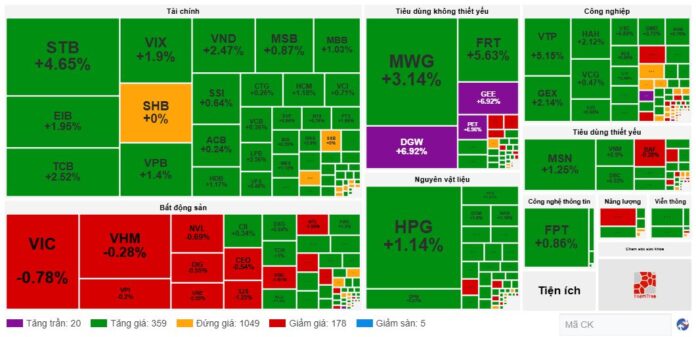

The VN-Index closed nearly 6 points higher, settling at 1,316.23. Meanwhile, the HNX-Index witnessed a slight dip of 0.09 points, landing at 226.4.

|

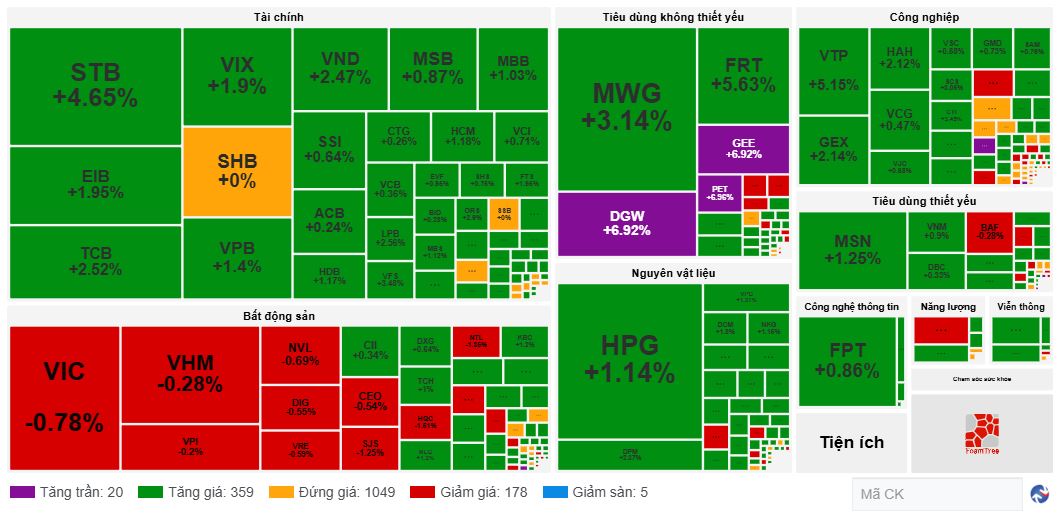

Source: VietstockFinance

|

VHM, which initially exerted the most pressure on the index, became the biggest supporter of the VN-Index by the end of the session, climbing by 2.7%. Along with VHM, VIC and VRE also returned to positive territory, alleviating the downward pressure.

However, increased selling activity in certain bank stocks and a mixed performance in sectors such as real estate, information technology, and energy restrained the market’s upward momentum.

A bright spot in the market was the distribution and electronics retail sector, with MWG, FRT, DGW, and PET maintaining their gains throughout the session.

The telecommunications group witnessed a positive session, with VGI, CTR, SGT, ELC, and VTK all advancing.

Foreign investors turned net buyers in today’s session, with a net purchase value of nearly VND 280 billion. Notably, EIB was bought the most, with a net purchase value of VND 133 billion, followed by VIX with VND 102 billion and GEX with VND 87 billion.

| Foreign Investors’ Net Buying and Selling Activities |

Morning Session: Banks Lead the Rally

At the end of the morning session, the VN-Index stood at 1,318, up nearly 8 points. The HNX-Index also edged higher by 0.6 points to reach 227.06.

