Insider trading at CTF: A case of share transfer among relatives?

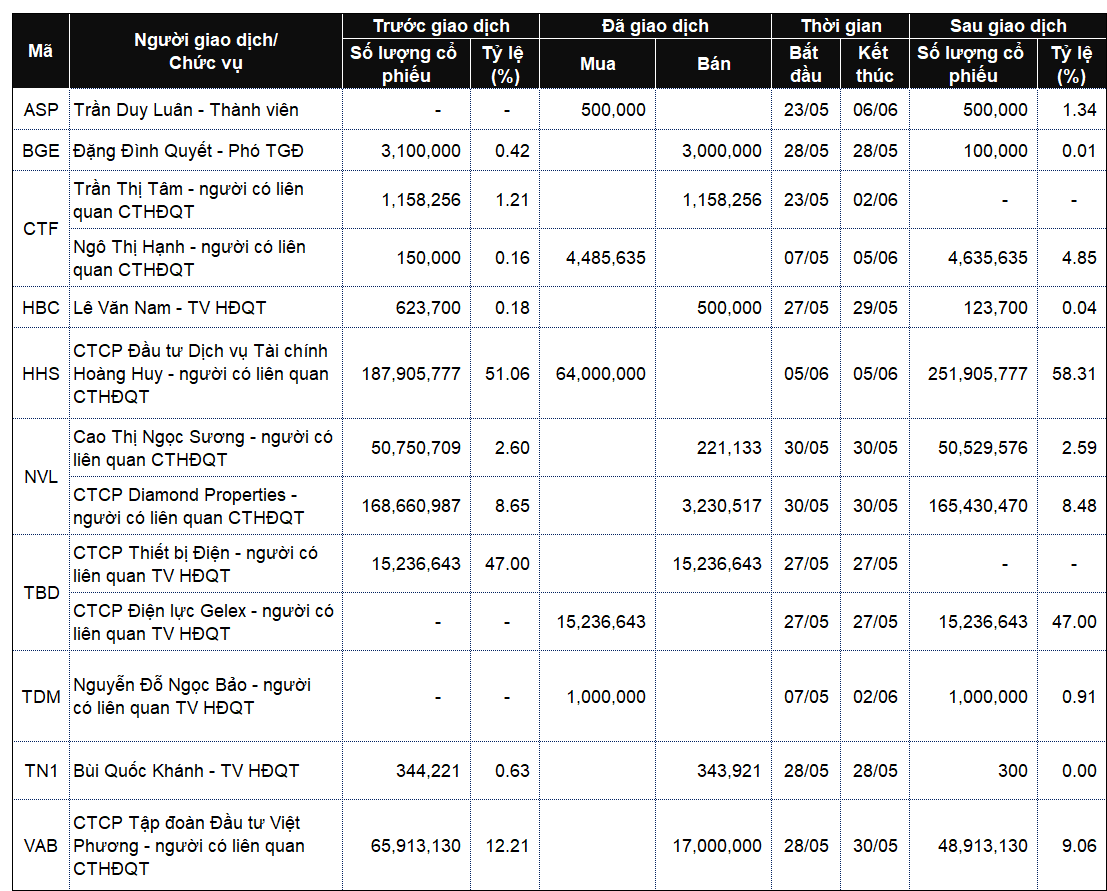

Ms. Tran Thi Tam, sister of Mr. Tran Ngoc Dan, Chairman of the Board of Directors of City Auto Joint Stock Company (HOSE: CTF), sold nearly 1.2 million CTF shares, or 1.21% of the charter capital, from May 23 to June 2, 2025, through matched transactions. The total value of the deal was nearly VND 26 billion.

Meanwhile, from May 7 to June 2, Ms. Ngo Thi Hanh, Mr. Dan’s wife, bought nearly 4.5 million CTF shares out of the registered 6 million shares. The reason for not purchasing the remaining shares was due to insufficient financial arrangements. After the transaction, Ms. Hanh’s ownership increased from 0.16% (150,000 shares) to 4.85% (4.64 million shares).

Similar to Ms. Tam’s transaction, the number of shares bought by Ms. Hanh matched the volume of CTF shares traded through matched transactions during the same period. Thus, it is highly likely that Ms. Hanh purchased shares from Ms. Tam. It is estimated that Ms. Hanh spent more than VND 97 billion on the abovementioned CTF shares.

TCH spends VND 800 billion to acquire 64 million HHS shares

Hoang Huy Financial Services Joint Stock Company (HOSE: TCH) plans to make a full payment for the purchase of 64 million privately placed shares from Hoang Huy Investment Services Joint Stock Company (HOSE: HHS) in June 2025. With a selling price of VND 12,500 per share, TCH will need to spend VND 800 billion for this transaction. As a result, TCH‘s ownership in HHS will increase from 51.06% to 58.31%, equivalent to nearly 252 million shares.

