Rạng Đông CEO Shares Insights on Economic Challenges and Future Plans

In a recent annual general meeting, Mr. Nguyen Doan Thang, CEO of Rạng Đông Lightbulbs Joint Stock Company (stock code: RAL), shared his insights on the company’s performance and future plans amid economic challenges.

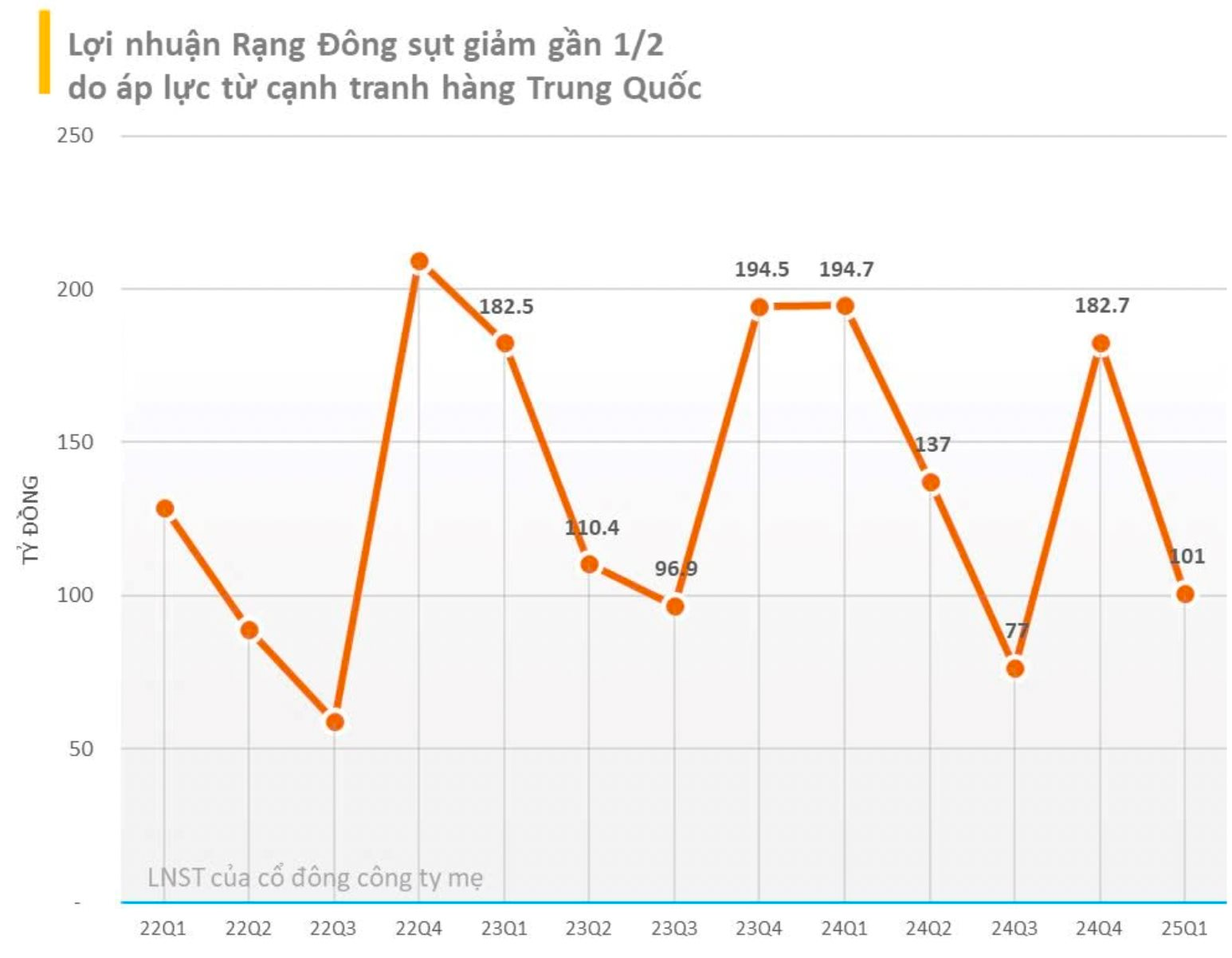

For 2025, the company has set a sales revenue target of VND 6,100 billion and a pre-tax profit target of VND 395 billion, reflecting a 27% and 37% decrease, respectively, from the previous year’s results.

Navigating the Flood of Chinese Imports

According to Mr. Thang, 2025 has been a tumultuous year for the global economy, with escalating trade tensions between the US and China. As a result, Rạng Đông expects intense competition from a surge of Chinese imports.

“With US restrictions on Chinese goods, where will the excess inventory go? It will flood into neighboring markets, and Vietnam is the closest. We anticipate intense competition in the Vietnamese market,” Mr. Thang predicted.

Another factor contributing to the uncertainty of 2025 is the advancement of artificial intelligence (AI). Mr. Thang highlighted that AI has become service-oriented, enabling startups to develop AI software and apply it to their products, resulting in unique offerings.

“This is an extremely competitive race in science and technology,” he emphasized.

Additionally, the government’s policy to abolish the lump-sum tax and transition household businesses to enterprises is expected to cause disruptions in the short term, along with the introduction of electronic invoices from June 1, 2025. The new tax policy has already led to demands for discounts and reduced selling prices, impacting the company’s revenue by approximately 10%.

Across the market, the transition from household businesses to enterprises is triggering a wave of shop closures nationwide, particularly among traditional market traders.

