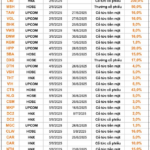

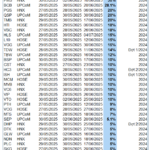

This week, 43 companies announced record closing rights to pay dividends, including 8 companies paying stock dividends, 2 companies offering stock rewards, and 1 company paying mixed dividends.

Offering 300 million shares

On June 19th, the Corporation for Investment and Industrial Development (Becamex IDC – stock code: BCM) will finalize the list of shareholders to collect written opinions. The expected time for collecting opinions is in July 2025.

Accordingly, Becamex IDC plans to present to shareholders the plan to offer additional public shares to increase its charter capital.

Becamex IDC returns to the plan of offering 300 million shares.

According to the initial plan, Becamex IDC would offer 300 million shares through auction on HoSE with a starting price of VND 69,600/share. The auction took place at 9:00 am on April 28 at the Ho Chi Minh City Stock Exchange (HoSE). However, due to the impact of US retaliatory tariffs on the stock market, the Industrial Investment and Development Corporation postponed the plan to auction shares on HoSE, as shares fell to the floor for four consecutive sessions.

At that time, Becamex IDC stated that it would consider deciding to implement the additional public offering of shares to increase capital at another time that suits the interests of the company, shareholders, and in accordance with the law.

If the auction is successful, Becamex IDC could raise at least VND 20,880 billion. Thus, the scale of this auction is the largest in the history of share auctions in the Vietnamese stock market, far surpassing the famous auction of Vietcombank in late 2007, which successfully raised over VND 10,500 billion.

With the proceeds, Becamex IDC will use VND 6,300 billion for investment projects, including VND 2,800 billion for Cay Truong Industrial Park and VND 3,500 billion for Bau Bang Expanded Industrial Park.

The company will use VND 3,634 billion to contribute additional capital to its associated companies, including Vietnam-Singapore Industrial Park Joint Venture Company (VSIP), Becamex Binh Phuoc Joint Stock Company, Becamex – VSIP Energy Development Joint Stock Company (BVP), Vietnam-Singapore Smart Energy Solutions Joint Stock Company (VSSES), and Becamex Binh Dinh Joint Stock Company.

In addition, BCM will also allocate VND 5,066 billion for financial restructuring, specifically for bond and bank debt repayment. Capital utilization will follow the principle of prioritizing project investment, followed by capital contribution to existing companies, and finally, financial restructuring.

An Binh Commercial Joint Stock Bank (ABBank – stock code: ABB) announced that its foreign strategic shareholder, Maybank, authorized Mr. Syed Ahmad Taufik Albar to represent 100% of Maybank’s capital at ABBank from June 5th.

Maybank changes its representative for capital contribution at ABBank.

Mr. Michael Foong Seong Yew is no longer the representative of Maybank’s capital at ABBank. Mr. Michael Foong Seong Yew is also no longer a member of the Board of Directors of ABBank from June 5th.

Mr. Syed Ahmad Taufik Albar (53 years old) was nominated and elected by Maybank as a member of the Board of Directors of ABBank at this year’s annual general meeting. Currently, Mr. Syed Ahmad Taufik Albar is the Director of Community Financial Services Division of Maybank Group. Maybank currently holds 16.4% of ABBank’s charter capital.

Two banks increase capital by thousands of billions

The State Bank has recently approved Vietbank (stock code: VBB) to increase its charter capital by VND 3,783 billion through two issuances of shares to existing shareholders.

Accordingly, in the first phase, Vietbank plans to issue more than 107 million shares (equivalent to a ratio of 15%) to existing shareholders at a par value of VND 10,000/share. The source of funding will come from retained earnings and the supplementary capital reserve fund up to the end of 2024. The shares issued will not be restricted for transfer. The issuance is expected to take place from the second to the third quarter of this year. After the first issuance, Vietbank’s charter capital will increase to VND 8,210 billion.

In the second phase, Vietbank will issue nearly 271 million shares (equivalent to a ratio of 33% compared to the capital increased after the first phase) to existing shareholders and new investors. With an issuance price of VND 10,000/share, the total value of shares issued in this phase will be over VND 2,709 billion. These shares will also not be restricted for transfer.

The expected implementation time is from the third to the fourth quarter of this year. If both issuances are successful, Vietbank’s charter capital may increase from VND 7,139 billion to nearly VND 10,920 billion.

Vietbank’s charter capital may increase from VND 7,139 billion to nearly VND 10,920 billion.

Similarly, Nam A Bank (stock code: NAB) has also been approved by the State Bank of Vietnam to increase its charter capital by nearly VND 4,300 billion through share issuances to existing shareholders and ESOP.

Specifically, Nam A Bank plans to issue over 343 million shares to existing shareholders, equivalent to a ratio of 25%, increasing its charter capital by nearly VND 3,431 billion. Along with this, Nam A Bank will also issue 85 million ESOP shares to its officers and employees, increasing its charter capital by VND 850 billion. After completing these two issuances, Nam A Bank’s charter capital will increase from VND 13,726 billion to over VND 18,000 billion.

Vietnam National Petroleum Group (Petrolimex – stock code: PLX) will finalize its list of shareholders on June 11th to pay 2024 dividends in cash at a rate of 12%. With 1.27 billion circulating shares, Petrolimex is expected to spend about VND 1,500 billion on this dividend payment. The expected payment date is June 24th.

The Big Capital Boost: Businesses Amplify Their Ambitions

The Orient Commercial Joint Stock Bank has unveiled plans to issue over 197 million OCB shares, while Chuong Duong Joint Stock Company is set to privately offer 30 million CDC shares. In a similar move, Dong A Joint Stock Company aims to boost its charter capital by issuing an additional 34 million GDA shares.

The Race for Capital: Companies Boost Funding through Share Issues

The Orient Commercial Joint Stock Bank has unveiled plans to issue over 197 million OCB shares, while Chuong Duong Joint Stock Company is set to privately offer 30 million CDC shares. In a similar move, Dong A Joint Stock Company aims to boost its charter capital by issuing an additional 34 million GDA shares.

“HanoiMilk’s Major Shareholder Transfers 10 Million Shares to His Daughter”

“Ha Phuong Thao, the daughter of Ha Quang Tuan – Chairman of the Board of Hanoi Milk Joint Stock Company (Hanoimilk, UPCoM: HNM) – has become the new major shareholder of the company. Thao acquired 10 million shares from her father, solidifying her position as a key player in the business.”