**PSI’s Financial Strategies: A Comprehensive Analysis**

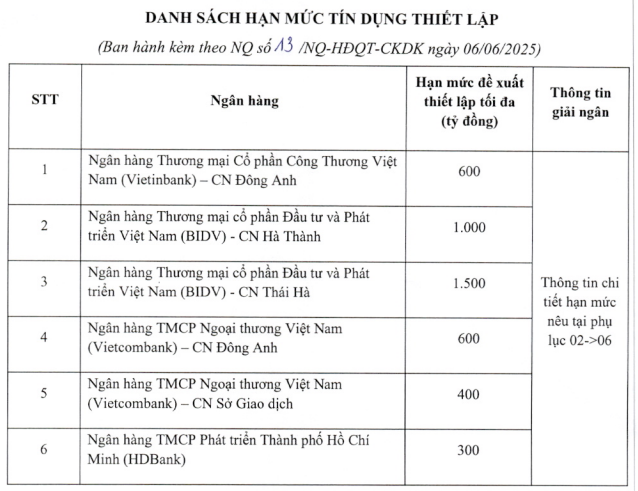

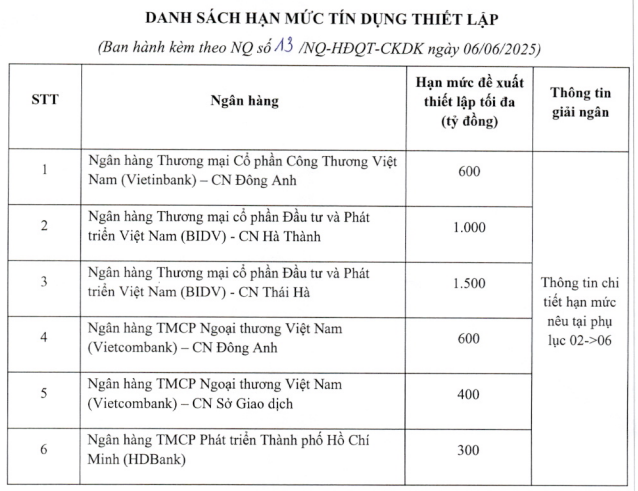

As per the released list, BIDV extended the largest credit limit of VND 2,500 billion, with the Thai Ha Branch providing VND 1,500 billion and the Ha Thanh Branch offering VND 1,000 billion.

Other prominent lenders include Vietcombank with a credit limit of VND 1,000 billion, comprising VND 600 billion from the Dong Anh Branch and VND 400 billion from the Head Office Branch; VietinBank’s Dong Anh Branch with a limit of VND 600 billion; and HDBank with a limit of VND 300 billion.

These six loans are primarily aimed at investing in government bonds or other purposes as per the banks’ credit regulations during specific periods.

Source: PSI

|

As of March 31, 2025, PSI’s short-term debt exceeded VND 1,868 billion, a VND 300 billion increase from the beginning of the year, and 2.6 times its equity. Bank loans accounted for nearly VND 984 billion, while the remaining VND 884 billion was borrowed from other sources. Additionally, PSI raised nearly VND 70 billion through the issuance of non-convertible long-term bonds.

Out of PSI’s total assets of nearly VND 2,900 billion, loans constituted the largest proportion at 53%, amounting to nearly VND 1,532 billion, an increase of nearly VND 514 billion from the beginning of the year. Margin lending exceeded VND 1,431 billion, a significant surge from the start of 2025, and currently almost twice the company’s equity.

The company also held over VND 703 billion in term deposits with a maturity of less than one year and financial assets recognized through profit/loss (FVTPL) of nearly VND 180 billion, including deposit certificates, listed and registered stocks, and unlisted bonds of FECON JSC and Hai Phat Investment JSC.

In Q1/2025, PSI’s business performance resulted in a net profit of over VND 8.3 billion, a 20% decrease from the previous year, despite a 3% increase in operating revenue to over VND 95 billion. With these results, the company has achieved 28% of its annual profit plan.

| PSI’s Q1/2025 net profit exceeds VND 8.3 billion |

In a recent development, on May 27, the State Securities Commission of Vietnam imposed a fine of VND 860 million on PSI for multiple administrative violations, ranging from executing orders without sufficient funds to providing financial services that breached regulations.

Huy Khai

– 15:57 10/06/2025

“Novaland’s Receivables and Going Concern: SMC’s Response to the Audit Emphasis”

“Following the independent auditor’s report from Moore AISC, which included emphasis-of-matter paragraphs regarding trade receivables from the Novaland Group and going concern in the 2024 audited financial statements, CTCP Trade and Investment SMC (HOSE: SMC) submitted an explanatory letter to the Ho Chi Minh Stock Exchange (HOSE) on May 20, 2025. In the letter, the company also addressed its plan to rectify consecutive years of losses.”

A VIX Securities Board Member Resigns Ahead of the Annual General Meeting

“In a surprising development, Ms. Tran Thi Hong Ha has tendered her resignation as a Board Member of VIX Securities ahead of the upcoming 2025 Annual General Meeting. With her departure, the upcoming assembly will elect two new members to fill the vacant positions, ushering in a new era for the company’s leadership.”