The sole investor in this private placement of 64 million HHS shares was TCH, as approved by the HHS General Meeting of Shareholders in April 2025.

HHS intends to utilize the proceeds from this transaction, totaling over VND 1,300 billion, to purchase shares of HHS Capital Joint Stock Company from existing shareholders. Specifically, HHS plans to acquire nearly 50.1 million shares of HHS Capital (equivalent to 99.99% of capital), with nearly VND 503 billion sourced from HHS‘s own capital and the remaining VND 800 billion from the aforementioned private placement.

The primary objective of this acquisition is for HHS to directly and indirectly hold 51.03% of the capital of CRV Real Estate Group Joint Stock Company, which is currently a subsidiary of TCH and an associate of HHS.

TCH spends VND 800 billion to buy 64 million HHS shares

Wife of Mr. Bui Thanh Nhon and related entities complete the sale of over 3.4 million NVL shares

Ms. Cao Thi Ngoc Suong, wife of Mr. Bui Thanh Nhon, Chairman of the Board of Directors of No Va Real Estate Investment Corporation (HOSE: NVL), and Diamond Properties Joint Stock Company, a company managed by Mr. Nhon, completed the sale of NVL shares as previously registered. On May 30, through matched transactions, Ms. Suong sold 221,133 shares, and Diamond Properties sold over 3.2 million shares. After the transaction, Ms. Suong’s ownership in the company decreased from 2.602% to 2.591% (equivalent to over 50.5 million shares), while Diamond Properties’ ownership decreased from 8.649% to 8.483% (equivalent to over 165 million shares).

Based on the closing price of VND 14,150 per share on May 30, the transaction value for Ms. Suong and Diamond Properties was estimated at over VND 3 billion and nearly VND 46 billion, respectively.

