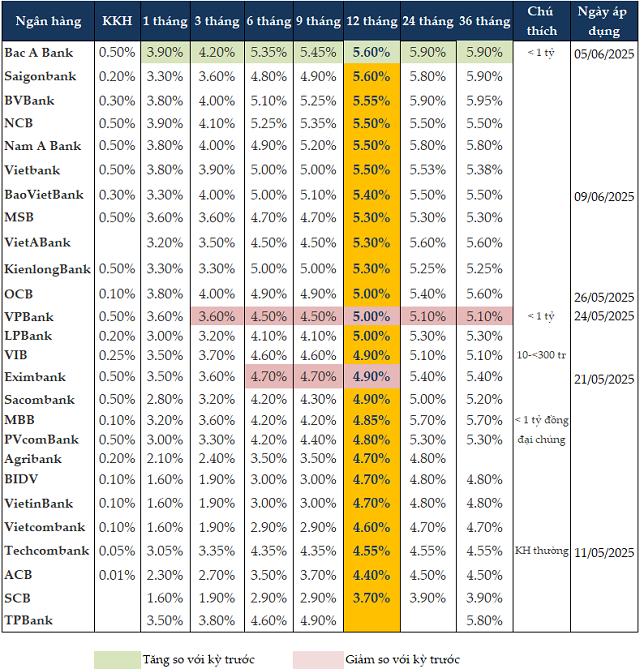

In the rate adjustment of 05/24/2025, VPBank reduced interest rates on savings deposits by 0.2 percentage points. For deposits below VND 1 billion, VPBank offered an interest rate of 3.6%/year for 1-3 months, 4.5%/year for 6-9 months, 5%/year for 12 months, and 5.1%/year for over 12 months.

Eximbank also reduced interest rates on 6-12 month term deposits by 0.2 percentage points from 05/21/2025. The bank offered an interest rate of 4.7%/year for 6-9 months and 4.9%/year for 12 months.

On the other hand, from 06/05/2025, Bac A Bank increased interest rates on all term deposits by 0.1-0.2 percentage points. For deposits below VND 1 billion, Bac A Bank offered an interest rate of 3.9%/year for 1 month, 4.2%/year for 3 months, 5.35%/year for 6 months, and 5.6%/year for 12 months.

As of 06/09/2025, interest rates on savings deposits for 1-3 months ranged from 1.6 to 4.2%/year, 6-9 months from 2.9 to 5.45%/year, and 12 months from 3.7 to 5.6%/year.

For the 12-month term, Bac A Bank and Saigonbank offered the highest interest rate at 5.6%/year, followed by BVBank at 5.55%/year. NCB, Nam A Bank, and Vietbank maintained an interest rate of 5.5%/year.

For the 6-month term, Bac A Bank led with an interest rate of 5.35%/year, followed by NCB at 5.25%/year and BVBank at 5.1%/year.

Meanwhile, for the 3-month term, Bac A Bank offered the highest interest rate at 4.2%/year, followed by NCB at 4.1%/year. BVBank, BaoVietBank, Nam A Bank, and OCB provided an interest rate of 4%/year.

Notably, some banks offered special interest rates for specific conditions. ABBank provided an interest rate of up to 9.65%/year for customers depositing a minimum of VND 1,500 billion at the counter for a 13-month term.

PVcomBank also announced a maximum interest rate of 9%/year for customers with deposits of VND 2,000 billion or more for 12-13 months. HDBank offered a savings interest rate of 7.7%/year for 12 months and 8.1%/year for 13 months for customers with deposits of VND 500 billion or more.

|

Personal savings deposit interest rates at banks as of 06/09/2025

Source: Consolidated

|

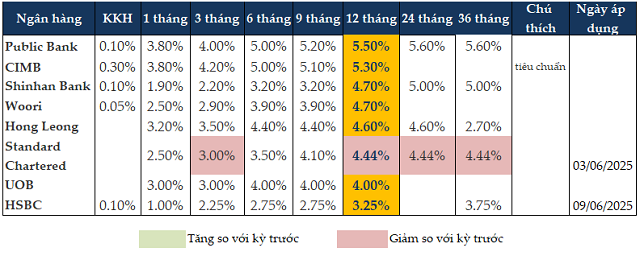

Foreign banks mostly maintained their deposit interest rates, with only Standard Chartered Bank making a slight reduction from 06/03. Among foreign banks, as of 06/09, Public Bank offered the highest 12-month term deposit interest rate at 5.5%/year, and Public Bank and CIMB offered the highest 6-month term deposit interest rate at 5%/year.

|

Personal savings deposit interest rates at foreign banks as of 06/09/2025

Source: Consolidated

|

Interest rates are expected to remain stable until the end of the year.