Amid these challenges, Mr. Thang affirmed: “In the face of storms and uncertainties, we cannot be overly ambitious with our goals. Now is the time to consolidate our systems, mitigate risks, and safeguard our capital and resources. This is Rạng Đông’s focus for 2025.”

Despite the difficulties, Rạng Đông has approved a cash dividend payout of 50%, maintaining the same rate as the previous year. According to Mr. Thang, this will be the ninth consecutive year of Rạng Đông paying a 50% cash dividend. With a profit target of VND 395 billion, the planned dividend payout of approximately VND 117.5 billion is “well within our means.”

Navigating Challenges: Rạng Đông’s CEO Shares Insights

Transaction with Gia Lộc Phát

The RAL Board of Directors also sought shareholder approval for a related-party transaction with Gia Lộc Phát Joint Stock Company.

Specifically, the Board proposed that the total transaction value with Gia Lộc Phát exceed 35% of the company’s total assets, as per the latest financial statements. The transaction is expected to take place in 2025–2026, up until the next annual general meeting.

In 2024, the value of transactions with Gia Lộc Phát reached VND 3,077 billion, accounting for 37.03% of the company’s total assets.

Gia Lộc Phát has been a long-standing and significant customer of RAL since 1990, often contributing over 45% of the company’s revenue in previous years. Currently, their business accounts for 60–70% of Rạng Đông’s total revenue in Northern Vietnam.

In the latter half of 2024, when cash flow was particularly challenging, Gia Lộc Phát provided financial support to enhance Rạng Đông’s business performance. They also boast a nationwide distribution network, facilitating Rạng Đông’s sales and revenue growth.

Notably, Mr. Le Dinh Hung, a member of the Supervisory Board (term 2022–2027) of RAL, concurrently serves as the Chairman of Gia Lộc Phát’s Board of Directors. Mr. Hung and his sister, Ms. Le Thi Kim Yen, are major shareholders of RAL, holding 9.26% and 11.1% stakes, respectively.

Delayed Project Timeline: A Fortuitous Turn of Events

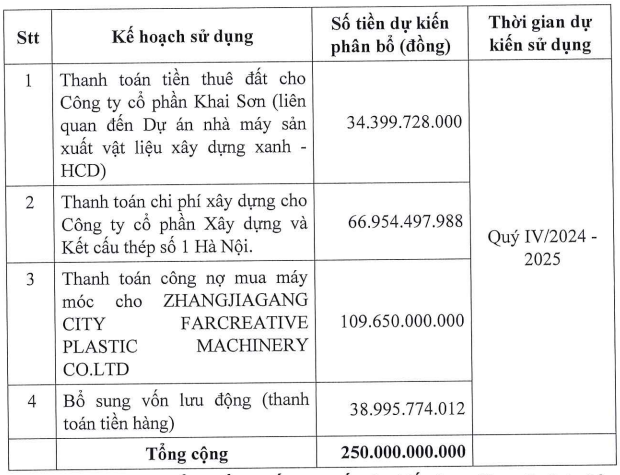

In another significant update, the Board sought shareholder approval to authorize the Board to proceed with the implementation of the “High-tech Electronics Factory Project Integrated with a Smart LED Lighting Ecosystem.”

This project is located in the Hoa Lac High-Tech Park, Hanoi, spanning approximately 7.1 hectares, with a total investment of VND 2,334 billion. The investment includes VND 540.4 billion in capital contribution from investors and VND 1,794 billion in mobilized capital. The factory is expected to produce approximately 100 million units of smart LED lighting and high-tech electronic products.

Rạng Đông was approved as an investor in this project by the Hoa Lac High-Tech Park Management Board in April 2021. To fund this project, Rạng Đông offered 11 million shares to the public at VND 93,000 per share in early 2022, raising VND 1,023 billion.

Mr. Thang attributed the project’s delay to the “extremely complex” procedures, given its large scale and investment value. During the implementation process, the management of the Hoa Lac High-Tech Park was transferred from the Ministry of Science and Technology to the Hanoi People’s Committee, resulting in personnel and bureaucratic changes that caused delays.

“We began construction in October 2024, and the foundation piling is almost complete. We aim to have the factory operational by the end of 2026 or early 2027,” Mr. Thang shared.

Interestingly, Mr. Thang viewed the project’s delay as a blessing in disguise, given the rapid advancements in information technology and AI. He explained, “Had the project been approved in 2021, with the factory completed by 2022, where would our products be in this current market situation? So, we consider ourselves fortunate. What seemed like a delay turns out to be a timely development, especially with the rapid evolution of AI. The years 2027–2028 will be the perfect time for us.”

“Leveraging FTAs to Expand Export Markets for Textiles and Footwear”

As the Deputy Director of the Multilateral Trade Policy Department has highlighted, Vietnam’s competitive tax advantages compared to rivals such as Thailand, Malaysia, and Indonesia, are narrowing in markets like the EU, the UK, Canada, and Mexico. Therefore, it is imperative that we act swiftly to capitalize on the existing benefits offered by FTAs, or risk losing this edge over time.

Mooncakes at Affordable Prices: The New Trend in Ho Chi Minh City

This Mid-Autumn Festival, we’re witnessing a delightful trend of affordable mooncakes, with prices starting as low as 29,000 VND each. This budget-friendly segment has not only captured the attention of consumers but also intensified competition among businesses and stores, resulting in a diverse range of offerings.