“HSC Seeks Capital Injection with Share Offering to Bolster Margin Lending and Proprietary Trading”

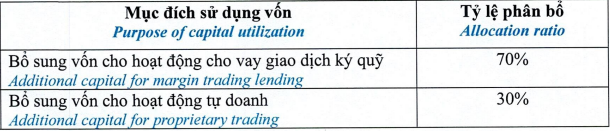

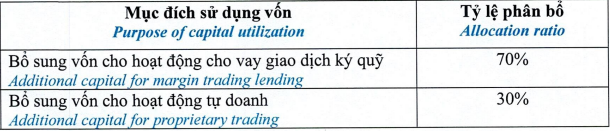

HSC, a state-owned securities company, with nearly 17% of its shares held by the Ho Chi Minh City Finance Investment State-owned Company (HFIC), is embarking on its first capital-raising issuance since late 2021. The expected proceeds of approximately VND 3.6 trillion from this share offering will be utilized to bolster margin lending and proprietary trading activities.

|

Plans for utilizing the anticipated VND 3.6 trillion in proceeds from the share offering

Source: HSC Securities

|

Existing shareholders will have the right to purchase additional shares at a ratio of 2:1. The record date for this offering is June 25, corresponding to an ex-rights date of June 24. The subscription period is set from July 14 to August 13. Transfer of subscription rights will be allowed from July 14 to August 8, and existing shareholders can transfer these rights once to other eligible entities or individuals during this period. Domestic shareholders are restricted from transferring subscription rights to foreign investors and can only transfer them to other domestic entities or individuals.

Any remaining unallocated shares will be offered to domestic shareholders, employees of the company, and/or other investors at a price not lower than that offered to existing shareholders. These shares will be subject to a one-year lock-up period from the end of the offering. Should there be any unallocated shares after the legally mandated distribution period (including any extensions), a resolution will be passed by the Board of Directors to cancel these shares and conclude the offering.

Following the announcement of this share offering, HSC’s stock price witnessed a slight uptick during the morning session on June 10, reaching VND 25,700 per share.

– 10:30, June 10, 2025

“VTG Securities Aims to Disburse Up to 1,100 Billion VND in Margin in 2025”

VTG Securities JSC (VTGS) is gearing up for its 2025 Annual General Meeting, scheduled for June 26 in Ho Chi Minh City. The company has set its sights on an ambitious business plan for the upcoming year, targeting over VND 81 billion in total revenue and VND 32 billion in pre-tax profits. These figures represent a staggering 26-fold and 2.3-fold increase, respectively, compared to the previous year’s performance. VTGS aims to achieve these goals by focusing on margin lending, with plans to disburse VND 1,000 to 1,100 billion in new loans in 2025.

“VIX Brokerage Aims for 1.8X Profit Growth in 2025”

On May 23, 2025, the Annual General Meeting of Shareholders of VIX Securities Joint Stock Company (HOSE: VIX) approved an ambitious profit target, aiming for an 80% increase compared to the previous year’s performance. VIX attributes this bold growth strategy to its focus on high-quality human resources and cutting-edge technology.

Mirae Asset: VN-Index to Extend its Recovery in May

In their latest strategic report, Mirae Asset Vietnam Securities predicts a continued recovery for the VN-Index in May. With countries entering trade negotiations, the market sentiment is expected to turn more positive as this could reduce the frequency of unpredictable news from the US, leading to a more stable environment.