From 2012 and prior, the term “gold-based economy” was not uncommon. Gold was involved in transactions for buying houses, land, cars, and loans. Decree 174/1999/ND-CP, dated December 9, 1999, limited the State Bank to only managing gold currency in the foreign exchange reserve; while non-monetary gold (gold bars and jewelry) was freely traded as regular commodities.

On October 13, 2000, the State Bank issued Decision 432/2000/QD-NHNN, implicitly recognizing “gold credit” in commercial banks and the State Bank’s policy management. Thus, in the “money-commodity” relationship, gold reigned as a means of payment alongside VND and USD and was officially recognized in bank credit activities.

With this management framework, banks were free to engage in gold bullion and gold account business and lending. At that time, gold account trading floors mushroomed, from banks to websites outside the market.

A PAINFUL LESSON TO REMEMBER

Perhaps the “gold-based economy” would have continued this way, with all participants satisfied with their profits, if not for the financial crisis in the US in 2007, which threw everything into a vortex. There, gold and USD prices fluctuated, gold liquidity in banks was disrupted, gold smuggling was rampant, and risks gradually emerged, pushing at least five leading private joint-stock commercial banks into a chaotic situation due to gold.

During 2007-2009, Vietnam’s economic openness to the world increased. In 2009, the total import-export turnover was 125.4 billion USD, accounting for 119.89% of GDP (2009 GDP was 104.6 billion USD), and foreign investment flows, including FDI and FII, were quite strong. Therefore, almost all financial market fluctuations and commodity prices in the world were “imported” into Vietnam.

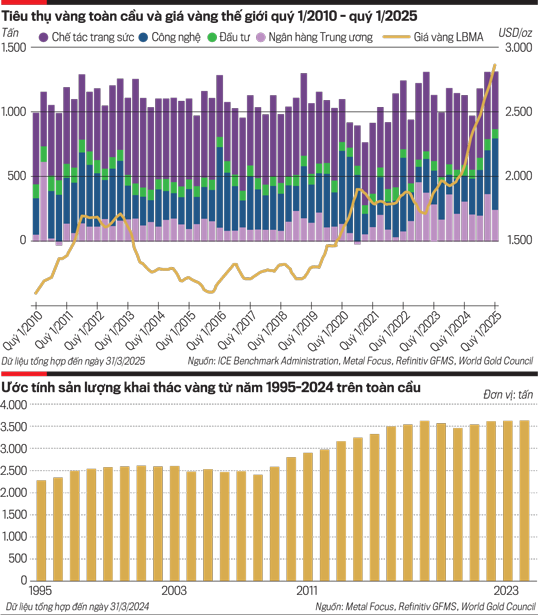

Particularly for the price of global gold raw materials, in early September 2009, it soared to 1,227.50 USD/ounce. Experts at that time attributed the increase in gold prices to three main reasons: (i) central banks increased purchases; (ii) the decline in the value of the USD; (iii) speculative buying pressure from investment funds increased; and (iv) especially the fear of inflation.

“According to estimates, before the termination of gold trading floors and the State’s monopoly on gold raw material import and gold bar production, the Vietnamese market imported an average of 100 tons of gold annually, of which up to 70 tons were smuggled gold, equivalent to 3.5 billion USD.

The relaxation of management over non-monetary gold has had negative impacts, especially when gold prices fluctuate strongly. Some individuals and organizations manipulate the market by creating artificial supply shortages and spreading rumors, causing “gold fever” among the people.

When the domestic gold price is higher than the world price, there is an immediate rush to hoard foreign currencies in the free market to smuggle gold raw materials and produce gold bars from smuggled sources, thereby adversely affecting the exchange rate and the foreign currency market.”

.

Domestically, on November 11, 2009, for the first time in history, the gold price peaked at 29.3 million VND/tael, and a few days later, it reached 29.1 million VND/tael, 4-5 million VND/tael higher than the world price. Analysts attributed this huge gap to the government’s decision in 2008 to stop issuing licenses for precious metal imports to ensure macroeconomic balances, including the exchange rate.

