Source: SSI Research

|

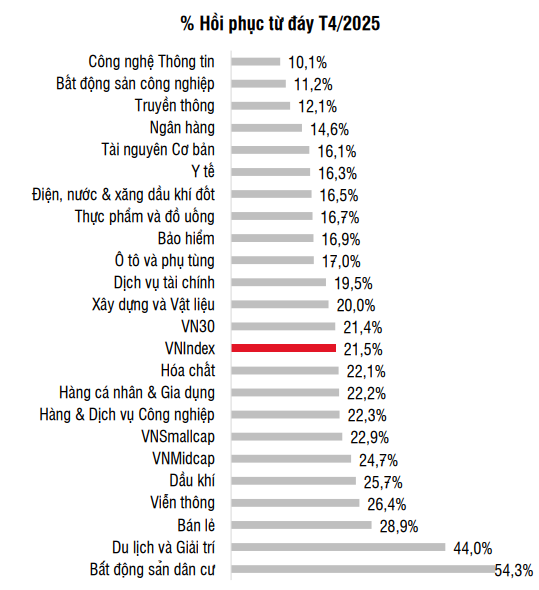

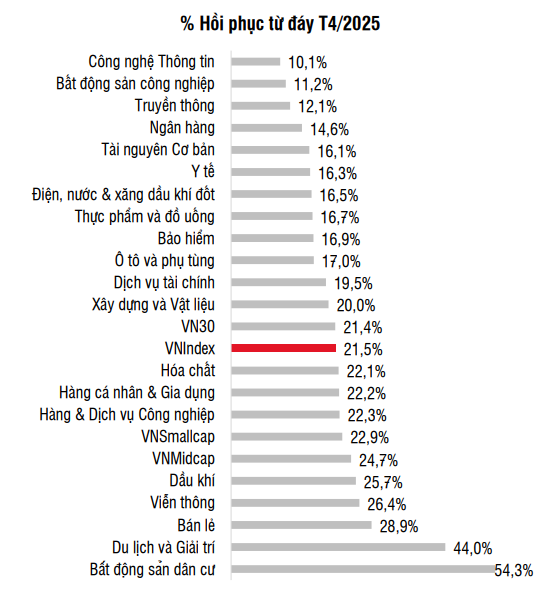

According to SSI Research, the VN-Index has recently staged a swift recovery from the counter-tariff shock, albeit unevenly, with Vingroup stocks taking the lead. Selling pressure may increase after the market rebounded approximately 22% from its early-April lows, especially in the latter part of June ahead of the earnings season and the conclusion of the US’s 90-day tariff deferral period in early July.

As such, capital may flow towards stocks in the following categories: (1) defensive stocks, (2) stocks with robust Q2 earnings growth, and (3) stocks less susceptible to tariff-related news.

From a technical perspective, the VN-Index has established an upward trend across short-term, medium-term, and long-term time frames after successfully breaching the 1,350 threshold, accompanied by positive money flow. Key levels to watch include resistance at 1,360 – 1,390 and support at 1,300 – 1,320.

Positive long-term outlook

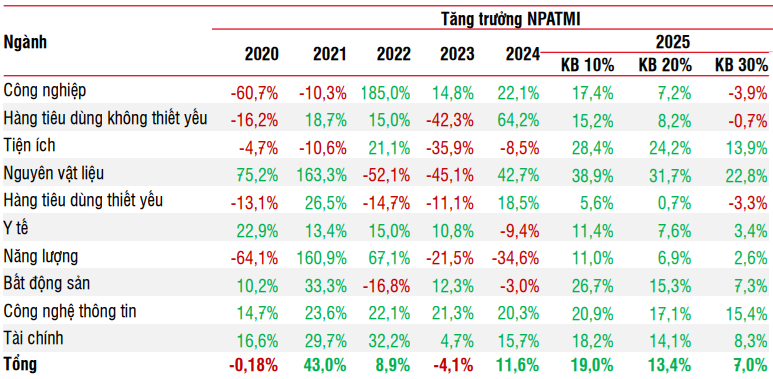

According to SSI Research’s estimates for over 80 stocks within their scope of research, corporate profits are projected to increase by 13.4% year-over-year in the scenario of a 20% US tariff.

Public investment activities and the real estate market recovery are expected to be significant drivers for cyclical sectors such as construction, materials, residential real estate, information technology, and finance. Conversely, consumer stocks may benefit from the gradual recovery of domestic consumption and expanding profit margins, although consumer sentiment could be indirectly impacted by tariff-related factors towards the year-end.

Source: SSI Research

|

Positive developments in market upgrading

The State Bank of Vietnam has issued Circular No. 03/2025/TT-NHNN (TT03), which, along with Circular 18/2025 of the Ministry of Finance, has facilitated the implementation of the Non-Prefunding Solution (NPS) for foreign institutional investors. Notably, TT03 has simplified the procedure for opening indirect investment accounts by eliminating the requirement for consular legalization of foreign-language documents.

After over a month of implementation, the new KRX information technology system has been operating stably, providing a foundation for the potential introduction of new products and services in the Vietnamese stock market.

In June, alongside MSCI’s announcement of its 2025 market classification results, information related to the amendment of Decree 155 and related documents continued to attract investors’ attention ahead of FTSE Russell’s upcoming evaluation. Changes concerning account opening time, payment accounts, foreign ownership limits, the Non-Prefunding Solution, CCP, and other factors will address issues previously raised by FTSE Russell when considering upgrading Vietnam’s market status to emerging market status in October 2025.

– 14:55 10/06/2025

The Hunt for Whale Money: Proprietary Traders Scoop Up $400 Billion on HOSE, Foreigners Turn Net Buyers

The market rebounded from a series of adjustments, with a harmonious flow of capital from proprietary and foreign investors. Trading centered on large-cap stocks such as HPG, FPT, EIB, and VIX, indicating a strong presence of institutional investors and a positive outlook for the market’s future trajectory.

“Markets Rise with Caution: Vietstock Daily Overview for June 10, 2025”

The VN-Index pared its gains and failed to reclaim its March 2025 highs (1,320-1,340 points). Trading volumes remained below the 20-day average, indicating investor caution. The Stochastic Oscillator continued its downward trajectory, providing a sell signal and exiting the overbought territory. Meanwhile, the MACD echoed a similar sentiment, with the gap between the MACD line and the signal line widening, suggesting that the risk of a correction persists.

The Real Estate Stock Market: Mid and Small Caps’ Week of Cash Flow

The small and mid-cap real estate sector was the focal point for fund flows last week (June 2-6). On the flip side, marine transportation stocks witnessed significant outflows.

Market Pulse, June 9: VIC, VHM Wipe Out Over 10 Points from VN-Index

The market closed with notable losses, as the VN-Index fell by 1.45% to 1,310.57, shedding 19.32 points. Likewise, the HNX-Index declined by 0.93%, or 2.12 points, settling at 226.49. The session was dominated by sellers, with 507 declining tickers against 228 advancing ones. Within the VN30 basket, 19 stocks retreated, 7 advanced, and 4 remained unchanged, echoing the broader market’s bearish sentiment.