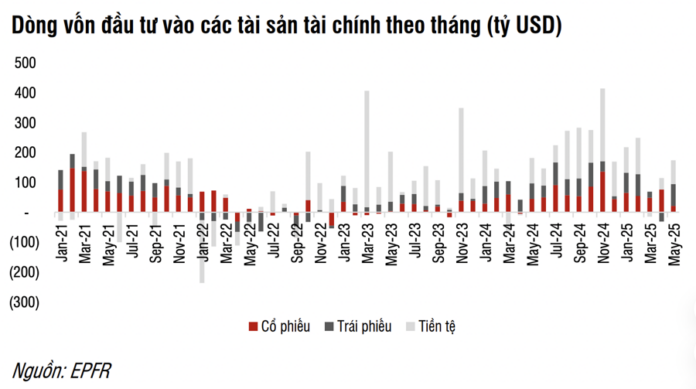

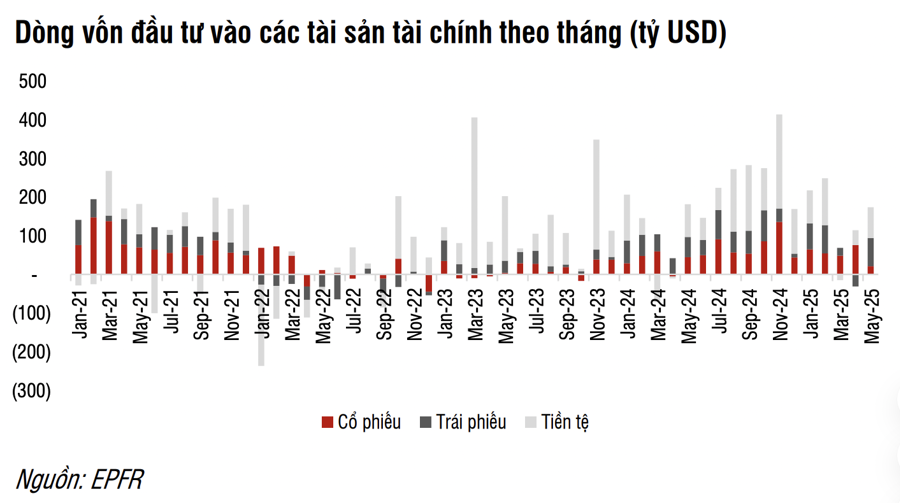

Global equity fund flows were volatile in May, swinging from positive in the first two weeks, to outflows in the third week, and back to inflows in the final week, according to SSI Research. This volatility was driven by news related to President Trump’s tariff policies.

For the month, net inflows declined 72% from the previous month to $21.2 billion.

On the other hand, bond funds saw strong inflows again after outflows in the previous month. Inflows for the month totaled $72.9 billion, mainly in developed markets (+$64.9 billion), bringing year-to-date bond fund inflows to $201.8 billion. Bond funds in emerging markets also saw positive inflows of $8 billion. Bond yields in most markets rose as investors grew cautious about unpredictable tariff policies and a weakening economic outlook.

Money market funds continued to attract strong inflows, with net inflows of $79.7 billion in May, up 107.5% from the previous month. This brought year-to-date inflows to $310.7 billion.

The temporary easing of trade tensions helped alleviate recession concerns and supported a market sentiment recovery. However, as tensions gradually escalated towards the end of the month, inflation remained high, and tariff policies remained unpredictable. As a result, asset and investment diversification remained essential.

Developed market equity funds saw continued inflows in May. ETF and active funds recorded net inflows of $28.1 billion, with the US market recording inflows despite a significant decline compared to previous months (+$4.1 billion).

Despite the technology sector’s outperformance, uncertain policies, Moody’s credit rating downgrade, and weak economic data raised concerns about the durability and growth of the US economy. The Atlanta Fed’s GDPNow tool, as of June 5, indicated a potential US GDP growth of 3.8% for Q2 2025.

Emerging market equity funds experienced outflows of $6.9 billion, although the final week of May saw positive inflows of $2.1 billion. Excluding China, inflows for the month totaled $1.9 billion. This change in sentiment mainly came from institutional investors, who sold $5.2 billion, reversing the capital inflow trend of the previous two months. Meanwhile, retail investors continued the capital withdrawal trend from June 2024, with outflows of $1.7 billion. Dividend funds sold off $499 million.

In contrast, ESG/SRI funds continued to attract capital (+$1.2 billion) since December 2024. Leveraged funds and frontier markets equity funds recorded minor inflows of $16.6 billion and $87.5 billion, respectively.

China experienced the most significant outflows (-$8.9 billion), reversing from inflows in the previous month (although the final week of May saw inflows of $1.1 billion). According to a private survey released on June 3, China’s manufacturing activity in May contracted at the fastest pace since September 2022. The Caixin/S&P Global Manufacturing PMI fell to 48.3, down from 50.4 in April and below Reuters’ forecast of 50.6.

South Korea also saw a reversal to outflows of $751 million, the strongest since 2024, after recording the highest inflows since January 2024 in the previous month.

According to S&P Global, South Korea’s manufacturing PMI for May was 47.7, up from 47.5 in April but marking the fourth consecutive month of contraction. The Bank of Korea (BoK) decided to cut interest rates for the fourth time in the current easing cycle, while also slashing its economic growth forecast for the year by nearly half to 0.8%.

Taiwan continued to attract inflows of $2.3 billion, driven by technology stocks. Amidst weak global demand, Taiwan’s semiconductor and ICT exports remained robust. Notably, exports surged in the first half of 2025 as customers front-loaded orders ahead of US tariff measures.

India maintained its positive inflows with $667 million. India surpassed Japan to become the world’s fourth-largest economy, with a GDP exceeding $4 trillion, as announced by NITI Aayog at the beginning of 2025. This milestone reflects the long-term and robust growth trajectory of the Indian economy.