On June 9, Vietnam Report released the Top 10 Commercial Banks Reputation Ranking for 2025. According to the report publisher, the ranking is constructed based on scientific and objective principles.

The banks are evaluated and ranked based on three main criteria: Financial capacity demonstrated in the latest financial reports; Media reputation evaluated through the Media Coding method – coding articles about the banks on influential media channels; and Survey results from the research objects and related parties, updated as of May 2025.

The Top 10 Commercial Banks Reputation Ranking for 2025 shows stability in the leading group, with the first five positions remaining unchanged from the previous year: Vietcombank, Techcombank, VietinBank, BIDV, and MB.

Some notable changes occurred in the middle and lower groups. Agribank moved up to the sixth position, swapping places with ACB. Similarly, HDBank advanced to the eighth position, while VPBank dropped to ninth. Notably, Sacombank re-entered the ranking this year at the tenth position, replacing TPBank, which fell out of the Top 10.

The ranking of the Top 10 Private Joint-Stock Commercial Banks also showed stability at the top, with Techcombank and ACB retaining their first and second positions, respectively. HDBank moved up to third place, while VPBank dropped to fourth. Sacombank improved to fifth place, and SHB and LPBank took the sixth and seventh positions, respectively, both improving from the previous year.

On the other hand, TPBank and VIB dropped in the rankings, taking the eighth and ninth positions, respectively. SeABank maintained its tenth position for the second consecutive year. These changes reflect adjustments based on various factors such as operating results, media presence, and market evaluations.

Banking Industry Forecast for 2024

In addition to the rankings, Vietnam Report also released a report on the banking industry’s performance in 2024 and its outlook for 2025.

In 2024, the Vietnamese banking industry maintained stable business results, despite the market still feeling the impact of the bond and real estate crisis from previous years. Credit growth reached 15.08%, equivalent to over VND 2.1 quadrillion, surpassing the set target. Interest rates remained low thanks to the proactive management of the State Bank, contributing to inflation control (3.63%) and economic growth (7.09%).

