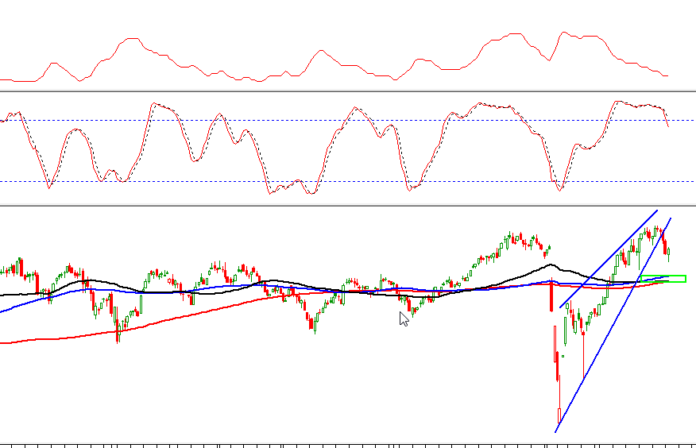

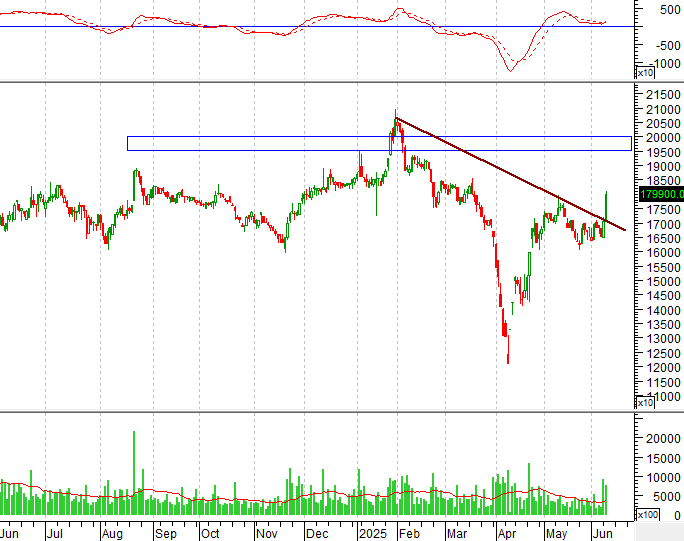

Technical Signals for VN-Index

In the morning trading session of June 10, 2025, the VN-Index witnessed a strong upward candle, signaling a potential recovery. While trading volume remained low, it slightly increased compared to the previous day’s morning session, indicating investors’ cautious optimism.

Currently, the index is hovering near the lower boundary of a Rising Wedge pattern and gradually filling the gap from the sharp decline on February 4, 2025. If the index continues to correct, it may retest the SMA200 resistance level (1270-1280 zone).

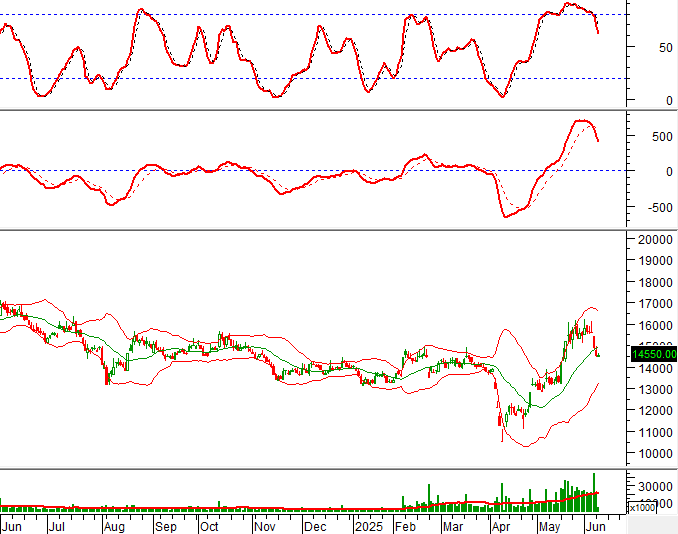

Technical Signals for HNX-Index

On June 10, 2025, the HNX-Index posted a slight gain, while trading volume declined during the morning session, reflecting investors’ cautious sentiment.

Additionally, the ADX (Average Directional Index) remained below 25 and continued to decrease during the session, suggesting that trading activity on the HNX-Index has yet to improve significantly.