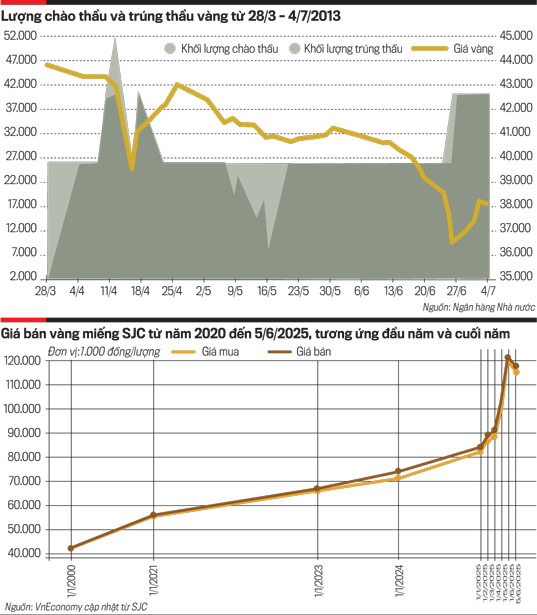

When the gold price surged, banks with a large proportion of gold bullion and gold accounts on their balance sheets were in a dire situation. The reason was that before the price increase, the gold price was low; for example, in 2007, the buying/selling price of SJC gold bars was only about 1,255,000 – 1,290,000 VND/tael, equivalent to 12,550,000 – 12,900,000 VND/tael (10 taels equal 1 tael of gold). But by 2009, the gold price had soared to over 29.3 million VND/tael, an increase of 2.38 times. By 2011, before the issuance of Decree 24 and during the days when banks had to settle their gold mobilization status to zero (before June 30, 2013), the gold price reached 42.6 million VND/tael, 3.44 times higher than in 2007.

No bank could have predicted such a scenario. Faced with long queues of people demanding to withdraw their gold at the beginning of each day, many banks procrastinated to buy time as the price had doubled compared to a few years ago. Worse still, when they tried to buy more gold, the market psychology was stimulated, causing prices to soar uncontrollably and turning the gold market into a “wild horse” during 2009-2012.

At that time, the authorities also identified it as one of the most harmful factors to the exchange rate, leading the State Bank to continuously sell foreign currencies to balance the market.

Dr. Nguyen Duc Trung, Vice Rector of Ho Chi Minh City University of Banking, analyzed that the relaxation of management over non-monetary gold had caused negative impacts, especially when gold prices fluctuated strongly. Some individuals and organizations manipulated the market by creating artificial supply shortages and spreading rumors, causing “gold fever” among the people.

When the domestic gold price is higher than the world price, there is an immediate rush to hoard foreign currencies in the free market to smuggle gold raw materials and produce gold bars from smuggled sources, thereby adversely affecting the exchange rate and the foreign currency market.

OBJECTIVES OF DECREE 24

Faced with this reality, the State Bank advised, and on April 3, 2012, the government issued Decree No. 24/2012/ND-CP on gold business management (effective May 25, 2012) with several clear objectives: (i) resolving gold liquidity issues in some banks; (ii) nationalizing and monopolizing the SJC gold bar brand (accounting for over 90% of the gold bar market share); (iii) monopolizing the import of gold raw materials; (iv) setting a roadmap to “push out” gold from banking activities, strictly prohibiting gold credit and other forms of gold mobilization, and ending gold trading floors; (v) allowing the purchase and sale of gold bars only by organizations licensed by the State Bank…

Among these objectives, the import of gold to resolve gold liquidity for banks was the most challenging issue, given the thin foreign exchange reserves. The State Bank has never officially announced how many tons of gold it imported, but according to some experts, it was about 70-75 tons of gold raw materials.

In reality, the State Bank continuously organized gold auction sessions through the auction process specified in Circular No. 06/2013/TT-NHNN dated March 12, 2013. The first auction session sold 2,000 taels of gold, but subsequent sessions sold up to 25,700 taels and even 39,200 taels. According to the State Bank’s data, by May 3, 2013, through the gold supply from the State Bank’s auctions, credit institutions with “gold credit” business settled 80% of the mobilized gold capital. Generally, before June 30, 2013, banks completed the settlement of 100% of the mobilized gold.

Disconnecting gold (bullion and accounts) from banking activities not only restored the health of banks in their function of allocating savings to investments in the domestic currency but also stabilized the exchange rate. Before Decree 24 was issued, when the domestic gold price was higher than the world price, many licensed gold bar manufacturers hoarded foreign currencies in the free market to smuggle gold raw materials and illegally produce gold bars.

Especially when the gold market was tightly controlled, the exchange rate also stabilized, and this situation has persisted from 2013 until now.

Researchers also found that after implementing Decree 24 for many years, the relationship between gold and USD prices became less significant, unlike the period before the Decree’s issuance. In addition, from 2012 to the present, the exchange rate and inflation have always been within or lower than the targets assigned by the National Assembly to the government.

However, starting in 2020, after the world emerged from the Covid-19 pandemic, the global economy underwent numerous upheavals that profoundly impacted gold prices. In a recent report to the National Assembly, the State Bank stated that at the beginning of 2025, world gold prices continuously broke previous records.

The main reasons for the increase in international gold prices are: (i) political instability, military conflicts, and strategic competition increasing globally, such as the prolonged Russia-Ukraine conflict, followed by economic and political sanctions and retaliation between Russia and the US and its allies; military conflicts between Israel and Islamic countries in the Middle East; (ii) many central banks and investment funds increasing gold purchases to supplement foreign exchange reserves, which is also an important reason for the rise in gold prices; (iii) US President Donald Trump’s announcement of high countervailing duties on countries worldwide negatively affected investors’ psychology and global economic growth, causing investment flows to shift towards gold…

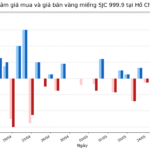

Domestically, SJC gold bar prices moved in tandem with world prices. With synchronous management solutions, by early April 2025, the gap between domestic and world gold prices continued to be controlled and maintained at a margin of about 3-5 million VND/tael (equivalent to about 5-7%); at the beginning of 2025, the gap narrowed to just over 1 million VND/tael (equivalent to about 1-2%). By April 23, 2025, the gap between domestic SJC gold bar prices and world prices was about 14.48 million VND/tael (equivalent to about 13.62%).

