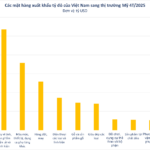

Vietnam’s footwear industry currently ranks third in the world in terms of production (after China and India) and second in exports. In the first four months of 2025, exports in this sector increased by 16% compared to the same period in 2024.

Similarly, the textile industry ranked second in the world in terms of exports in 2024. In the first five months of 2025, export turnover reached 17.58 billion USD, up 9% over the same period last year.

UNTYING SUPPLY CHAIN CONSTRAINTS

At the workshop “Promoting Trade to Diversify Export Markets, Exploiting FTA Markets for Vietnam’s Textile and Footwear Products” held by the Ministry of Industry and Trade, Ms. Phan Thi Thanh Xuan, Vice Chairman and General Secretary of the Vietnam Leather, Footwear and Handbag Association, shared that the biggest challenge for the Vietnamese footwear industry is the global economic instability as over 90% of the shoes produced are for export. The United States is a large export market for the industry, accounting for up to 40%, so the risk of tariffs in this market greatly affects the footwear sector.

Another challenge is that the footwear industry relies on raw material imports from China. According to Ms. Xuan, the localization rate of the footwear industry is currently about 55%, and up to 70-80% for shoes. However, we still depend on the Chinese market for raw materials, which makes it difficult to meet the requirements of origin in FTAs.

In addition, there are increasingly more non-tariff barriers and stringent market requirements such as green and circular production, CO2 reduction, and CBAM from the EU, which increase compliance costs for businesses.

Similarly, the textile industry also faces a volatile environment (diseases, geopolitical conflicts, protectionism…). Mr. Truong Van Cam, Vice Chairman and General Secretary of the Vietnam Textile and Apparel Association, shared that changing the textile strategy from “fast fashion” to “sustainable fashion” requires exporting enterprises to strive to meet new requirements. The supply chain must meet requirements such as Germany’s Supply Chain Due Diligence Act; EU Directive on Corporate Responsibility in the Supply Chain, and the roadmap for greenhouse gas emission reduction of brands…

There are also challenges from domestic demands, such as the pressure to implement Vietnam’s commitment roadmap at COP 26 on Net Zero by 2050; the huge demand for human resources and capital for dual transformation and circular economy; the requirement for self-sufficiency in raw materials to take advantage of FTA tax incentives…

To achieve sustainable exports of textiles and footwear, representatives of both industries emphasized the need to solve the problem of raw materials. According to Ms. Xuan, we need to attract investors to produce and distribute raw materials (HUB) domestically; build chains and channels to distribute raw materials. The footwear industry has successfully penetrated the global supply chain, but now the “game” is focusing on manufacturers who can take control of the raw material supply chain. Taking control of the raw material source will help Vietnam participate deeper in the global supply chain, contributing to competitiveness in terms of cost, price, and time to market.

Mr. Truong Van Cam emphasized the fundamental solution for the development of the textile industry is for Vietnam to be self-sufficient in raw material supply. Vietnam needs a strategy to build the textile industry with a high localization rate and attract investment in fabric and dyeing. If we simply diversify the supply source by buying from many places, the businesses will be affected when the market fluctuates.

Mr. Nguyen Trong Phi, Chairman of the Board of Directors of Giovanni Joint Stock Company, also acknowledged that the biggest limitation of the textile industry is the lack of a raw material market. We have industrial parks for the garment industry but not for the raw material industry. Therefore, foreign partners who want to relocate to Vietnam to produce raw materials, especially fabric production, face tremendous difficulties. Moreover, many localities do not welcome and do not license the tanning and dyeing industries.

Chairman of the Board of Directors, General Director of Hanoi Rubber Joint Stock Company, Pham Hong Viet, also emphasized the importance of developing a domestic raw material supply chain. Customers care about delivery time, and supplying raw materials not only meets the rules of origin but also shortens production time, bringing products to market as soon as possible, which will be a competitive advantage for businesses.

SEARCHING AND EXPLOITING NICHE MARKETS

Besides raw material solutions for sustainable exports in traditional markets such as the US, enterprises believe that expanding and diversifying export markets is a must. However, according to Mr. Bach Thang Long, Deputy General Director of May 10 Corporation, market diversification is not easy because not only Vietnam but also other textile competitors are looking for new markets to replace the US.

