VN-Index closes at 1,310 points at the end of the June 9 session

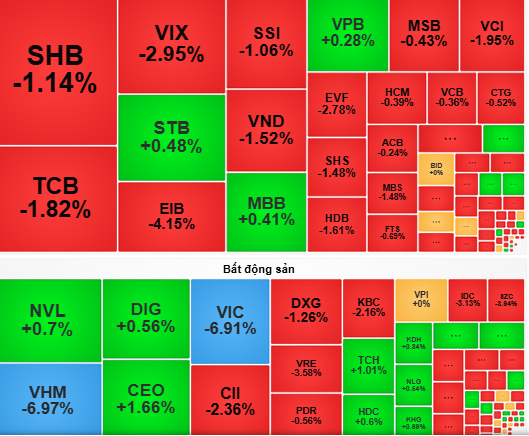

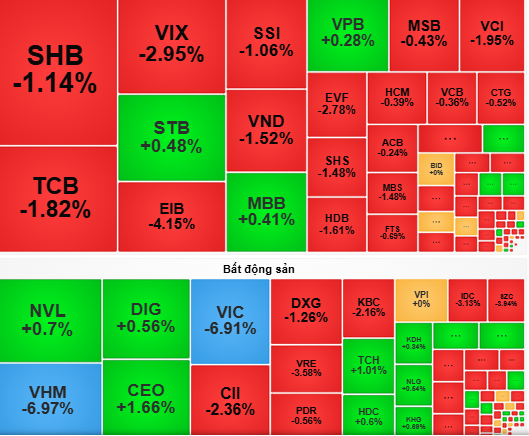

Vietnam’s stock market on June 9 witnessed a stressful trading session. Strong selling pressure from large-cap stocks such as VIC, VHM, GVR, and banks pushed the VN-Index down sharply in the morning session.

Some real estate stocks like NVL, DIG, HDC, and agricultural stocks like DBC, MML attracted cash flow but were not enough to support the market.

In the afternoon session, increased selling pressure caused the VN-Index to fall further, closing at 1,310 points. Notably, VIC and VHM stocks fell to the floor price at the end of the session, contributing up to 11 points to the VN-Index’s total loss of 19 points.

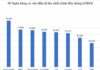

Most industry groups experienced strong profit-taking pressure, with the market’s liquidity reaching more than VND 17,000 billion, a significant decrease compared to the previous sessions.

According to VCBS Securities Company, strong profit-taking pressure, along with the lack of supportive positive information, caused the VN-Index to retreat, likely to find a balance around the 1,300-point level in the June 10 session. Investors can take advantage of the recovery periods to manage risks, take profits on stocks that have risen strongly, and wait for opportunities to reinvest when the market stabilizes.

Dragon Vietnam Securities (VDSC) assessed that liquidity on June 9 decreased sharply. This indicates that the stock supply continues to put pressure, while supportive cash flow is still cautious. The next support region at the 1,290-point level could be the market’s new balance point.

“Investors should slow down, observe supply and demand dynamics, prioritize short-term profit-taking, and maintain a reasonable portfolio ratio. In case of buying new stocks, investors need to be selective in terms of good signals and appropriate timing for trading decisions,” VDSC said.

“Cautious Selling by Individuals and Foreign Institutions, Proprietary Traders Seize the Opportunity to Accumulate Positions”

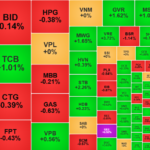

The VN-Index continued its upward trajectory, with a notable net buying figure of 809.2 billion VND, of which 785.1 billion VND was matched orders.

Technical Recovery, But Is the Market Risking a “Bull-Trap”?

The VN-Index continued to be heavily influenced by a few key stocks, with VHM taking center stage today. Investors took advantage of the technical rebound to exit their positions, resulting in a gradual weakening of the market throughout the session. The VN-Index failed to reclaim the 1320-point threshold, while trading volume remained subdued.

Stock Market Blog: Buying Opportunities Not Yet “Ripe”

Today’s recovery momentum was quite positive, especially with the reversal witnessed in VIC and VHM. However, the rotation lacked clarity, liquidity was not robust, and there was a notable sell-off during the latter half of the afternoon session.