Novaland JSC, a leading real estate investment group, has recently announced a board resolution seeking consent from bondholders of the NVLB2123012 bond package (security code NVL122001) regarding amendments to the bond documents and a change in the maturity date.

The voting ratio is set at 1:1, with each bondholder entitled to one vote. The consent solicitation process will take place from June to July 2025, conducted through written forms or electronic voting.

Previously, in June 2023, the NVL board disclosed that holders of the NVLB2123012 bonds agreed to extend the maturity date by 24 months, from July 20, 2023, to July 20, 2025. The interest rate for this period was fixed at 11.5% per annum.

As per the consolidated financial statements for Q1 2023, this bond issuance was arranged by Techcom Securities JSC. The bonds are non-convertible and do not include warrants, with a face value of VND 100,000 per bond and a total issuance value of VND 1,300 billion. The bonds had an original maturity of 18 months from the issuance date, with an initial interest rate of 9.5% for the first four interest periods, followed by a floating rate of the reference rate plus a margin of 3.28% per annum.

These bonds are secured by shares owned by shareholders and future asset rights related to a project in Phan Thiet. Subsequent to the consolidated balance sheet date, the Group is in discussions to add further collateral and adjust the bond maturity.

Additionally, the board approved the company’s engagement of Novaland Agent JSC as a brokerage service provider for the transfer of assets related to two projects under Lucky Dragon, with a brokerage fee not exceeding 2% of the sale price, totaling over VND 2.7 billion, including VAT.

Furthermore, the board approved a loan facility of over VND 114 billion from Delta – Valley Binh Thuan JSC, with an interest rate of 11% per annum, to supplement the company’s working capital.

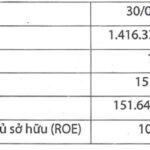

For Q1 2025, NVL reported a loss of VND 476.3 billion, an improvement from the VND 600 billion loss in Q1 2024. This reduction in loss was attributed to an increase in profit from sales and service provision of VND 456 billion and a decrease in profit from financial and other activities of VND 379 billion.

“Latest Developments in the Enforcement of Civil Judgments in the Vạn Thịnh Phát Case: Phase 2”

The Ho Chi Minh City Department of Justice has requested that individuals who have not yet submitted their applications for providing personal and account details do so promptly to facilitate the standardization, verification, and cross-referencing of information before processing payments to the beneficiaries.

The Solar Power Company Reports Half-Year Profit of $220 Million After ACIT Acquisition

After being acquired by ACIT (Asia Industrial Technical Corporation) in July, Trung Nam Solar Power reported a remarkable post-tax profit of over VND 220 billion for the first half of 2024.

The Ultimate Guide to Stock Market Success: Unveiling the Secrets of the Pros

“Revolutionizing Debt Management: VPI’s Strategic Move to Settle Bond Debt with a Twist”

“Van Phu – Invest Joint Stock Company is poised to issue 29.65 million shares to settle a VND 690 billion debt (excluding interest) in convertible bonds, with a conversion price set at approximately half of the current market price.”

Let me know if there are any other adjustments or refinements you would like to see!