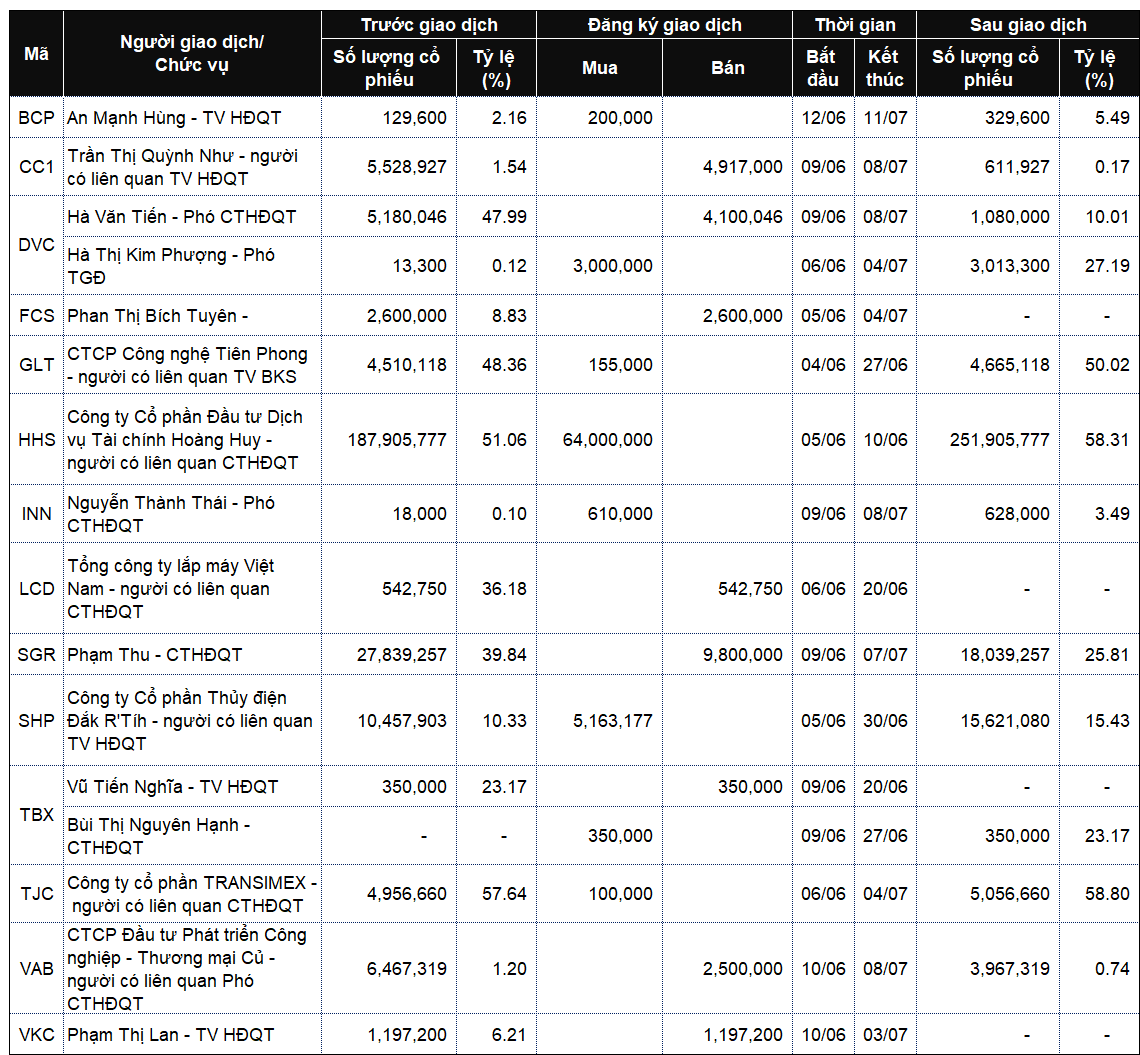

CCI related to VietABank’s Vice Chairman plans to divest

Cu Chi Industrial and Commercial Development Investment Joint Stock Company (HOSE: CCI) has registered to sell 2.5 million shares of Vietnam Asia Commercial Joint Stock Bank (VietABank, UPCoM: VAB) from June 10 to July 8 to raise capital for business activities. CCI currently holds nearly 6.5 million VAB shares, equivalent to 1.2% of the charter capital. If the sale is successful, CCI‘s ownership in VietABank will decrease to 0.01%, equivalent to less than 4 million shares.

At the closing price of VND 13,600 per share on June 6, CCI is expected to collect approximately VND 34 billion from this divestment. It is worth noting that Mr. Phan Van Toi, Chairman of the Board of Directors of CCI, concurrently serves as Vice Chairman of VietABank’s Board of Directors, but he does not hold any VAB shares.

Previously, from May 28 to May 30, Viet Phuong Investment Group, a major shareholder of VietABank, sold 17 million VAB shares through matched transactions, earning approximately VND 238 billion (equivalent to VND 14,000 per share). Unlike CCI, Viet Phuong Group stated that the reason for the divestment was to comply with the regulation that limits the ownership ratio of an organization in a credit institution to no more than 10% of the charter capital, as stipulated in the Law on Credit Institutions.

Large-scale internal “hand-over-hand” transactions of DVC shares?

Mr. Ha Van Tien, Vice Chairman of the Board of Directors and General Director of Haiphong Seaport Trading and Services Joint Stock Company (UPCoM: DVC), has registered to sell more than 4.1 million shares out of his holding of 5.18 million DVC shares, with the expected transaction period being from June 9 to July 8. Following this sale, Mr. Tien’s ownership will decrease from 47.99% to 10%, equivalent to 1.08 million shares.

On the opposite side, Ms. Ha Thi Kim Phuong, Deputy General Director of DVC, registered to buy 3 million DVC shares from June 6 to July 4. Prior to this transaction, Ms. Phuong held a negligible amount of shares (0.12%), and if the purchase is completed, her ownership will increase to nearly 28%.

Ms. Phuong is the daughter of Mr. Ha Van Tien and the sister of Ms. Ha Thi Kim Cuc, who holds multiple positions at DVC, including Administration Manager, Company Secretary, and Authorized Information Disclosure Official. Additionally, Ms. Cuc is the wife of Mr. Nguyen Tien Quan, another Deputy General Director of DVC.

|

List of company leaders and relatives trading from May 2 to May 6, 2025

Source: VietstockFinance

|

|

List of company leaders and relatives registering for trading from May 2 to May 6, 2025

Source: VietstockFinance

|

– 14:00 09/06/2025

Market Pulse, June 9: VIC, VHM Wipe Out Over 10 Points from VN-Index

The market closed with notable losses, as the VN-Index fell by 1.45% to 1,310.57, shedding 19.32 points. Likewise, the HNX-Index declined by 0.93%, or 2.12 points, settling at 226.49. The session was dominated by sellers, with 507 declining tickers against 228 advancing ones. Within the VN30 basket, 19 stocks retreated, 7 advanced, and 4 remained unchanged, echoing the broader market’s bearish sentiment.

The Cautious Cash Flow: Liquidity at a 21-Day Low, Foreigners Sell Over VND 500 Billion

The market witnessed a significant downturn during Monday’s morning session, with a sea of red and a sudden dip in liquidity. The VN-Index took a severe hit, retreating to just above the 1320-point mark, largely due to the substantial decline of two heavyweight stocks, VIC and VHM.

Market Beat: A Pulse Check on Investor Sentiment

The market witnessed a lackluster performance in the morning session, with no significant recovery efforts. The subdued participation of cash flow, coupled with persistent pressure from the pillar group, painted a gloomy picture. VN-Index hovered at 1,323.17 points, reflecting a 0.51% decline, while HNX-Index mirrored this sentiment with a 0.52% drop, settling at 227.42. The market breadth further emphasized the bearish trend, with 386 declining stocks outweighing the 222 advancing ones.