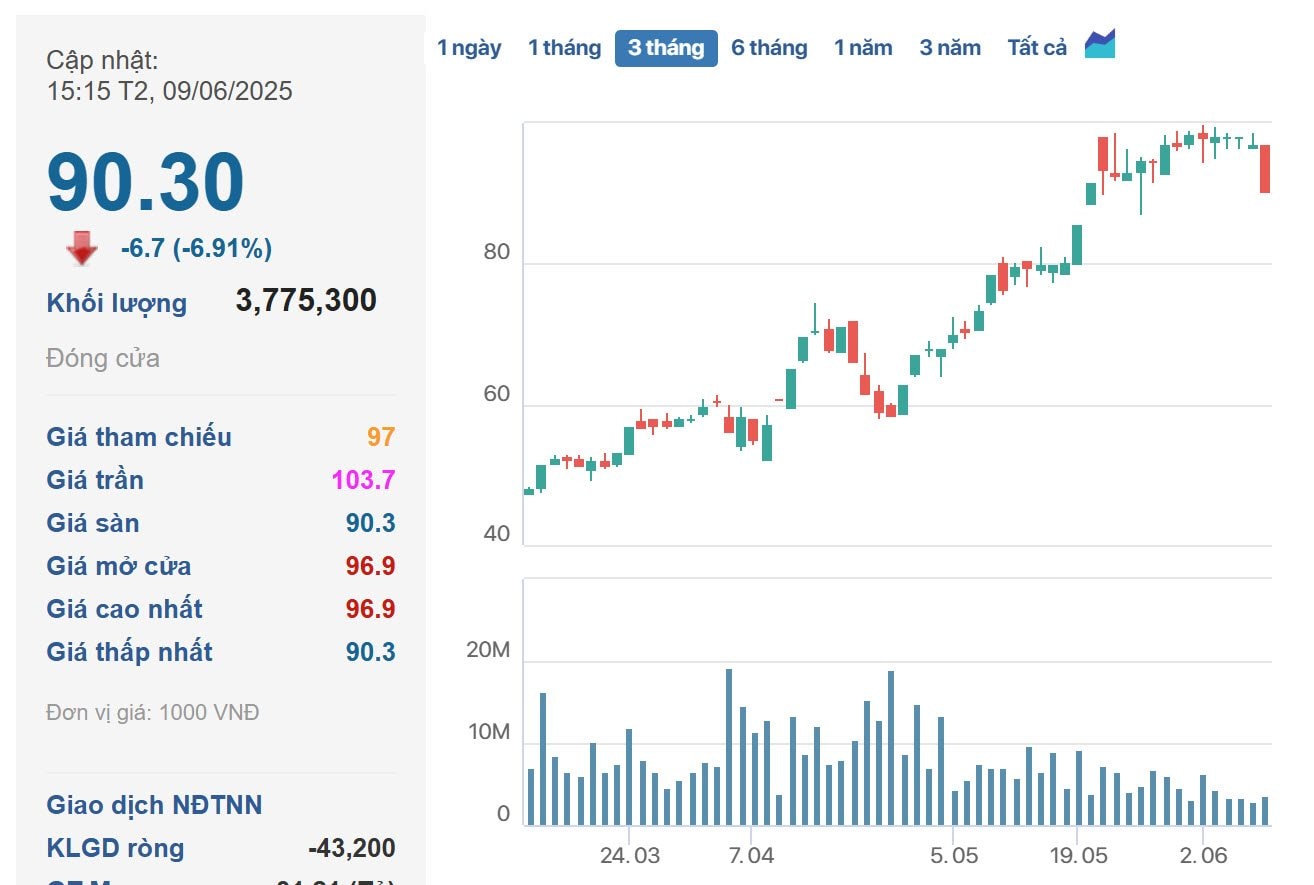

VinFast Auto’s Stock Surges as Q1 Results Impress

On June 9, 2025, VinFast Auto’s stock (ticker: VFS) soared in early US trading hours, surging over 12% to surpass $3.70 per share. This pushed the company’s market capitalization to over $8.6 billion.

The rally was fueled by VinFast’s remarkable Q1 financial results: the company delivered a total of 36,330 electric vehicles in the first quarter of 2025, marking a staggering 296% increase compared to the same period last year.

Despite the typically slow start to the year for the automotive industry, VinFast’s Q1 deliveries surpassed the total number of vehicles delivered in the first half of 2024. Additionally, the company witnessed a remarkable 473% year-over-year growth in e-scooter and e-bike deliveries, reaching 44,904 units.

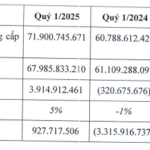

Strong Revenue Growth and Improved Profit Margins:

VinFast’s total revenue for Q1 2025 stood at VND 16,306.4 billion ($656.5 million), reflecting a significant 149.9% jump compared to Q1 2024.

While the company reported a gross loss of VND 5,736.5 billion ($231.0 million) and a net loss of VND 17,693.8 billion ($712.4 million) for the quarter, there are signs of improvement.

Notably, VinFast’s gross profit margin showed a significant improvement compared to the same period last year and the previous quarter, standing at -35.2%. This is a considerable recovery from -58.7% in Q1 2024 and -79.1% in Q4 2024, indicating the company’s enhanced operational efficiency through revenue growth and cost optimization.

As of May 31, 2025, Mr. Pham Nhat Vuong has disbursed VND 20,500.0 billion ($825.4 million) in non-refundable funding to VinFast, as part of his previously announced commitment of up to VND 50,000 billion ($2.1 billion) made on November 12, 2024.

Additionally, as of the same date, Vingroup has disbursed VND 30,571.3 billion ($1.2 billion) in loans to VinFast, in line with its commitment made last year to provide up to VND 35,000 billion in new loans to support VinFast’s continuous growth trajectory.

Securities Commission Receives Full Application for Big Group Holdings’ Stock Dividend Issuance

On June 06, the State Securities Commission (SSC) corresponded with BIG Group Holdings JSC (UPCoM: BIG), informing them that the SSC had received a complete set of documents from BIG. This announcement was made public through the commission’s official website.

The King of Cooking Oil Ventures into Real Estate: A Mega Project Unveiled

The KIDO Group unveils its strategic initiative to capitalize on its existing land banks to embark on large-scale real estate ventures. With a vision to expand its ecosystem and attract investments, the group is poised to transform these lands into thriving hubs of development, creating opportunities for growth and innovation.

A Seasoned Publishing and Retail Executive Joins Phuong Nam’s Leadership

Two senior personnel with extensive experience in publishing, distribution, and retail have been appointed to key positions at the Ho Chi Minh City-based Culture Corporation of Phuong Nam (HOSE: PNC). This development comes as the Tien Long Group is gradually taking over and restructuring this enterprise.