At this point, a series of issues were raised again for the State Bank, including: (i) reducing the gold price gap between the domestic and international markets; (ii) allowing gold trading on gold and commodity exchanges; and (iii) unlocking gold resources for socio-economic development.

However, there are also extreme opinions that Decree 24 has “completed its mission” and should “cease to be effective” and “open the door to gold imports again according to market demand”

TRANSPARENCY IN GOLD “ASSETS”

According to the analysis of the former deputy general director of a state-owned commercial bank, compared to countries with similar economic scales in the region (Indonesia, Thailand, and Malaysia), Vietnam’s foreign exchange reserves are currently lower in terms of absolute value and import coverage. Meanwhile, the economy is heavily dependent on energy and raw material imports (garments, electronics…), putting more pressure on foreign exchange reserves.

The fluctuations of the world economy, especially the tax and trade policies of the US (under Donald Trump), have strongly affected Vietnam’s balance of payments. Maintaining foreign exchange reserves for the import of essential goods such as machinery and technology has become more urgent than importing gold for gold bar production.

Imagine a bank or any other entity mobilizing or borrowing one tael of gold when the price is nearly 12.3 million VND/tael and selling it to make a profit. However, two years later, the gold price increases by 2.38 times, and after three years, it reaches 42.6 million VND/tael. The depositor demands gold instead of cash. In this situation, it is understandable how desperate the bank would be.

For a long time, the gold market has been distorted by monopolistic behaviors, as revealed by six inspection conclusions of the State Bank recently.

An interesting view is that the demand for gold bar hoarding does not only stem from “inflation concerns” and the need to store assets but also from individuals wanting to conceal ill-gotten wealth. In the context of the government promoting transparency and asset declaration (requiring asset and income declaration…), cash and real estate have become “easily traceable” assets, while gold bars and gold jewelry are more discreet.

In reality, bank deposits and securities are fully data-backed, and even real estate is managed through a land database.

Gold (gold bars and gold jewelry), on the other hand, does not require registration, is traded in cash, and is easily transferable. Gold has no serial numbers like motorcycles or cars.

Therefore, gold becomes an ideal “asset hiding place” for those with unclear sources of wealth. A series of regulations are being tightened (Anti-Corruption Law, Asset Declaration Law…), but gold – which is outside the registered asset system – remains in a state of “non-recognition” by the law.

Gold smuggling is not only driven by economic needs but also serves the “money laundering” purpose for unclear assets. Many recent cases have revealed gold smuggling syndicates involving hundreds of kilograms of gold.

To promote a healthy gold market and effectively combat corruption, it is necessary to study gold transactions through accounts and connect information between bank accounts, real estate, and gold accounts using personal identification codes.

All gold buying and selling transactions should be accounted for and monitored through individuals’ gold accounts, thereby facilitating the traceability of asset sources.

In the six inspection conclusions of the gold market recently issued to six units, few people paid attention to the transaction of a large volume of gold between individuals and organizations, even though the individual’s background did not seem to match their ability to possess such a substantial amount of gold. Could this be a case of legalizing smuggled gold and money laundering?

The former deputy general director of the bank mentioned above said: “Before discussing unlocking gold resources in organizations and the people, the first necessary thing is transparency. Those who own gold must be identified in some form. In the past two years, those who bought gold from the four state-owned commercial banks could check the full information by entering the correct serial number”

The full content of this article was published in the Vietnam Economic Magazine, Issue 23-2025, released on June 09, 2025. Please refer to the link below for more details: https://postenp.phaha.vn/tap-chi-kinh-te-viet-nam/detail/1440

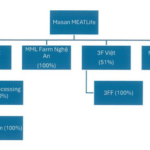

“Masan MeatLife to Receive $16 Million in Dividends from Subsidiary, Investing in Meat Processing and Preservation Enterprise.”

Masan MeatLife JSC (UPCoM: MML) is planning to transfer its undistributed profit of VND 380 billion from MML Farm Nghe An Ltd. by December 31, 2025, at the latest. Concurrently, the Company has approved a plan to contribute a maximum of VND 380 billion to MEATDeli HN Ltd., also to be finalized by the same date.

The End of Easy Profits: Riding the Golden Wave

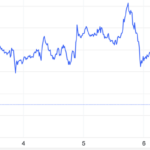

The Vietnamese gold market witnessed a tumultuous surge in April 2025, with gold prices fluctuating by up to VND 7.5 million per tael per day. This volatility presented a lucrative opportunity for savvy traders and investors to profit from the rapid price movements. However, those days of frenzied gold trading seem to be over, as the current market offers little room for such lucrative waves.