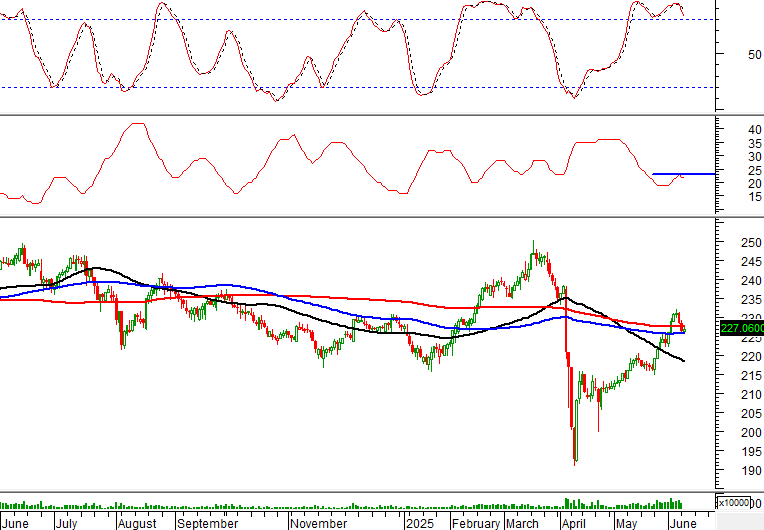

CII – Ho Chi Minh City Infrastructure Investment Joint Stock Company

On the morning of June 10, 2025, CII’s stock price rose slightly, forming a Doji-like candle after three consecutive sessions of sharp declines. The significant drop in volume indicates investors’ cautious attitude. However, the gap between the MACD line and the signal line has not shown signs of narrowing after the sell signal, and if the indicator continues to widen, the short-term outlook remains unfavorable.

The previous high when the price broke the long-term downward trend line (corresponding to the 13,800-14,000 zone) will act as a good support level for the stock in the near term.

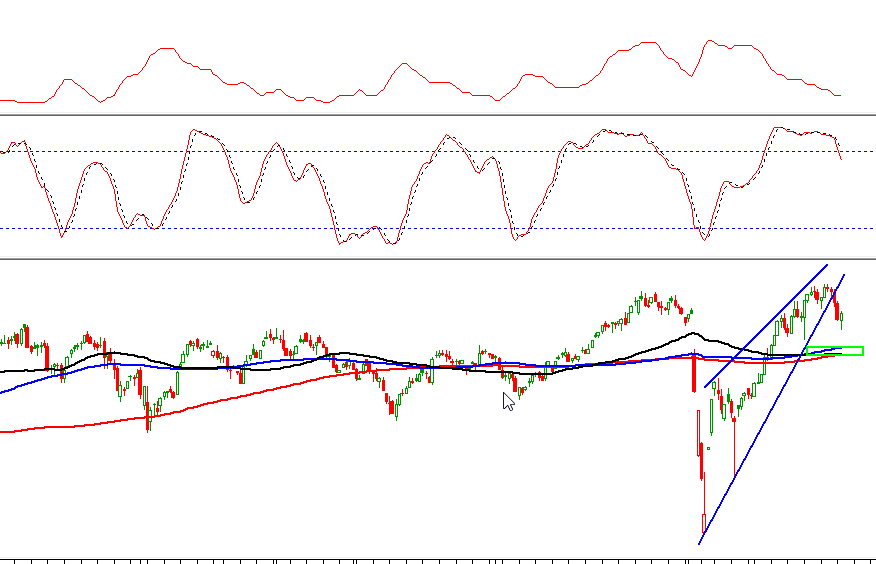

FRT – FPT Digital Retail Joint Stock Company

In the morning trading session of June 10, 2025, FRT’s stock price surged, forming a White Marubozu candle, accompanied by a breakthrough in volume, surpassing the 20-session average. This indicates increased trading activity and stronger buying pressure.

Additionally, the MACD line has crossed above the signal line, generating a buy signal and suggesting a potential short-term recovery. The price target may be the previous high from January 2025 (195,000-200,000 zone).

Vietstock Consulting and Technical Analysis Department

– 12:38, June 10, 2025

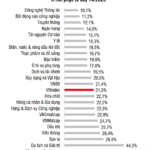

Stock Sell Pressure Rises After Strong Recovery: Which Stocks to Pick for June?

“According to the strategic report by SSI Research, there could be increased selling pressure after the market’s strong recovery. The differentiation may continue in June, with cash flow potentially favoring defensive stocks, equities with strong Q2 earnings growth, and those less impacted by tariff-related news.”

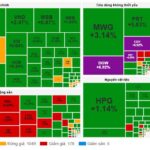

The Market Beat: Vingroup Stocks Turn the Tide, Keeping VN-Index in the Green.

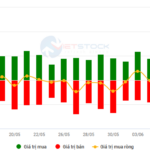

The market psychology couldn’t sustain the mid-session confidence. As today’s session drew to a close, the divergence intensified. The market breadth at the end of the session showed nearly 380 gainers compared to 320 losers.

The Hunt for Whale Money: Proprietary Traders Scoop Up $400 Billion on HOSE, Foreigners Turn Net Buyers

The market rebounded from a series of adjustments, with a harmonious flow of capital from proprietary and foreign investors. Trading centered on large-cap stocks such as HPG, FPT, EIB, and VIX, indicating a strong presence of institutional investors and a positive outlook for the market’s future trajectory.

“Markets Rise with Caution: Vietstock Daily Overview for June 10, 2025”

The VN-Index pared its gains and failed to reclaim its March 2025 highs (1,320-1,340 points). Trading volumes remained below the 20-day average, indicating investor caution. The Stochastic Oscillator continued its downward trajectory, providing a sell signal and exiting the overbought territory. Meanwhile, the MACD echoed a similar sentiment, with the gap between the MACD line and the signal line widening, suggesting that the risk of a correction persists.

The Real Estate Stock Market: Mid and Small Caps’ Week of Cash Flow

The small and mid-cap real estate sector was the focal point for fund flows last week (June 2-6). On the flip side, marine transportation stocks witnessed significant outflows.