In a report published on 06/03/2025 by An Binh Securities Company (ABS), low-interest rates were identified as a key driver for credit growth among banks and a motivator for new business investments, positively impacting the economy. The low-interest rate environment during the first five months of the year played a crucial role in reducing borrowing costs for businesses, households, and cooperatives, enabling them to expand their operations.

In a report published on 06/09/205, UOB predicted that the State Bank of Vietnam (SBV) would maintain policy rates, keeping the refinancing rate at 4.5%. If domestic business conditions and the labor market were to deteriorate significantly, UOB anticipated that the SBV might consider lowering the refinancing rate to 4%, matching the low observed during the COVID-19 period. A further reduction to 3.5% could be possible if the foreign exchange market remained stable and the US Federal Reserve cut interest rates. However, the base case scenario still indicated that the SBV would maintain policy rates.

Mr. Pyon Young Hwan, Head of Foreign Exchange and Derivatives Trading at Shinhan Bank Vietnam, forecasted that if the US Federal Reserve cut interest rates in its upcoming meeting, it would provide an opportunity for emerging markets like Vietnam to loosen monetary policies.

A Fed rate cut could help stabilize the USD/VND exchange rate, allowing the SBV to implement monetary policy easing measures more flexibly.

However, Vietnam might need to maintain higher interest rates than the US for a certain period. Higher interest rates are crucial for attracting investment to emerging markets. In the past, when Vietnam’s interest rates were lower than those in the US, the country faced challenges, including a slowdown in FDI attraction and difficulties in maintaining domestic economic stability.

Assuming the Fed cuts interest rates once or thrice by the end of the year, it is likely that Vietnam will maintain its base interest rate. Nevertheless, there may still be pressure from the government to keep interest rates low to stimulate the domestic economy.

Associate Professor Nguyen Huu Huan, Senior Lecturer at the University of Economics Ho Chi Minh City, noted that the increase in interest rates for special customers was observed mainly in a few small-scale banks. This move could be aimed at retaining large depositors and attracting new customers with strong financial capabilities. With the SBV closely monitoring interest rate policies, even a slight increase can be attractive. However, it is important to consider that for small banks, the withdrawal of a large depositor could lead to liquidity issues.

Meanwhile, despite the low interest rates on regular deposits, the amount of money deposited in banks has not decreased. This is because alternative investment channels have not been attractive enough to compete with the relative safety of savings deposits. Although the stock market has shown signs of recovery recently, it still entails risks that deter individual investors. The real estate market has only seen increases in specific segments, and the sentiment of wave riders remains cautious. Other investment channels have also failed to attract large amounts of capital due to concerns about the volatile global and domestic economic context. As a result, many individuals opt to hold cash or save it in the bank as a safe way to preserve their capital.

Mr. Huan predicted that deposit interest rates would likely remain stable until the end of the year. The government’s priority is to maintain macro-economic stability and promote growth, and low-interest rates are seen as necessary to support these goals.

On the other hand, Dr. Nguyen Tri Hieu, an economist, opined that the number of individual customers with assets of hundreds of billions of VND or more is not significant. However, if banks can attract this group of customers, they will have access to a substantial amount of deposits. Particularly, if these funds are deposited for long periods, banks will gain stability in their capital sources, facilitating lending to profitable sectors like real estate.

From now until the end of the year, to boost credit growth, the banking system needs abundant capital mobilization. Currently, deposits are competing fiercely with other investment channels such as securities and gold. In this context, the possibility of an increase in deposit interest rates in the coming time is higher than a decrease. If deposit interest rates rise, lending rates will surely adjust accordingly. Therefore, to achieve the goal of promoting credit, deposit interest rates are likely to continue rising in the second half of this year.

– 09:58 06/10/2025

Latest ACB Bank Interest Rates for June 2025: Which Term Deposit Offers the Best Returns?

As of June 2025, ACB offers a competitive interest rate of 5.1% p.a. on its time deposits, making it one of the most attractive options in the market for savvy savers looking to maximize their returns.