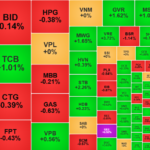

The trading session on June 9th, 2025, ended with the VN-Index down 1.45%, closing at 1,310.57 points. The matched transaction value reached VND 16,404.1 billion, a decrease of 19.3%, accounting for 92.0% of the total trading value.

The total trading value on the three exchanges reached VND 19,835.0 billion, a decrease of 27.5% compared to the previous session. Of which, the matched transaction value reached VND 18,304.9 billion, down 20.7% compared to the previous session, down 19.2% compared to the 5-day average, and down 20.6% compared to the 20-day average.

In terms of industries, liquidity decreased broadly, except for Retail, Warehousing, Logistics & Maintenance, Food, Building Materials, Aviation, and Express Delivery. In terms of price movements, Retail, Information Technology, Steel, and Express Delivery increased while the remaining industries mostly decreased compared to the previous Friday’s session.

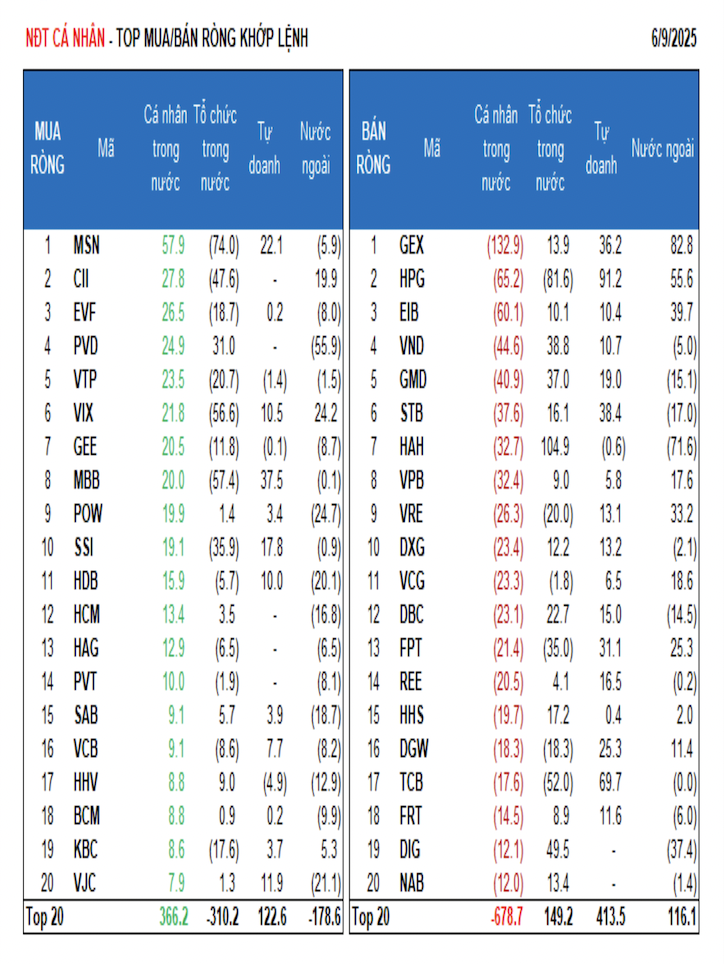

Foreign investors sold a net VND 339.0 billion, and they net sold VND 323.8 billion in matched transactions. The main sectors that foreign investors net bought in matched transactions were Basic Resources and Information Technology. The top stocks that foreign investors net bought were GEX, HPG, VHM, EIB, BAF, VRE, FPT, VIX, CII, and VCG.

On the selling side, foreign investors net sold the Financial Services sector in matched transactions. The top stocks that foreign investors net sold were SHB, HAH, VCI, PVD, DIG, DGC, POW, VJC, and HDB.

Individual investors net sold VND 342.5 billion, including a net sell of VND 391.9 billion in matched transactions. In terms of matched transactions, they net bought 3/18 industries, mainly in the Food & Beverage sector. The top stocks that individual investors net bought were MSN, CII, EVF, PVD, VTP, VIX, GEE, MBB, POW, and SSI.

On the net selling side, they net sold 15/18 industries, mainly in the Industrial Goods & Services and Banking sectors. The top net sold stocks were GEX, HPG, EIB, VND, GMD, STB, VPB, VRE, and DXG.

Proprietary trading bought a net VND 809.2 billion, including a net buy of VND 785.1 billion in matched transactions. In terms of matched transactions, proprietary trading net bought 15/18 industries. The sectors with the largest net buys were Banking and Real Estate. The top stocks that proprietary trading net bought today were HPG, TCB, VIC, MWG, STB, MBB, GEX, FPT, DGW, and VNM.

The top net sell was the Household Goods & Appliances sector. The top net sell stocks were VCI, HHV, VGC, DPM, E1VFVN30, VTP, HAH, GEE, PNJ, and FUETCC50.

Domestic institutional investors net sold VND 120.5 billion, including a net sell of VND 69.5 billion in matched transactions. In terms of matched transactions, domestic institutions net sold 8/18 industries, with the largest value in the Food & Beverage sector. The top net sell stocks were HPG, MSN, VHM, MBB, VIX, TCB, VIC, CHI, MWG, and SSI.

The sector with the highest net buy value was Industrial Goods & Services. The top net buy stocks were HAH, VCI, SHB, DIG, NVL, VND, GMD, PVD, DGC, and VSC.

The value of negotiated transactions today reached VND 1,530.1 billion, down 64.2% compared to the previous session and contributing 7.7% of the total trading value.

Notable transactions today included domestic individuals and domestic institutions in a series of stocks: Banking (SHB, MSB, STB), FPT, VJC, SJS, MWG, NKG, and STK. In addition, domestic institutions also traded VPB and BWE among themselves.

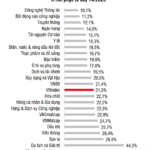

The allocation of money flow ratio increased in Real Estate, Banking, Retail, Food, Chemicals, Agricultural & Seafood, Warehousing, Building Materials, and Aviation, while it decreased in Securities, Steel, Information Technology, Construction, Oil & Gas, Electrical Equipment, and Garments.

In terms of matched transactions, the money flow ratio increased in the small-cap group VNSML, while it decreased in the large-cap group VN30 and the mid-cap group VNMID.

Technical Recovery, But Is the Market Risking a “Bull-Trap”?

The VN-Index continued to be heavily influenced by a few key stocks, with VHM taking center stage today. Investors took advantage of the technical rebound to exit their positions, resulting in a gradual weakening of the market throughout the session. The VN-Index failed to reclaim the 1320-point threshold, while trading volume remained subdued.

Stock Sell Pressure Rises After Strong Recovery: Which Stocks to Pick for June?

“According to the strategic report by SSI Research, there could be increased selling pressure after the market’s strong recovery. The differentiation may continue in June, with cash flow potentially favoring defensive stocks, equities with strong Q2 earnings growth, and those less impacted by tariff-related news.”