In this latest assessment, Vietcap lowers its forecast for electricity consumption growth in 2025 to 5.5% from 10.0% in its previous estimate, reflecting weaker-than-expected demand growth of 3.7% in the first four months of 2025, mainly due to cooler weather compared to the sharp 12.4% increase in the same period in 2024, according to EVN. The slowdown in demand comes despite a 6.9% rise in Q1 2025 GDP, with the industry and construction sector expanding by 7.4%.

Vietcap has also lowered its forecast for average electricity consumption in the 2025–30 period by 7%, reflecting expected demand growth of 5.5%/7.5%/9.0% for 2025/26/27 (compared to 10.0% in the previous estimate).

Total installed capacity in the country is projected to increase by 5.3% to 86,772 MW, mainly driven by additional hydropower from the Hoa Binh expansion, coal-fired power from the Vung Ang 2 plant, gas & LNG-fired power (Nhon Trach 3&4), and expected renewable energy capacity under the DPPA plan and new pricing mechanisms for renewables.

Regarding weather conditions, the International Research Institute for Climate and Society (IRICS) forecasts neutral conditions for 2025, with a 60% chance of neutral conditions and a 28% chance of La Nina in the second half of the year as per its May forecast.

Vietnam’s National Center for Hydro-Meteorological Forecasting predicts that from July to September 2025, rainfall in the northern and north-central regions is likely to be higher than the multi-year average, while other areas are expected to receive average rainfall. From October to December 2025, rainfall across the country is forecast to be generally in line with the multi-year average.

Vietcap maintains its expectation of a 5%/10% price hike in 2025/2026. These increases are necessary to help EVN gradually eliminate accumulated losses incurred during 2022-2023, cover higher input costs (gas +16%/+4% in 2025/2026), and fund capital expenditures.

Vietcap maintains its gas price forecast for power plants in 2025 at 11.3 USD/MMBTU, a 16% increase year-over-year, due to higher LNG prices, but expects gas prices to remain in the range of 11-12 USD/MMBTU during 2026–29, supporting demand growth from power plants as EVN is likely to increase retail prices. Meanwhile, it forecasts a 2% decrease in blended coal prices in 2025 followed by stable prices year-over-year in 2026.

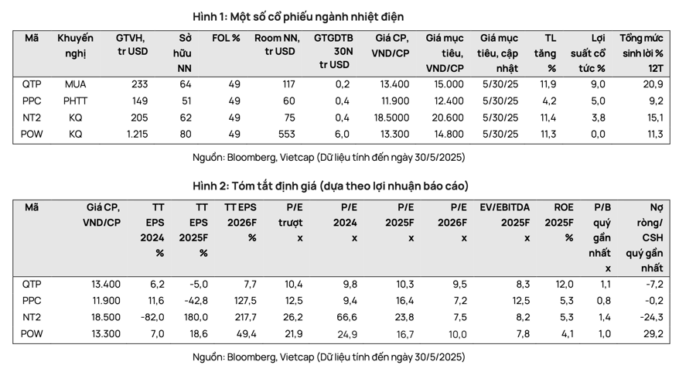

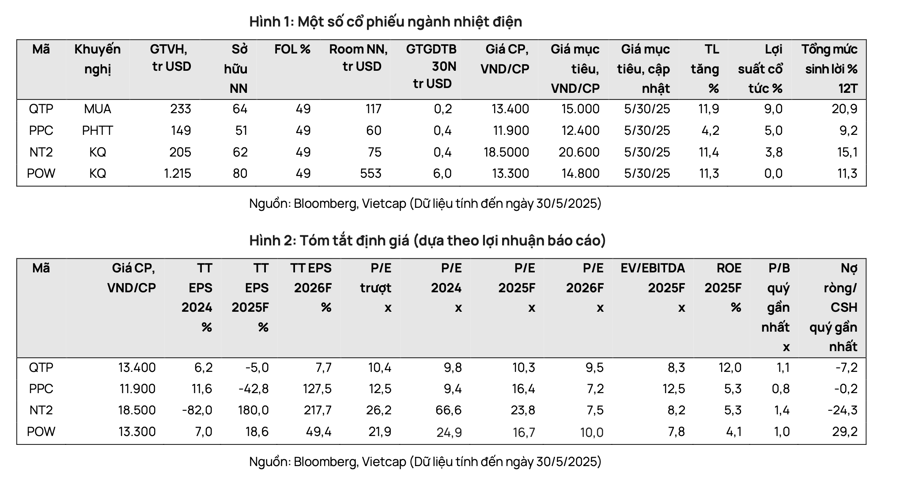

In terms of stock outlook, Vietcap raises its target price for POW by 14.7% to VND14,800 per share and upgrades its recommendation from market perform to outperform.

The firm lowers its target price for NT2 by 6.4% to VND20,600 per share and maintains an outperform recommendation, mainly due to a 13% decrease in forecasted total reported net profit after minority interest for the 2025-2029 period.

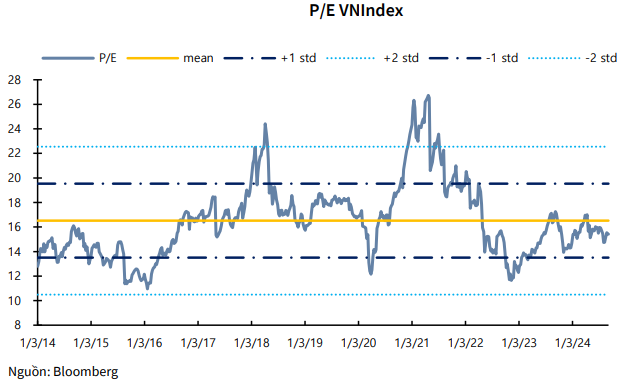

Vietcap lowers its target price for QTP by 6% to VND15,000 per share but maintains a buy recommendation. The lower target price reflects a 13.0% adjustment downward in the forecasted total reported net profit after minority interest for the 2025-2029 period. QTP’s valuation appears attractive with a projected P/E of 9.5x for 2026, which is 51% lower than the five-year median of regional peers, and a projected high dividend yield of 9% supported by strong estimated operating cash flow of approximately VND1,400 billion per year.

At the same time, Vietcap lowers its target price for PPC by 5% to VND12,400 per share and downgrades its recommendation from buy to market perform. The lower target price reflects a 10% discount for PPC’s standalone power business and a 6% downward adjustment in QTP’s valuation due to a 13% decrease in the forecasted total reported net profit after minority interest for the 2025–2029 period.

PPC’s valuation appears attractive with projected P/E ratios of 16.4x and 7.2x for 2025 and 2026, respectively, which are in line with and 54% lower than the five-year median of regional peers chosen by Vietcap. However, the firm maintains a cautious view on the stock due to the lack of detailed information to reflect the potential transition to LNG-fired power.

“Coal-fired Power Plants Lead the Way: Over 127 Billion kWh of Electricity Generated”

In the first five months of 2025, the total electricity production and import of the system reached 127.6 billion kWh. Notably, coal-fired power continued to dominate with an output of 72.4 billion kWh, accounting for 56.8% of the total.

Streamlining Retail Electricity Tariffs: A New Structure with a Peak Rate of Nearly VND 4,000 per kWh

“Vietnam’s Deputy Prime Minister, Bui Thanh Son, has recently signed Decision No. 14/2025/QD-TTg, issued on May 29, 2025, which introduces a new framework for electricity retail price structures. This pivotal decision is set to bring about transformative changes to the country’s energy landscape, impacting both businesses and citizens alike.”