The VN-Index continued to be heavily influenced by a few key stocks, with VHM taking center stage today. As investors took advantage of the technical rebound to exit their positions, the market witnessed a gradual decline throughout the session, with the VN-Index failing to reclaim the 1320-point level while trading volume remained low.

The index peaked at 1,323.61 points at 1:40 pm local time, a gain of over 13 points from the reference point. However, the rest of the session saw a steady decline, with the index even dipping close to the reference point. VHM attempted to provide support, especially towards the closing, helping the VN-Index gain 5.66 points (+0.43%).

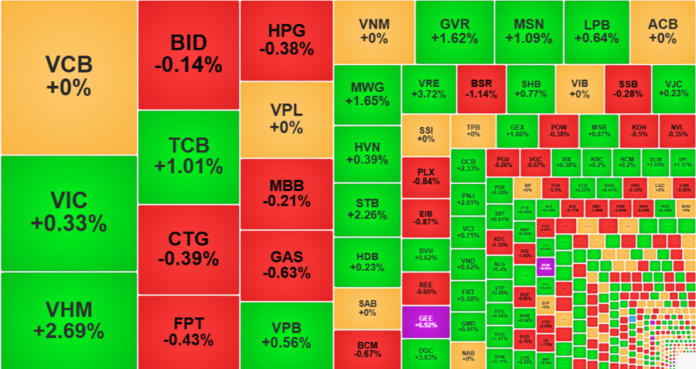

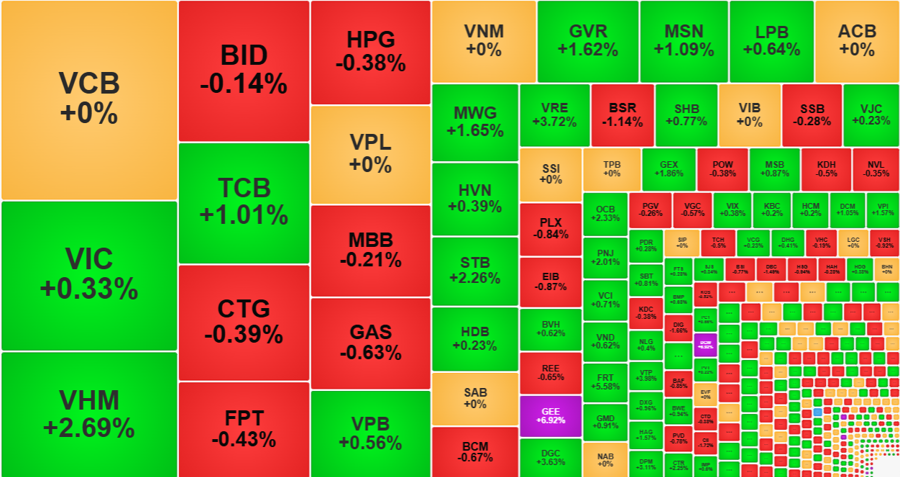

VIC and VHM were mostly weak during the early part of the session, but they gained momentum in the afternoon. VIC rose by up to 2.88% at one point, while VHM increased by 3.11%, with both stocks reaching their highs at a similar time as the VN-Index. The breadth at the peak was also favorable, with HoSE recording 204 gainers and 84 losers. This reflected a broader market enthusiasm. However, this strength was short-lived as both VIC and VHM faced significant selling pressure.

VIC was pressured for most of the remaining session and closed with a modest gain of 0.33%. VHM fared slightly better, with a strong push in the last five minutes, closing with a 2.69% increase, contributing nearly 1.9 points to the VN-Index’s gain. VRE saw an even more dramatic turnaround, as its price briefly dipped to 24,950 dong, a 2.35% drop from the reference point, but was pushed back up to close with a 3.72% gain. Among the other blue chips, only TCB’s 1.01% gain was notable.

