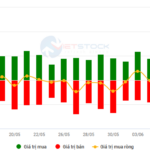

The latest statistics reveal an average matched order trading value of 19,883 billion VND on the HOSE in the past month, a 36.7% increase compared to the 5-month average. The average trading value across the three exchanges reached 24,018 billion VND in May 2025. Specifically, for matched orders, the average trading value per session was 21,672 billion VND, a 6.9% decrease from the previous month but still 30.1% higher than the 5-month average.

Sessions with liquidity reaching $1 billion were not uncommon, but the market’s surge wasn’t overly aggressive. The VN-Index approached the 1,350-point mark before retreating to fluctuate around the 1,300-point level.

Commenting on this trend in the ‘Phố Tài chính’ talk show, Mr. Ngo The Hien, Deputy Director of the Analysis Center at Saigon-Hanoi Securities Joint Stock Company (SHS), said: “It’s true that market liquidity in recent months has improved compared to the latter part of 2024. However, a closer look reveals that liquidity is lower than the same period last year. Overall, the 5-month trading value for the entire market decreased by 14% compared to the same period in 2024.”

April, out of the past five months, witnessed a significant surge in liquidity, partly due to market adjustments influenced by tariffs. Following a sharp decline that brought many stock prices down, positive developments in negotiations attracted capital back into the market, allowing the VN-Index to return to pre-tariff levels, and even pushing the VN30 index higher than the early April 2025 levels.

When segmented by capitalization, large-cap stocks, represented by the VN30 index, continued to attract the most capital, accounting for over 50% of the trading value on the HOSE. This was followed by the Midcap group, while the small-cap stocks witnessed low capital inflows and even a decline in the past two months.

This partly reflects investor sentiment after a significant discount phase, with investors primarily focusing on large-cap stocks that are less susceptible to tariff-related policies.

According to SHS data, there were three prominent industry groups attracting capital in the market: banking, real estate, and financial services stocks.

This can be attributed to several reasons: For banks, the first quarter of the year maintained a healthy growth trend. Real estate companies, on the other hand, experienced a surge in profits in the first quarter compared to the previous year, especially due to several large-scale companies. Furthermore, the government introduced policies to boost capital flow into the real estate market, such as those related to credit for social housing development and infrastructure projects like highways and airports funded by public investment.

Regarding securities stocks, the introduction of the KRX system on May 5th was a pivotal step in the market upgrade process, raising expectations that FTSE might soon promote the Vietnamese stock market to the Secondary Emerging market in September. Additionally, capital flow during this period exhibited significant differentiation across industries, even concentrating heavily on specific stock groups.

In contrast, foreign capital flows remained negative over the past five months, with consistent net selling in the Vietnamese market for the first four months. While there was a brief period of net buying at the beginning of May, foreign investors resumed net selling by the end of the month, causing further investor concern.

Currently, the VN-Index has returned to pre-tariff levels, and the impact of tariffs remains uncertain as negotiations are ongoing globally and in Vietnam.

According to the latest S&P report, the global manufacturing PMI declined for two consecutive months in May, especially in countries bearing the brunt of high tariffs, such as Mexico and Canada. Even the US and China experienced PMI declines in the manufacturing sector.

This less-than-favorable global macroeconomic context could adversely affect Vietnam’s economy due to its high level of economic openness. Additionally, exchange rates have been unfavorable, with the Vietnamese dong depreciating by over 2% against the US dollar since the beginning of the year, compared to a 5% depreciation in 2024, impacting capital flows.

“In the short term, the market is likely to continue consolidating around the current range, with some potential for minor adjustments. However, a deep correction of around 20%, similar to the tariff event in April, is unlikely. Instead, we may witness shorter and milder adjustments. The market is expected to consolidate at the current levels, awaiting further developments and the outcome of Vietnam’s trade negotiations,” emphasized Mr. Hien.

“Markets Rise with Caution: Vietstock Daily Overview for June 10, 2025”

The VN-Index pared its gains and failed to reclaim its March 2025 highs (1,320-1,340 points). Trading volumes remained below the 20-day average, indicating investor caution. The Stochastic Oscillator continued its downward trajectory, providing a sell signal and exiting the overbought territory. Meanwhile, the MACD echoed a similar sentiment, with the gap between the MACD line and the signal line widening, suggesting that the risk of a correction persists.

The Market is Sensitive as the Negotiation Deadline Looms – What Should Investors Do?

With clear and large-scale numerical commitments, the tariffs that Vietnam expects to achieve through negotiations are quite positive. However, the current situation is sensitive as the final round of talks draws near, and investors should consider multiple factors before making decisions.