I. MARKET ANALYSIS OF SECURITIES ON JUNE 10, 2025

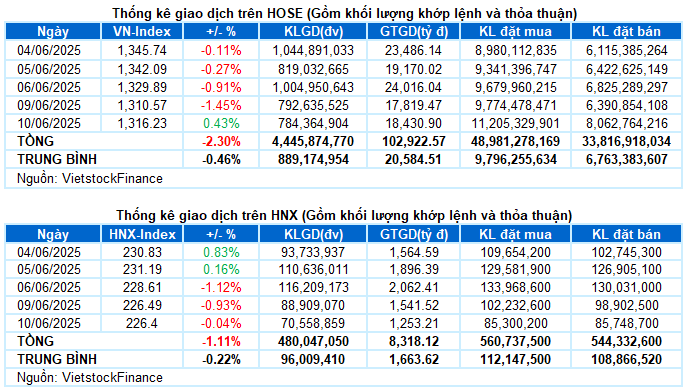

– Mixed performance was observed during the trading session on June 10th. The VN-Index regained its positive momentum with a 0.43% increase, reaching 1,316.23 points; while the HNX-Index witnessed a slight decline of 0.04%, settling at 226.4 points.

– Market liquidity remained subdued. The matched order volume on the HOSE decreased slightly by 2.2%, amounting to over 702 million units. Meanwhile, the HNX recorded nearly 70 million units, reflecting a 19.4% drop compared to the previous session.

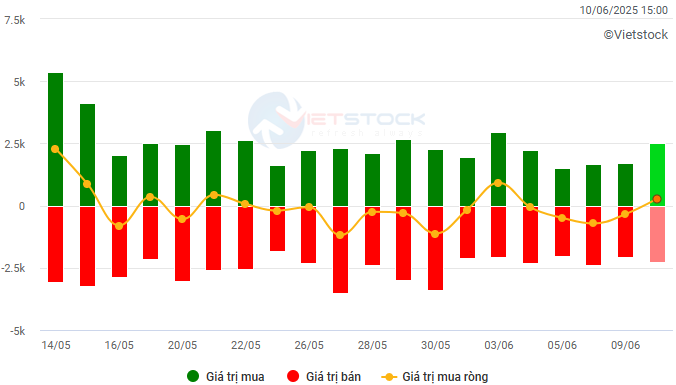

– Foreign investors recorded net buying with a value of nearly VND 326 billion on the HOSE and net selling of VND 17 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM. Unit: VND billion

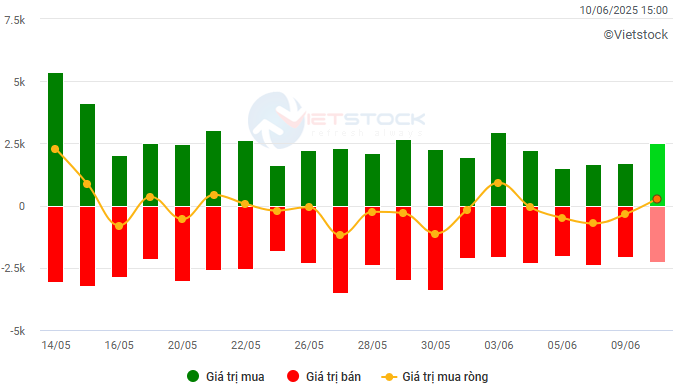

Net trading value by stock. Unit: VND billion

The securities market rebounded during the June 10th session as buying pressure regained the upper hand after four consecutive sessions of adjustments. Green dominated the market with leading stocks taking the lead, helping the VN-Index maintain a steady upward trajectory throughout the morning and early afternoon sessions. However, unexpected selling pressure emerged in the last hour of trading, causing the index to quickly narrow its gains and even briefly dip into negative territory. Nonetheless, late buying support helped the VN-Index close with a 5.66-point gain, ending at 1,316.23 points.