The VN30-Index closed with a 0.59% gain, with 14 gainers and 9 losers. Despite the positive breadth, only VRE closed at its highest price. Eighteen stocks in this basket faced selling pressure, with their prices retreating by more than 1% from their highs. Notably, HPG fell by 2.42% to close with a 0.38% loss, LPB retreated by 2.33% to gain 0.64%, MWG slipped by 2.23% to rise by 1.65%, and STB dropped by 2.5% but still managed to gain 2.26%. This price action indicated an increase in selling pressure in the latter half of today’s session. While not all stocks faced such intense pressure, the sellers’ ability to curb price advances was evident.

This pattern of price action was prevalent across the HoSE today. While the breadth remained positive at the end of the session, with 155 gainers and 134 losers (compared to 204 gainers and 84 losers at the peak), nearly half of the stocks on this exchange (49.5%) witnessed price retreats of more than 1% from their highs, mostly peaking simultaneously with the index. Hence, the VN-Index’s decline wasn’t solely due to the impact of VIC or VHM but reflected a broader market sentiment.

Among the 155 stocks that ended the session in positive territory on the HoSE, 79 posted gains of over 1%. The best-performing stocks with the highest trading volume mostly faced significant selling pressure. Excluding VHM, VRE, which saw aggressive price manipulation at the end, and DGW, which hit the daily limit-up, the remaining stocks with high trading volume experienced a gradual decline in prices. The positive aspect was that sellers couldn’t push prices down to reference levels or cause a reversal. This group of stocks also witnessed better buying support.

Today’s price gains failed to recover yesterday’s losses, and in most cases, they didn’t even reach the halfway mark. Hence, the session’s dynamics were primarily driven by technical factors. Naturally, some stocks stood out with their robust performance, including CCC, DGW, GEE, FRT, PET, SCS, and VTP, but they aren’t representative of the broader market. Moreover, the allocation of funds to these stocks was minimal compared to the overall market.

Foreign investors turned net buyers in the afternoon session, recording strong net buying of VND 329.9 billion after net selling of VND 18 billion in the morning. EIB, VIX, and GEX were the notable stocks bought in the afternoon session. EIB saw net buying of VND 43.9 billion in the morning session, which increased to VND 132.6 billion by the market close. VIX’s net buying increased from VND 54.8 billion to VND 101.9 billion, while GEX’s net buying rose from VND 47.4 billion to VND 87 billion. Additionally, DGC (+VND 53.5 billion), DXG (+VND 42.4 billion), VRE (+VND 40.6 billion), DPM (+VND 36.1 billion), VCI (+VND 36.1 billion), VPB (+VND 34.9 billion), and STB (+VND 32.1 billion) were also among the most bought stocks in the afternoon. On the selling side, CTG (-VND 61.3 billion), FPT (-VND 80.6 billion), VIC (-VND 58.2 billion), VND (-VND 41.2 billion), HPG (-VND 37.9 billion), MWG (-VND 36.6 billion), and HAH (-VND 35.8 billion) were the notable stocks.

“Technical Analysis for June 10: A Cautious Stance Persists”

The VN-Index and HNX-Index both witnessed a slight uptick, however, the trading volume remained low, indicating a cautious sentiment among investors.

Stock Sell Pressure Rises After Strong Recovery: Which Stocks to Pick for June?

“According to the strategic report by SSI Research, there could be increased selling pressure after the market’s strong recovery. The differentiation may continue in June, with cash flow potentially favoring defensive stocks, equities with strong Q2 earnings growth, and those less impacted by tariff-related news.”

The Hunt for Whale Money: Proprietary Traders Scoop Up $400 Billion on HOSE, Foreigners Turn Net Buyers

The market rebounded from a series of adjustments, with a harmonious flow of capital from proprietary and foreign investors. Trading centered on large-cap stocks such as HPG, FPT, EIB, and VIX, indicating a strong presence of institutional investors and a positive outlook for the market’s future trajectory.