Therefore, Mr. Long proposed that in this context, Vietnamese trade offices abroad need to have new ways of working, not just providing information about importers but also information about Vietnam as a reliable address for importers so that they can take the initiative to find out. As a result, there will be more opportunities for buyers and sellers to meet.

Considering the EU as a broad market with much potential for Vietnamese enterprises to exploit, Ms. Nguyen Hong Hanh, representative of the Vietnam Trade Office in Belgium and the EU, emphasized: “To export sustainably to the EU market, in addition to closely coordinating with EU policymakers to shape the scope of upcoming laws (such as the Eco-design for Sustainable Products Regulation (ESPR); Extended Producer Responsibility (EPR); Corporate Sustainability Reporting Directive (CSRD)…), government agencies need to focus on developing investment frameworks and legislation to support the industry’s transformation.”

At the same time, implement measures to realize the Vietnam-EU Free Trade Agreement (EVFTA) related to sustainable development and have a plan to control the impact on the environment and labor to continue to maintain the advantages of EVFTA.

For enterprises, Ms. Hanh recommended paying attention to necessary adjustments in operations to meet the increasingly high social and environmental standards before the official compliance deadline of the EU. Consider investing in research and development to innovate sustainable practices and train the workforce in new technologies. Gradually shift to using clean energy to meet energy efficiency requirements in sustainable design.

Regarding the market of the United Arab Emirates (UAE), although this is a small-scale market with a population of about 10 million people, Mr. Truong Xuan Trung, Commercial Counselor in the UAE, said that this is an open market without trade barriers to imports.

The UAE mainly focuses on oil and gas exploration and export, while consumer goods depend on imports. Therefore, this is a great opportunity for Vietnam’s textile and footwear industries. UAE people have high incomes, and there are two fashion trends among Muslims: they dress in traditional costumes and modern branded clothes and shoes.

The Muslim market is also considered a large niche market for Vietnamese textiles and footwear. To meet this market, enterprises need to pay attention to the cultural fashion tastes of Muslims to design and promote products that suit their needs.

However, this is also a highly competitive market. Most exporters worldwide target this wealthy market. The UAE is a “hub” for re-exporting to the world, which can be re-exported to Africa, the Middle East, the Americas, and the six GCC (Gulf Cooperation Council) countries without being taxed a second time. The UAE and the GCC countries currently impose a 5% tax on textile and footwear products…

The full content of the article is published in the Vietnam Economic Magazine, Issue 23-2025, released on 09/06/2025. Dear readers are invited to read it at here:

The Ultimate Guide to Textile Recycling: Unveiling the $1 Billion Polyester Revolution in Binh Dinh

The Syre Impact AB Group, a Swedish entity, has been granted approval for a substantial investment project in the Nhon Hoi Economic Zone, Binh Dinh Province, Vietnam. The project, valued at a billion dollars, specializes in polyester fabric recycling and marks a significant step forward for the region’s economic development and environmental sustainability initiatives.

The Stock Price of MSH Recovers Strongly After Tariff Shock, FPTS Registers to Sell Nearly 1.2 Million Shares

On May 28, FPT Securities Joint Stock Company (FPTS, HOSE: FTS) announced its plan to sell nearly 1.2 million shares of May Song Hong Joint Stock Company (HOSE: MSH) from June 3 to July 2, expecting to reduce its ownership from nearly 9.6 million shares (12.79%) to 8.4 million shares (11.2%).

“Leveraging FTAs to Expand Export Markets for Textiles and Footwear”

As the Deputy Director of the Multilateral Trade Policy Department has highlighted, Vietnam’s competitive tax advantages compared to rivals such as Thailand, Malaysia, and Indonesia, are narrowing in markets like the EU, the UK, Canada, and Mexico. Therefore, it is imperative that we act swiftly to capitalize on the existing benefits offered by FTAs, or risk losing this edge over time.

US-Bound Export Sector Soars: Trump’s Statement Spurs Sector-Wide Rally

Let me know if you would like me to tweak it further or provide additional variations.

“Previously, at the May seminar organized by the Vietnam Textile Group (Vinatex), Dr. Le Tien Truong, Chairman of Vinatex’s Board of Directors, shared his insights on the industry’s market opportunities. He stated that the textile industry would witness an abundance of orders in the first half of the year, with the potential for this trend to extend through the third quarter of 2025.”

![[On the Front Seat] Chinese Automakers Unite to Take on the Rest of the Vietnamese Market: A ‘Dream Scenario’](https://xe.today/wp-content/uploads/2024/08/quote-temp-100x70.jpg)