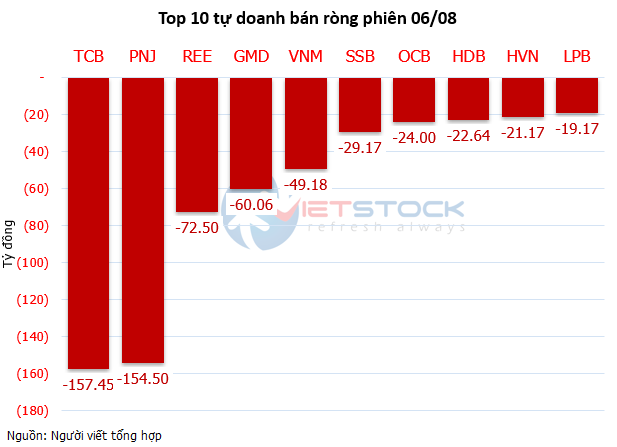

The main driver of the rally remained the banking sector, with TCB, STB, LPB, and VPB pushing the index upwards. On the other hand, VHM was the top laggard, but its impact was not significant.

| Top 10 Stocks with the Highest Impact on the VN-Index in the Morning Session of June 10, 2025 |

Liquidity improved towards the end of the morning session, with the trading value on the HOSE surpassing that of the same period yesterday. The total trading value across the market reached nearly VND 10 trillion, with the HOSE contributing over VND 7.6 trillion.

Foreign investors were net sellers, with a slight net sell value of nearly VND 60 billion. CTG, MWG, and FPT were among the most sold stocks.

| Top 10 Stocks with the Highest Foreign Net Buying and Selling Values |

10:30 AM: Retail and Electronics Distribution Stocks Surge

The pressure from the real estate sector eased, and many sectors witnessed positive breaks. The situation improved compared to the beginning of the session, with the VN-Index reaching 1,318, an increase of 8 points, as of 10:30 AM.

The buying side prevailed, with 380 stocks rising and nearly 180 falling. Green dominated various sectors, notably the banking sector, which saw increases in many stocks such as STB, EIB, TCB, SHB, and VPB… The securities group also performed well, with gains in SSI, VND, VIX, HCM, and VFS…

The best-performing sector of the day was retail and electronics distribution. DGW, GEE, and PET hit their daily limit-up prices early in the session, while MWG and FRT also posted significant gains.

Source: VietstockFinance

|

In the steel sector, HPG took the lead, followed by NKG, HSG, and VGS.

Selling pressure persisted in the real estate sector, but the decline weakened compared to the beginning of the session. VIC fell by only 1%, while VHM dropped by 0.4%.

Market Open: Significant Pressure from Real Estate Stocks

The stock market opened with a sharp drop at the beginning of the session, mainly due to the negative performance of the Vingroup duo, VIC and VHM. However, buying demand resurfaced, pushing the index back into positive territory.

After falling as much as 10 points, the VN-Index rebounded to gain 1.5 points. By 9:25 AM, the market breadth turned positive, with nearly 260 stocks rising and 115 falling. Bank stocks played a crucial role in the index’s recovery, with TCB, VCB, STB, and VPB… among the top 10 stocks with the most positive impact on the VN-Index. Additionally, HPG, GVR, and FPT also contributed significantly.

On the other hand, the Vingroup trio of VHM, VIC, and VRE exerted the most significant negative influence, dragging the index down by nearly 3 points. Their decline also spread to other real estate stocks, with NVL, CEO, HQC, DIG, and NTL… witnessing minor losses.

Green prevailed across most sectors, and in the non-essential consumer goods sector, GEE, MWG, DGW, and FRT stood out with notable gains.

– 15:35 06/10/2025

“Markets Rise with Caution: Vietstock Daily Overview for June 10, 2025”

The VN-Index pared its gains and failed to reclaim its March 2025 highs (1,320-1,340 points). Trading volumes remained below the 20-day average, indicating investor caution. The Stochastic Oscillator continued its downward trajectory, providing a sell signal and exiting the overbought territory. Meanwhile, the MACD echoed a similar sentiment, with the gap between the MACD line and the signal line widening, suggesting that the risk of a correction persists.

Market Pulse, June 9: VIC, VHM Wipe Out Over 10 Points from VN-Index

The market closed with notable losses, as the VN-Index fell by 1.45% to 1,310.57, shedding 19.32 points. Likewise, the HNX-Index declined by 0.93%, or 2.12 points, settling at 226.49. The session was dominated by sellers, with 507 declining tickers against 228 advancing ones. Within the VN30 basket, 19 stocks retreated, 7 advanced, and 4 remained unchanged, echoing the broader market’s bearish sentiment.

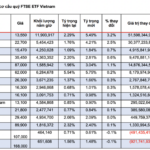

The Imminent Sale of Large-Cap Stocks by Foreign ETFs: A Preview

According to MBS’s forecast, Vingroup’s stocks (VIC and VHM) are expected to experience significant selling pressure in the upcoming rebalancing of the two foreign ETFs. This is due to their strong performance in Q2, which has pushed their weights beyond the allowed threshold in both the FTSE and VNM ETFs. On the buying side, EIB, HPG, and NAB are expected to be among the notable stocks in terms of purchase volume.