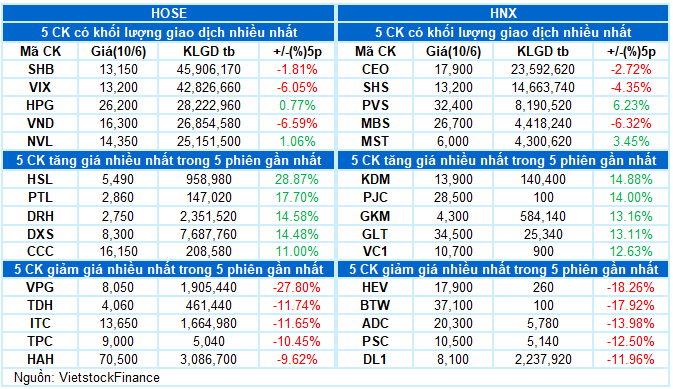

– In terms of impact, VHM resumed its role as the main driver for the VN-Index, contributing nearly 2 points to the index’s gain. This was followed by GEE, VRE, and TCB, which collectively added another 1.5 points. Conversely, no single stock had a significantly negative impact. The collective effect of the top 10 negative stocks resulted in a loss of just over 1 point for the index.

– The VN30-Index closed 0.59% higher at 1,404.82 points. Market breadth was positive with 14 gainers, 9 losers, and 7 unchanged stocks. VRE and VHM led the gains with increases of 3.7% and 2.7%, respectively. They were followed by STB, MWG, GVR, MSN, and TCB, which all posted gains of over 1%. On the other hand, no stock in the basket recorded a significant decline, and the losers all fell by less than 1%.

Sector performance was mixed. On the positive side, telecommunications led the gains with an impressive 2.11% increase, driven primarily by VGI (+2.72%), CTR (+2.25%), YEG (+1.71%), ELC (+0.89%), and SGT (+0.84%). The non-essential consumer sector also witnessed a strong performance, rising over 1% as several stocks attracted notable buying interest, including GEE and DGW hitting the daily limit-up, MWG (+1.65%), GEX (+1.86%), PNJ (+2.01%), FRT (+5.58%), VGT (+0.88%), and PET (+4.78%).

In contrast, the energy sector witnessed the most significant negative adjustment, declining by 1.27%. This was influenced by the downward movement of stocks such as BSR (-1.14%), PVS (-2.41%), PVD (-0.78%), PVC (-1%), POS (-3.31%), and TVD (-1.83%), among others.

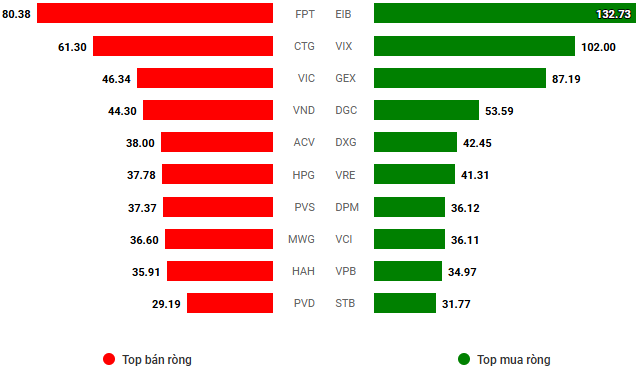

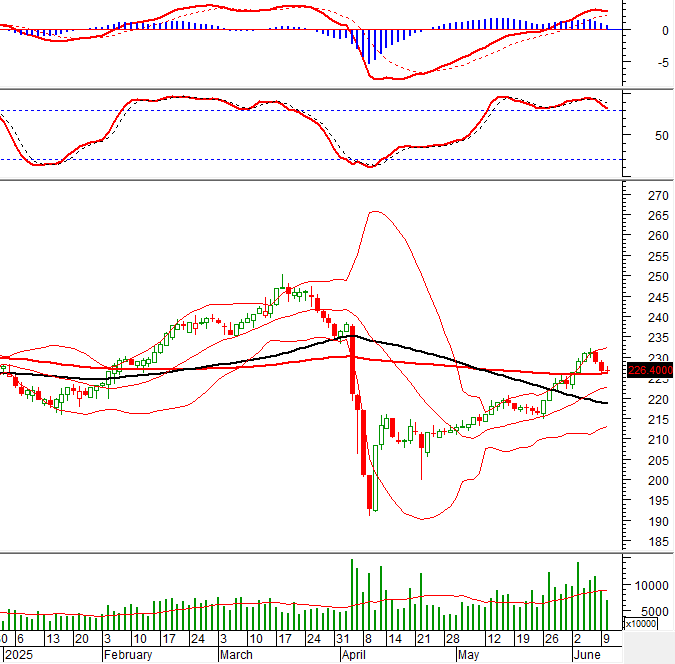

The VN-Index narrowed its gains and failed to reclaim the previous peak reached in March 2025 (corresponding to the 1,320-1,340 range). Moreover, trading volume remained below the 20-day average, indicating a cautious sentiment among investors. At present, the Stochastic Oscillator indicator continues to trend downward after generating a sell signal and has exited the overbought zone. Similarly, the MACD indicator also exhibits a sell signal, and the widening gap with the Signal line suggests that the risk of further corrections persists.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Trading volume remains below the 20-day average

The VN-Index narrowed its gains and failed to reclaim the previous peak reached in March 2025 (corresponding to the 1,320-1,340 range). Additionally, the trading volume remained below the 20-day average, indicating a cautious sentiment among investors.

