the end of June 2025, the Tra Khuc 3 Bridge, the first steel arch bridge in Quang Ngai, is expected to be completed. This state-of-the-art structure is set to become a landmark in the region, offering a unique and modern design that is sure to impress locals and visitors alike. With its sleek, curved shape and sturdy steel construction, the Tra Khuc 3 Bridge will not only provide a vital transport link but also stand as a symbol of progress and innovation in Quang Ngai.

Market Beat: A Pulse Check on Investor Sentiment

The market witnessed a lackluster performance in the morning session, with no significant recovery efforts. The subdued participation of cash flow, coupled with persistent pressure from the pillar group, painted a gloomy picture. VN-Index hovered at 1,323.17 points, reflecting a 0.51% decline, while HNX-Index mirrored this sentiment with a 0.52% drop, settling at 227.42. The market breadth further emphasized the bearish trend, with 386 declining stocks outweighing the 222 advancing ones.