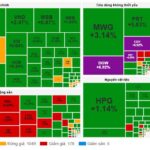

Today’s recovery momentum was quite positive, especially with the reversal witnessed in VIC and VHM. However, the rotation ability was unclear, liquidity was insufficient, and there was a rush to offload positions in the latter half of the afternoon session.

After a significant decline in the previous session, today’s rebound was unremarkable. Of course, there will always be a few outperforming stocks, but the overall likelihood of further adjustments remains higher. This is the time to exercise patience as adjustments are a period of expectation transfer, or at least a clear signal of the confidence of current stockholders.

The total trading value on the two exchanges today was equivalent to yesterday’s (up 0.9%), and even with the increase, it was a decrease (volume down 4%). The adjustment range was not wide enough to attract money that had exited during the distribution phase to return immediately. The technical rebound was merely an opportunity for investors who had not yet sold to exit with minimal losses.

This afternoon, liquidity was weak while stock prices mostly slid intraday. The problem was not only the weakening of the pillars – for example, VIC and VHM also slid – but also the performance of the majority. This confirmed the emergence of selling pressure on a large scale, a fairly unanimous view when taking advantage of rising prices to sell further. If the money flow had been better, prices would not have slipped with such a wide range on numerous stocks.

On the other hand, if we look at the statistics, the highest recovery range of stocks today compared to yesterday’s decline was insignificant and even more inferior to the range of the last few declining sessions. Many stocks are on the right side of the slope, and there is ample room for adjustment. The reversal sessions are not enough to end the trend, and it is highly likely that many specific codes will be trapped.

The market is still in a waiting phase for information, and when enthusiasm is at its peak, even the best money cannot break through. In fact, buying and holding for the long term means buying at any time, even at the peak because if the beautiful scenario occurs, the price will rise further by the end of the year or the next few years. However, if you want to optimize resources and gain a capital advantage, short-term adjustments still provide a good opportunity when the right time is chosen.

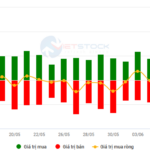

Today, the basis of the futures market was not too disadvantageous for both Long and Short. In fact, in the early session, F1 reflected a rather high expectation that the market would recover. In the first few minutes, VN30 fell to 1392, while the nearest support level was determined to be 1390.xx. Before the VN30 score was available, F1 only accepted a discount of about 3 points, and then it was insignificant. VN30 then rebounded to above 1399.xx and retested this level with a basis discount of less than 2 points. That was a good Long point because if VN30 did not turn down below 1399, it might have fluctuated around this level or risen to 1408.xx, which is the range of expansion. The index then twitched but still gradually rose to 1408 and even exceeded 1411 before falling. This was the best and easiest Long area.

The VN30 segment from 1408.xx to 1415.xx in the early afternoon session was notably supported by VIC and VHM, but there was no consensus from the other pillars. Therefore, these will be the two stocks to watch for signals. Although VN30 rose to 1415, F1 opened the basis, and F1 liquidity in this phase rose very high. That was a signal for Short orders to start coming in. When VN30 reached its highest level of 1414.89, the basis discount was also the widest. The rest was simply a downward adjustment of the pillar height to eat Short. VN30 fell very inertially and fell exactly to 1399.xx.

Although the underlying market recovered quite strongly today, the money flow was still weak, and selling pressure continued to have a clear effect on prices. In the coming sessions, money flow is likely to continue to weaken, paving the way for further adjustments. Intraday rebounds are not opportunities to buy stocks. The strategy is to wait and Short.

VN30 closed at 1404.82. Tomorrow’s nearest resistances are 1408; 1415; 1423; 1430; 1440. Supports are 1400; 1393; 1385; 1378; 1372; 1363.

“Stock Market Blog” is a personal blog and does not represent the views of VnEconomy. The views and opinions expressed are those of the individual investor, and VnEconomy respects the author’s style and perspective. VnEconomy and the author are not responsible for any issues arising from the investment views and opinions posted.

“Markets Rise with Caution: Vietstock Daily Overview for June 10, 2025”

The VN-Index pared its gains and failed to reclaim its March 2025 highs (1,320-1,340 points). Trading volumes remained below the 20-day average, indicating investor caution. The Stochastic Oscillator continued its downward trajectory, providing a sell signal and exiting the overbought territory. Meanwhile, the MACD echoed a similar sentiment, with the gap between the MACD line and the signal line widening, suggesting that the risk of a correction persists.

The Market is Sensitive as the Negotiation Deadline Looms – What Should Investors Do?

With clear and large-scale numerical commitments, the tariffs that Vietnam expects to achieve through negotiations are quite positive. However, the current situation is sensitive as the final round of talks draws near, and investors should consider multiple factors before making decisions.