Currently, the Stochastic Oscillator indicator continues to trend downward after generating a sell signal and has exited the overbought zone. Similarly, the MACD indicator also shows a sell signal, and the widening gap with the Signal line suggests that the risk of further corrections remains.

HNX-Index – Sustaining above the SMA 100-day moving average

The HNX-Index witnessed a slight decline, accompanied by a tug-of-war between buyers and sellers, while trading volume remained below the 20-day average.

At present, the index is holding above the SMA 100-day moving average. If liquidity improves in the coming sessions and the support level holds, the short-term outlook may not be overly pessimistic.

Money Flow Analysis

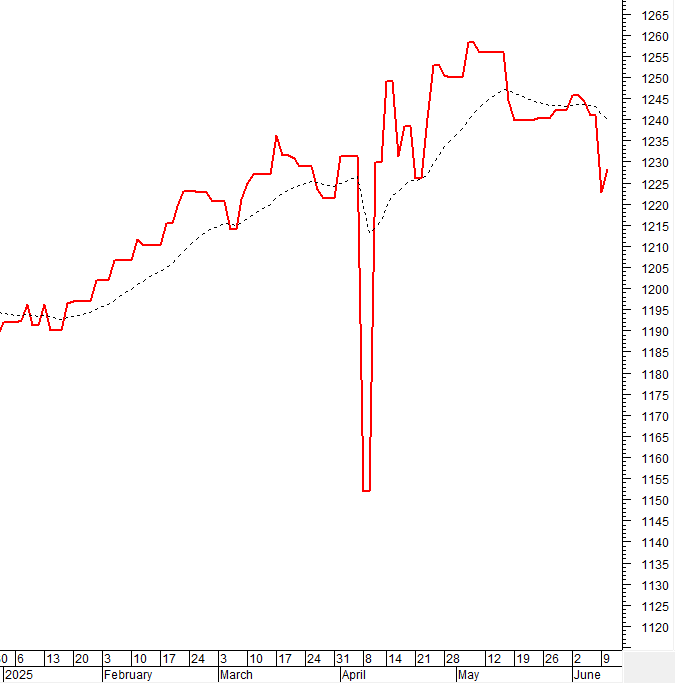

Movement of smart money: The Negative Volume Index indicator of the VN-Index dipped below the EMA 20-day moving average. If this condition persists in the next session, the risk of a sudden downward thrust will increase.

Foreign capital flow: Foreign investors returned to net buying during the trading session on June 10, 2025. If this trend continues in the coming sessions, the market sentiment is likely to improve.

III. MARKET STATISTICS ON JUNE 10, 2025

Economic and Market Strategy Division, Vietstock Consulting and Research

– 17:15 10/06/2025

The Market is Sensitive as the Negotiation Deadline Looms – What Should Investors Do?

With clear and large-scale numerical commitments, the tariffs that Vietnam expects to achieve through negotiations are quite positive. However, the current situation is sensitive as the final round of talks draws near, and investors should consider multiple factors before making decisions.

Stock Market Insights: A Shift in Perspective

The market witnessed a significant surge in sell-off pressure today, resulting in a notable decline in liquidity. This phenomenon can be attributed to the reduction in buying momentum, causing investors to step aside and allow sellers to take the reins in search of liquidity.

Market Pulse, June 9: VIC, VHM Wipe Out Over 10 Points from VN-Index

The market closed with notable losses, as the VN-Index fell by 1.45% to 1,310.57, shedding 19.32 points. Likewise, the HNX-Index declined by 0.93%, or 2.12 points, settling at 226.49. The session was dominated by sellers, with 507 declining tickers against 228 advancing ones. Within the VN30 basket, 19 stocks retreated, 7 advanced, and 4 remained unchanged, echoing the broader market’s bearish sentiment.