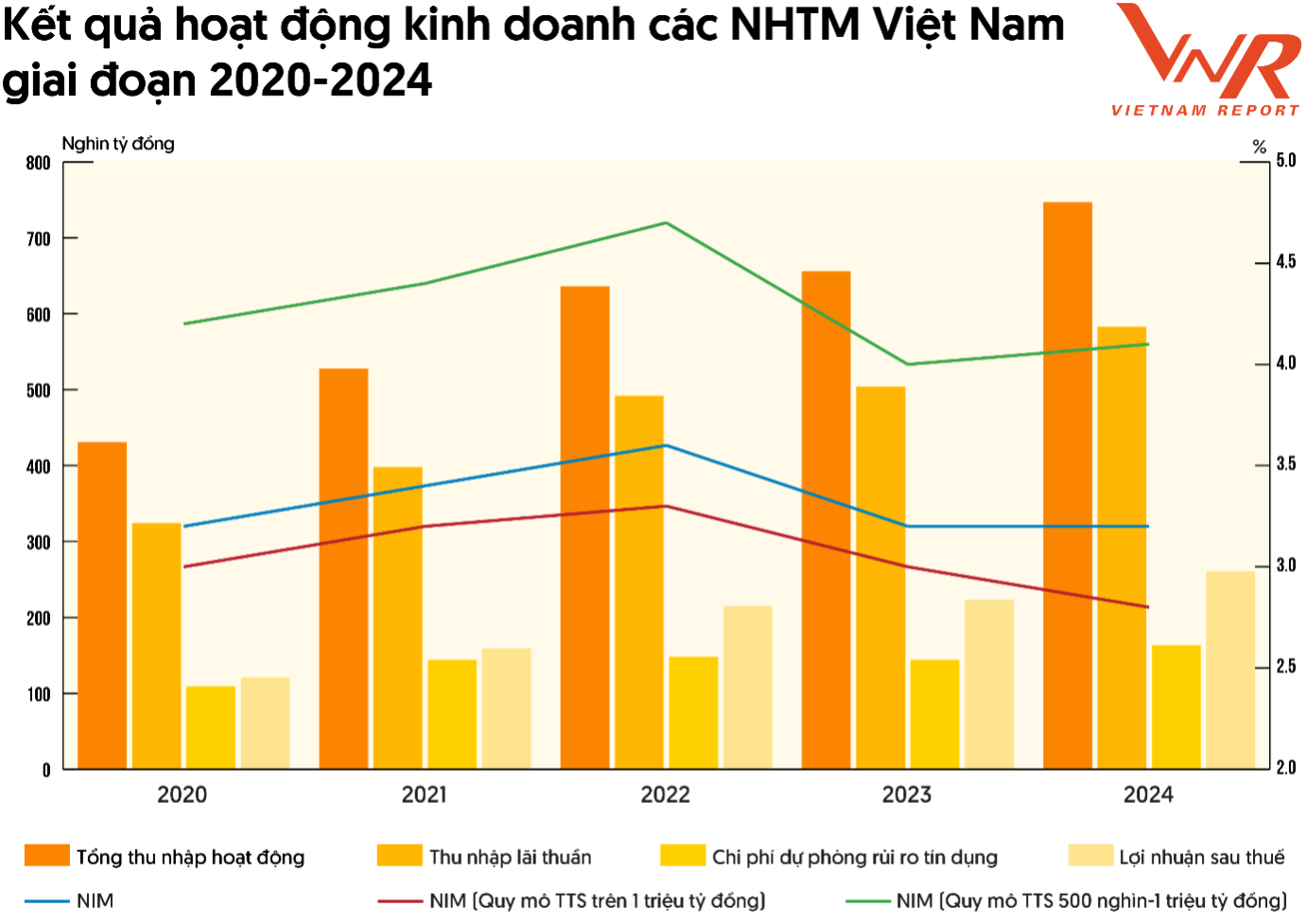

In terms of financial results, the total operating income of commercial banks reached VND 747 trillion, an increase of 13.9% compared to the previous year, and maintained a compound annual growth rate (CAGR) of 14.6% during 2020-2024. Income from interest accounted for a large proportion (75-78%) and continued to increase, indicating a high dependence on credit activities. This underscores the need for enhanced control over credit risks and improved asset quality.

The total after-tax profit of the industry exceeded VND 260 trillion, an impressive growth of 16.8% compared to the meager 4% growth in 2023. Notably, the five largest banks accounted for approximately 50% of the system’s profits, reflecting a clear differentiation in scale and efficiency between bank groups. Notably, the group of banks with total assets below VND 300 trillion recorded an 11.5% decline in profit growth.

Entering 2025, the banking industry is expected to continue its growth trajectory, supported by a stable macroeconomic foundation and policy directions focused on promoting development. Five key opportunities have been identified: digital financial product development, digital transformation investment, positive economic prospects, legal framework adjustments, and reforms in the state management apparatus. These factors will drive the industry’s progress in the coming period.

The Big Three’s Banking Strategies: Unveiling the Intriguing

In 2025, while many private banks are pursuing aggressive credit growth strategies to capitalize on the economic recovery cycle, state-owned banks such as Vietcombank, VietinBank, and BIDV are taking a more cautious approach. Instead of focusing on expansion, they are prioritizing credit portfolio restructuring, risk management, and optimizing cash flow.

“FiinRatings Assigns AA- Rating to TCBS with a Stable Outlook”

FiinRatings has recently assigned Techcom Securities (TCBS) an AA- (Very Strong) long-term issuer credit rating. This esteemed rating showcases TCBS’s strong market position and financial stability.

“Dollar and Yuan Dance to Different Tunes: A Tale of Contrasting Fortunes.”

“As of 8:30 a.m. on June 2nd, the USD exchange rate at Vietcombank and BIDV was set at 23,850-23,210 VND/USD for buying and selling, respectively. This marks an increase of 20 VND in both buying and selling rates compared to the morning of May 30th, indicating a slight strengthening of the USD against the VND in the interbank market.”